Analyzing The Fed & Current Earnings Expectations

Image Source: Unsplash

The market’s reaction to the ‘higher-for-longer’ view of interest rates following the latest Fed dot plot suggests that many had been banking on a relatively earlier onset to the easing cycle than the central bank’s guidance.

We see the seemingly hawkish Fed posture as nothing more than an insurance policy for the central bank that will come in handy should the recent favorable momentum on the inflation front start stalling.

It is prudent on the Fed’s part to have complete confidence in the inflation question before changing course, though we remain of the view that the enduring trend on the inflation front remains favorable even as the macroeconomic backdrop remains far more resilient relative to earlier expectations.

The economy’s resilience has been showing up in the positive turn in the earnings outlook that we have been flagging in this space in recent months. Specifically, the earnings estimate revisions trend notably stabilized in early April this year after steadily decreasing for almost a year.

Had it not been for the Energy sector weakness, aggregate earnings estimates would be modestly up since early April 2023.

Sectors enjoying positive estimate revisions in this time period include Tech, Construction, Autos, Consumer Discretionary, Industrial Products, and Retail.

We are seeing a similar revisions trend at play concerning estimates for 2023 Q3, whose advanced results have started coming out already.

The expectation currently is of S&P 500 earnings declining by -1.8% in Q3 from the same period last year on +0.8% higher revenues. This would follow the -7.1% decline on +1.1% higher revenues in 2023 Q2.

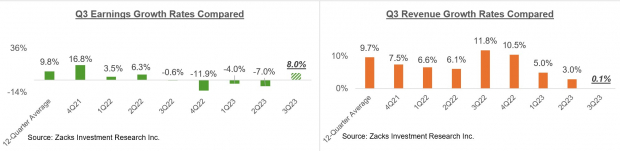

The chart below highlights the year-over-year Q3 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few periods.

Image Source: Zacks Investment Research

As you can see here, 2023 Q3 is expected to be the last period of declining earnings for the index, with positive growth resuming from 2023 Q4 onwards. In fact, had it not been for the Energy sector drag, earnings growth in 2023 Q3 would be positive.

You can see this in the chart below which shows the index’s year-over-year earnings growth on an ex-Energy basis.

Image Source: Zacks Investment Research

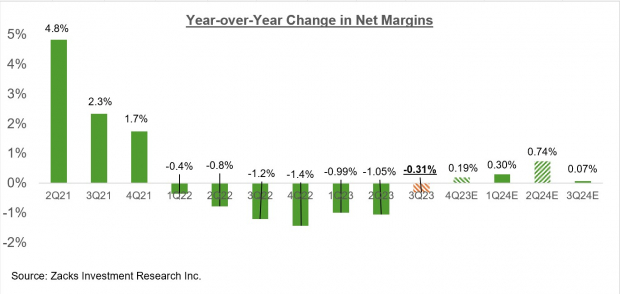

The chart below shows the year-over-year change in net margins, with Q3 currently expected to be the 7th quarter in a row of declining margins.

Image Source: Zacks Investment Research

Excluding the Energy sector, however, net margins would be modestly up from the year-earlier period.

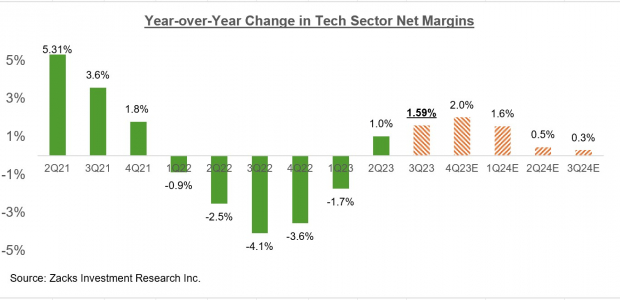

One sector that has made significant progress on the margins front is the Tech sector, whose year-over-year comparison turned positive in the preceding period and is expected to expand further this quarter, as the chart below shows.

Image Source: Zacks Investment Research

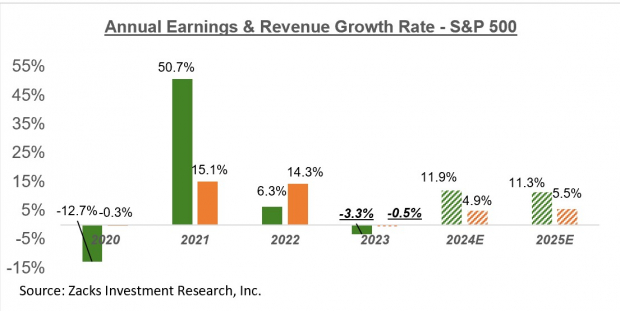

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

Look at current expectations for next year and the year after to understand the disconnect between the reality of current bottom-up aggregate earnings estimates and the seemingly never-ending worries about an impending economic downturn. That said, most economic analysts have been steadily lowering their recessionary odds in recent months.

This Week’s Notable Earnings Releases

The Q3 earnings season will really get going when the big banks start coming out with their quarterly numbers in mid-October. But the reporting cycle has actually gotten underway already, with results from 8 S&P 500 members out as of Friday, September 22nd.

These 8 S&P 500 members include bellwethers like FedEx (FDX - Free Report), Adobe (ADBE - Free Report), and others. We have another 8 S&P 500 members on deck to report results this week, including Nike (NKE - Free Report), Costco (COST - Free Report), and others.

FedEx, Adobe, Nike, and all of these other early reporters are coming out with their fiscal August-quarter results, which we and other research organizations count as part of the Q3 tally. We will have seen roughly two dozen such August-quarter results by the time JPMorgan comes out with its quarterly results on October 13th.

For the 8 S&P 500 members that have reported already, total earnings and revenues are up +8% and +0.09% from the same period last year, with 87.5% beating both EPS and revenue estimates.

The comparison charts below put the Q3 earnings and revenue growth rates at this very early stage in a historical context.

Image Source: Zacks Investment Research

More By This Author:

Previewing The Q3 Earnings Season

Looking Ahead To Q3 Earnings

Handicapping Q3 Earnings: What To Expect

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more