The Q3 Earnings Season Kicks Off

Image Source: Pexels

We have regularly been flagging the steady improvement in the revisions trend since April 2023, with the trend becoming more entrenched in recent months. In order to see this improvement, we have to look below the index level to appreciate the cross-current in estimates at the sector levels.

The aggregate Q3 earnings estimate for the S&P 500 index has declined about -0.1% since the start of the period, with rising estimates for six sectors, including the Tech sector, offsetting continued weakness of varying magnitudes in the remaining sectors. Had it not been for weakness in the Energy or Finance sector estimates, the revisions trend for Q3 for the S&P 500 index would be modestly positive since the start of the period.

In addition to the Tech sector, Q3 estimates have moved higher for the Construction, Autos, Medical, Retail, and Industrials sectors.

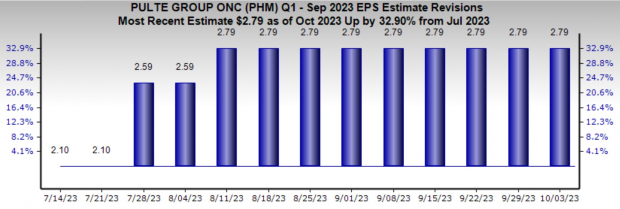

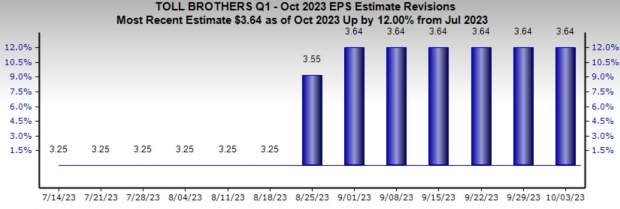

For the Construction sector, you can see this favorable revisions trend in estimates for homebuilders like PulteGroup (PHM - Free Report), KB Home (KBH - Free Report), and Toll Brothers (TOL - Free Report).

The chart below shows the revisions trend for PulteGroup, with the current $2.79 EPS estimate for Q3 up from $2.59 on August 4th and $2.10 on July 14th.

Image Source: Zacks Investment Research

The chart below shows the revisions trend for Toll Brothers, with the current $3.64 EPS estimate for Q3 up from $3.55 on August 25th and $3.25 on July 14th.

Image Source: Zacks Investment Research

PulteGroup and Toll Brothers shares are up +58.2% and +42.7% this year, handily outperforming the broader market’s +11.5% gain. While these stocks have lost ground in recent days in response to the rising treasury yields, it will be interesting what happens to the revisions should rates continue going up.

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

As you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t show up in this near-term earnings outlook. A big-picture view of corporate profitability on a long-term basis doesn’t leave much room for a recession either, as you can see in the chart below.

Image Source: Zacks Investment Research

Given the emerging consensus on the ‘soft-landing’ outlook for the economy, one can expect this favorable turn in the overall earnings picture to strengthen further as companies report Q3 results and share trends in underlying business.

More By This Author:

The Q3 Earnings Season Gets Underway

Analyzing The Fed & Current Earnings Expectations

Previewing The Q3 Earnings Season

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more