The S&P ESG Dividend Aristocrats Index Series: One Year Later

Dividends have historically provided a significant source of returns. A recent blog stated dividends have become an important source of household income for U.S. investors and accounted for 7.3% of personal income as of Q1 2022, climbing from 3.2% in 1980. Over the same period, interest income has declined in share from 16.2% to 9.2%. In the current environment of rising inflation and interest rates, dividends may also provide the benefit as an inflation hedge.

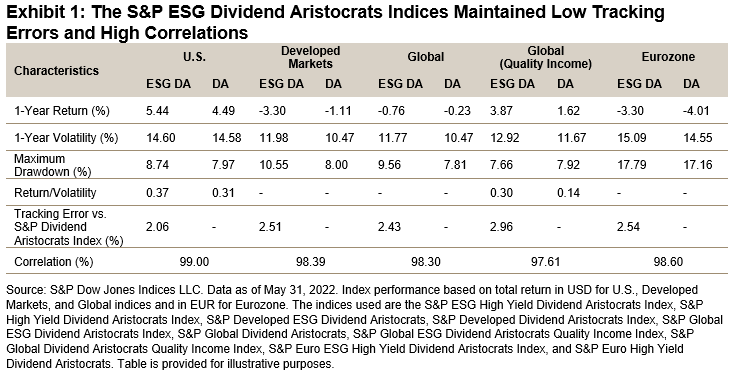

One year ago, S&P DJI expanded its S&P Dividend Aristocrats® (DA) Indices with a new index series focusing on both dividends and ESG, targeting companies that couple consistent dividend growth with minimum ESG standards.1 Despite offering an additional layer of sustainability, the newly launched S&P ESG Dividend Aristocrats (ESG DA) Index Series have historically been able to offer low tracking error and a dividend yield comparable to those of the historical non-ESG version.

With one year of live history, we review the performance and characteristics of the S&P ESG Dividend Aristocrats Index Series.

Similar Performance and Low Tracking Error

2021 was challenging for stock markets globally, with the return of central banks tightening globally and rising inflation after years of declining yields. Nonetheless, the S&P ESG Dividend Aristocrats Index Series managed to ride this period delivering similar and often better performance compared to its non-ESG counterparts. Furthermore, despite some market headwinds, the S&P ESG Dividend Aristocrats Indices increased their dividend yield over the past 12 months, further emphasizing the resilience of such strategies.

