The S&P 500 Rebounds As Reasons For Continuing Rate Hikes Lose Steam

The S&P 500 rose to end the trading week at 4137.64, up 0.8% from the previous week's close.

The main factor in the week's market moving headlines pointing to that outcome is the increasingly likelihood that the Federal Reserve's series of rate hikes that began back in March 2022 are much closer to being over. Better-than-expected inflation reports during the week and an increasingly likelihood of recession are instead raising the prospect the Federal Funds Rate will reach a peak target range of 5.00-5.25% in May 2023, which investors are betting will transition into a series of rate cuts starting as early as July 2023.

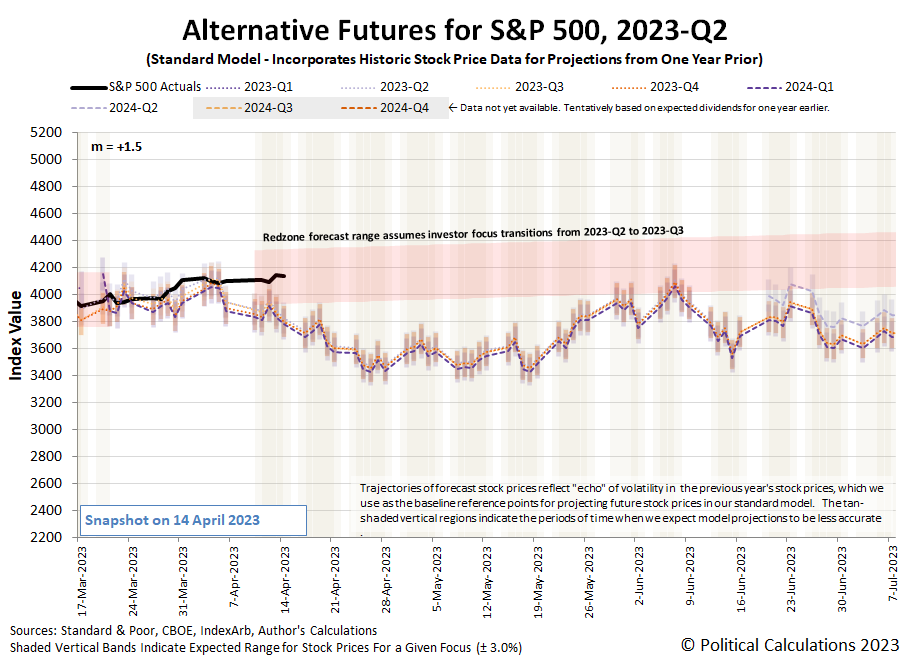

We've updated the alternative futures chart to show a new redzone forecast range that runs from 10 April 2023 through 18 July 2023, during which we assume investors will transition their focus from the current quarter of 2023-Q2 to the more distant future quarter of 2023-Q3. We anticipate a higher volatility for stock prices may apply during this period, which we're indicating with a wider forecast range of ±4% rather than a typical ±3%.

(Click on image to enlarge)

Here's our weekly summary of those market-moving headlines we mentioned earlier.

Monday, 10 April 2023

- Signs and portents for the U.S. economy:

- Fed minions claim monetary policy did not cause bank failures, outsider thinks they might be done with rate hikes:

- BOJ minions to keep never-ending stimulus alive!

- ECB minions thinking about more rate hikes:

- Wall Street ends mixed with inflation data, earnings on tap

Tuesday, 11 April 2023

- Fed minions starting to have second thoughts about more rate hikes, think they'll be shrinking their balance sheet for several years:

- Fed's Goolsbee: Prudence, patience needed on rate hikes

- Fed's Williams says interest rate path is data dependent

- Fed's Harker wants interest rates to get above 5%, then sit

- Fed's Kashkari: Recession possible, but high inflation would be worse

- NY Fed report sees several more years of balance sheet contraction

- Bigger trouble, stimulus developing in China:

- IMF getting nervous about financial stability, doesn't think central banks should halt rate hikes to prevent more:

- Central bankers pausing rate hikes:

- ECB minions thinking inflation may become entrenched:

- Wall St ends mixed as inflation data comes into focus

Wednesday, 12 April 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to deliver quarter point rate hike in May 2023, less sure of next steps:

- Bigger trouble developing all over?

- BOJ minions to continue never-ending stimulus:

- ECB minions thinking about bigger rate hikes or pausing them:

- Wall Street closes lower after Fed minutes, inflation data

Thursday, 13 April 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to hike rates one last time as next move:

- China export data confirms atmospheric CO2 signal, but doesn't dispel worries:

- Bigger trouble developing in U.K.:

- ECB minions thinking about quarter point rate hike as next move:

- Wall St rallies to higher close as inflation data feeds Fed pause hopes

Friday, 14 April 2023

- Signs and portents for the U.S. economy:

- Some Fed minions thinking one more rate hike and done, others thinking they want more rate hikes, looking forward to "mild" recession:

- Slow rebound from zero-COVID lockdowns, bigger stimulus developing in China:

- New boss of BOJ minions says all's good with Japan's economy:

- ECB minions still excited about hiking rates:

- Wall St dips to lower close as rate hike bets firm, banks jump

The CME Group's FedWatch Tool estimates a 83% chance the Fed will Federal Funds Rate by a quarter point to a target range of 5.00-5.25% at its upcoming meeting on 3 May (2023-Q2). After that, the FedWatch tool anticipates a series of quarter point rate cuts starting from 26 July (2023-Q3) and continuing at six-to-twelve-week intervals through the CME FedWatch tool's available forecast period, which extends through 25 September 2024 (2024-Q3). The CME FedWatch Tool's most distant forecast anticipates the Federal Funds Rate will reach a target range of 2.75-3.00% at that date.

The Atlanta Fed's GDPNow tool's projection for real GDP growth in the first quarter of 2023 rebounded to +2.5% from the previous week's estimate of +1.5%. The so-called Blue-Chip consensus predicts it will be +1.5%, or rather, that's the average of ten forecasts that anticipate real GDP growth anywhere from +0.3% to +2.5% for 2023-Q1). The GDPNow tool is now fully looking backward instead of forward and will continue to do so until the U.S. Bureau of Economic Analysis releases its advance estimate of real GDP on 27 April 2023.

More By This Author:

Accumulation Pace Of CO₂ Picks Up As China's Economy Speeds UpU.S. - China Trade Falls To Lowest Level Since Coronavirus Pandemic

Affordability Of New Homes Dips In February 2023

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more