Handicapping Q3 Earnings: What To Expect

Image Source: Unsplash

It isn’t news anymore that the overall earnings picture has unfolded much more positively and favorably than many thought possible just a few quarters back. The biggest contributing factor to this positive earnings surprise has been the resilience of the U.S. economy despite the Fed’s extraordinary tightening cycle.

While a segment of the market is still of the ‘recession-is-coming’ view, the market as a whole appears to have taken its collective cue from the continuous run of steady and reassuring economic readings and come around to the soft-landing view of the ground reality.

Regular readers of our earnings commentary are aware of the stabilization in the aggregate earnings estimate revisions trend since the start of 2023 Q2, which followed the roughly year-long negative revisions trend.

Since early April 2023, earnings estimates for full-year 2023 have declined by -0.34% for the S&P 500 index as a whole, with declining estimates for 9 of the 16 Zacks sectors, particularly the Energy sector, offsetting notable gains with other sectors.

Estimates for the Energy sector have been consistently under pressure, with the aggregate 2023 earnings estimates for the sector getting cut by -11.4% since the start of April 2023. If not for this negative Energy sector revisions trend, aggregate earnings estimates for the remaining 15 Zacks sectors would have risen by +0.7% in that period.

Sectors enjoying positive estimate revisions in this time period include Tech, Construction, Autos, Consumer Discretionary, Industrial Products, Retail, and Consumer Discretionary.

We are seeing a similar revisions trend at play concerning estimates for 2023 Q3, whose advanced results will start coming out in the coming days.

The expectation currently is for S&P 500 earnings to decline by -1.5% in Q3 from the same period last year on +0.7% higher revenues. This would follow the -7.3% decline on +0.2% higher revenues in 2023 Q2.

The chart below highlights the year-over-year Q3 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few periods.

Image Source: Zacks Investment Research

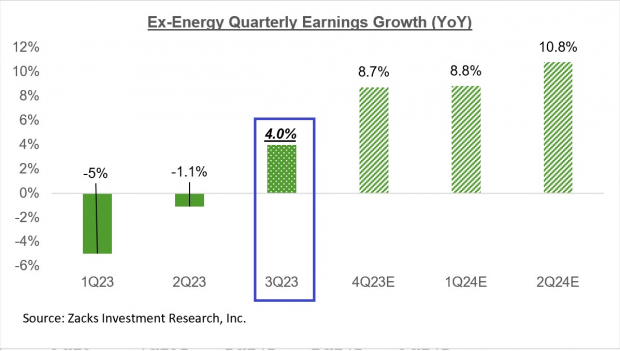

As you can see here, 2023 Q3 is expected to be the last period of declining earnings for the index, with positive growth resuming from 2023 Q4 onwards. In fact, had it not been for the Energy sector drag, earnings growth in 2023 Q3 would actually be positive.

You can see this in the chart below which illustrates the index’s year-over-year earnings growth on an ex-Energy basis.

Image Source: Zacks Investment Research

The chart below shows the year-over-year change in net margins, with Q3 currently expected to be the 7th quarter in a row of declining margins.

Image Source: Zacks Investment Research

Excluding the Energy sector, however, net margins would be modestly up from the year-earlier period.

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

This Week’s Notable Earnings Releases

We have a relatively light reporting docket this week, with Kroger (KR - Free Report) as the only S&P 500 member expected to report results. Kroger will be reporting results before the market’s open on Friday, September 8th. Kroger shares lost ground in May and have lagged the broader market since then.

Other notable companies reporting this week include C3.ai (AI - Free Report) and DocuSign (DOCU - Free Report). C3.ai shares are off their recent high but still remain outstanding performers this year, up +179.3% in the year-to-date period. AI shares were down following the last quarterly release on May 31st and have drifted lower since then. But it will be interesting to see if it can return to its earlier positive trajectory following its report after the market’s close on Wednesday, September 6th.

DocuSign, which reports after the market’s close on Thursday, September 7th, was a Covid darling but has struggled in the post-pandemic period. The stock is down about -7% this year, but it is actually down more than -60% from its Covid peak in the middle of 2021.

More By This Author:

A Positive Earnings Revisions Trend Emerges

Breaking Down The Construction & Housing Earnings Picture

Earnings Remain Stable: No 'Cliff' In Sight

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more