Increasing Dividend Yield

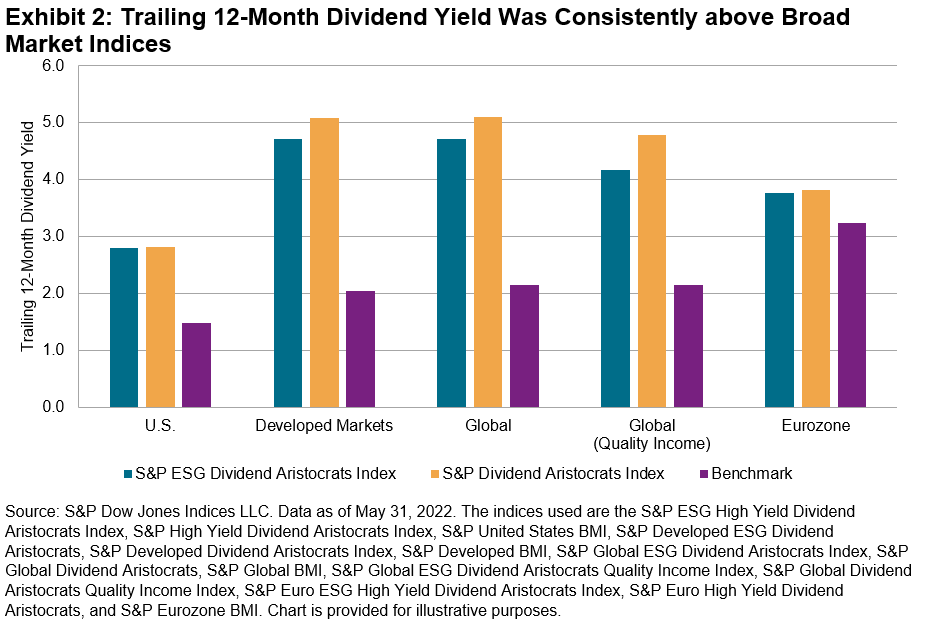

Exhibit 2 shows the realized trailing 12-month dividend yield for the S&P ESG Dividend Aristocrats Indices against their respective S&P Dividend Aristocrats Indices and broad benchmark indices. Over the past 12 months, the S&P Dividend Aristocrats Index Series offered comparable dividend yields and delivered a sizable yield pick-up compared with the benchmark.

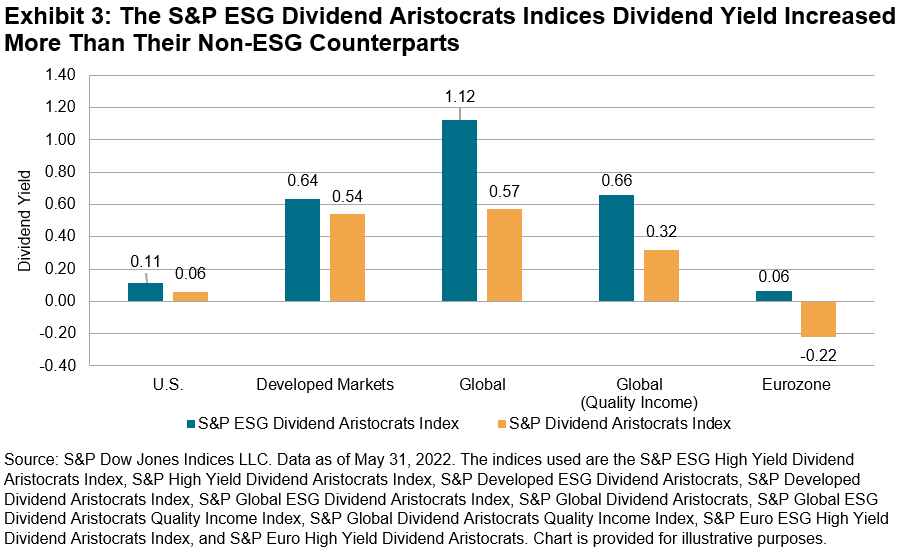

Exhibit 3 shows the difference between the trailing 12-month dividend yield from May 31, 2021, to May 31, 2022. Interestingly, the S&P ESG Dividend Aristocrats Indices’ dividend yield increased over the course of the past 12 months, not only in absolute terms but also compared with the standard S&P Dividend Aristocrats versions. Although the yield was still lower, the spread has been tightening. The current market dynamics may be driving these fluctuations in yield spreads. However, it is worth noting that with additional screens applied to the ESG versions of Dividend Aristocrats, yields of the S&P ESG Dividend Aristocrats Indices could remain at a discount to their non-ESG counterparts.

Underweight Utilities

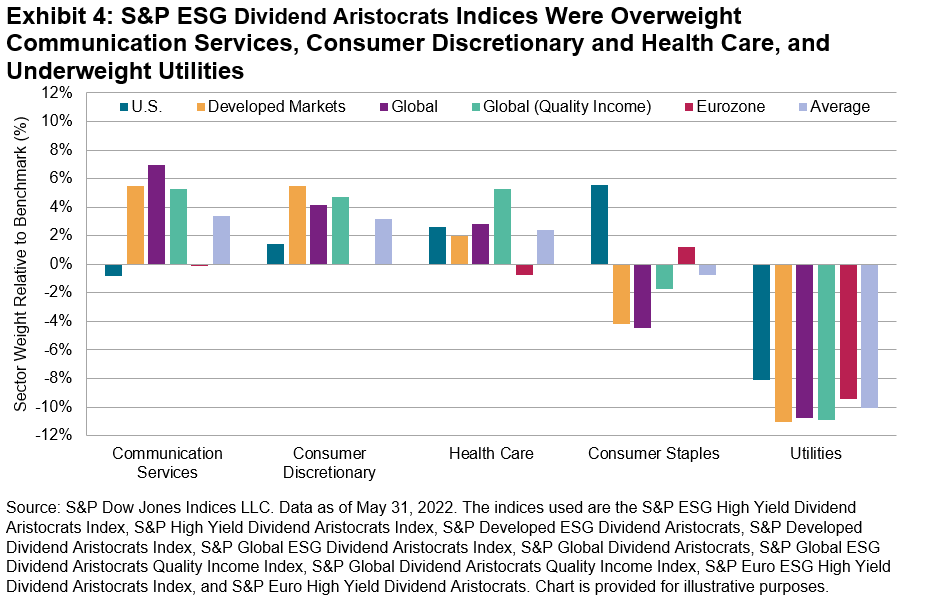

In terms of sector representation, the results were quite mixed, with different S&P ESG Dividend Aristocrats Indices overweighting different sectors (see Exhibit 4). However, one common trait is that the Utilities sector was systematically underrepresented. The reason for the Utilities underweight may lie in the index methodology, which excludes companies involved in thermal coal, among others. Compared with 2021, we didn’t identify any major trends in sector weights that remained broadly similar in both versions.

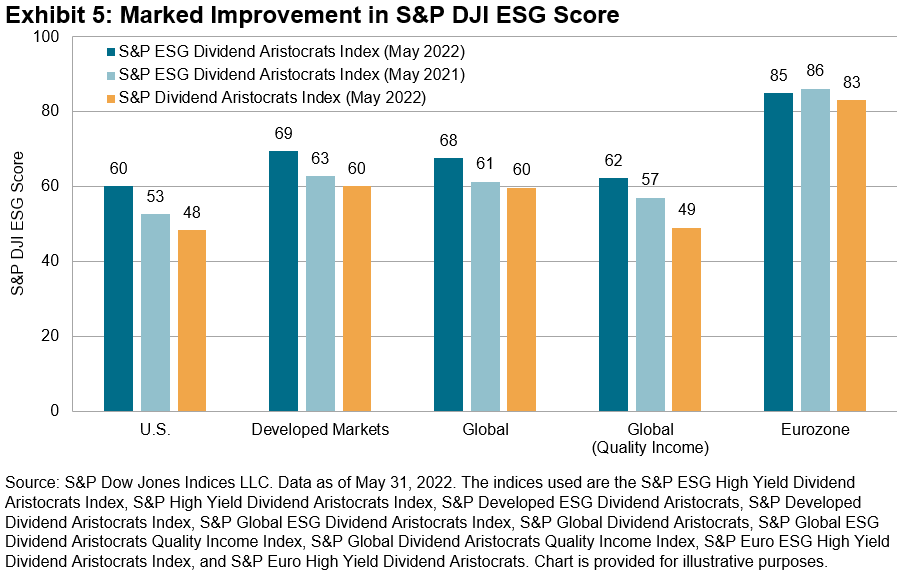

Improvement in S&P DJI ESG Score

The S&P ESG Dividend Aristocrats Indices delivered an improvement in the S&P DJI ESG Scores, averaging at 16%. Improvements were quite pronounced for the U.S, developed markets and global indices. In eurozone, the impact of the ESG screens and filter was lower, but this can be explained by the non-ESG version already having a high S&P DJI ESG Score. Furthermore, we noticed a general improvement in the S&P DJI ESG Scores since the launch of the index, except for the eurozone, where the score remained consistently high.

One year after their launch, the S&P ESG Dividend Aristocrats Index Series succeeded in providing similar performance and dividend yield, while keeping an eye on sustainability, and the series has recently expanded with the launch of the S&P 500 ESG Dividend Aristocrats Index.

The S&P ESG Dividend Aristocrats Index Series is designed to identify companies that combine consistent dividend growth with sustainability characteristics, providing an additional option for long-term, income-focused investors that are looking for high quality, dividend-paying companies with sustainable business models.

1 For a more in-depth look into this index series, see https://www.spglobal.com/spdji/en/education/article/aligning-income-with-esg-the-sp-esg-dividend-aristocrats/.

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.