The Promising Outlook For Thermal Coal And 3 Companies To Look Out For

Photo by Dominik Vanyi on Unsplash

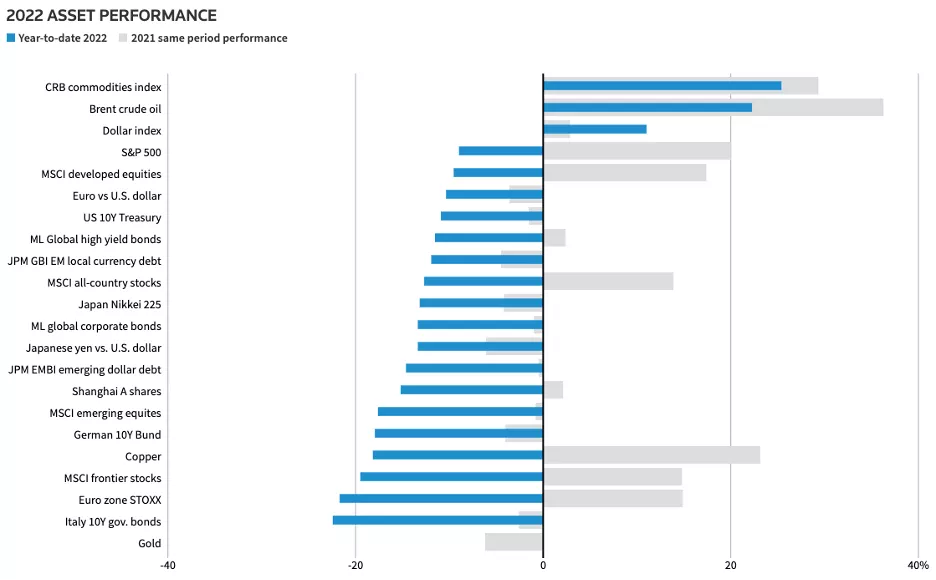

With macroeconomic headwinds and geopolitical tensions continuing to make headlines this year, commodities have outperformed all major asset classes, which does not come as a surprise. Many investors have turned to the energy sector this year in search of alpha returns amid chaotic market conditions, and their primary focus has been the oil and gas sector. Thermal coal, simply referred to as coal, has been one of the best-performing commodities so far this year although this asset class has not garnered the same attention as crude oil. With macroeconomic headwinds and geopolitical tensions continuing to make headlines this year, commodities have outperformed all major asset classes, which does not come as a surprise. Many investors have turned to the energy sector this year in search of alpha returns amid chaotic market conditions, and their primary focus has been the oil and gas sector. Thermal coal, simply referred to as coal, has been one of the best-performing commodities so far this year although this asset class has not garnered the same attention as crude oil.

Figure 1: Performance of major asset classes in 2022 (as of August)

Source: Reuters

As discussed in the following segment, the coal industry still has a lot to offer investors, and there are many reasons to believe that investing in coal mining companies could lead to substantial long-term capital gains.

Multiple Factors Are Driving Coal Prices Higher

Back in 2021, worldwide coal consumption grew 6% as the recovery of the global economy from the virus-induced recession led to strong demand for coal as the commodity is used for a wide variety of industrial purposes including power generation. The International Energy Agency estimates the demand for coal to rise another 700 basis points this year, pushing the global demand for coal to an all-time high.

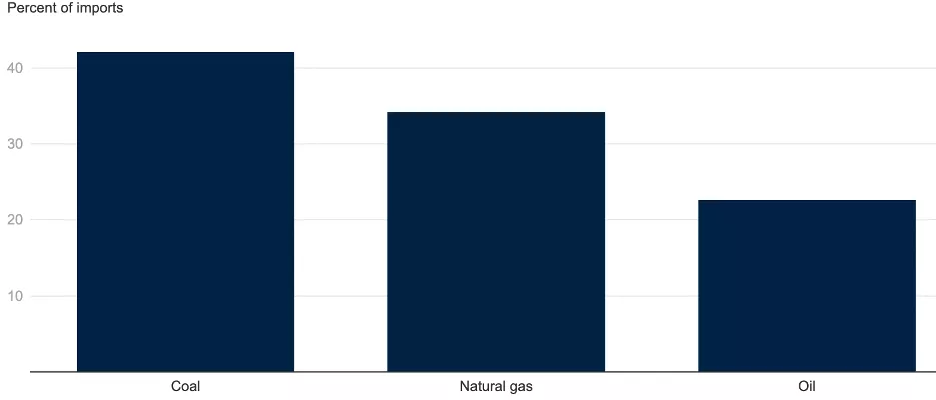

Coal prices are feeling the pressure of both demand and supply-side developments. Russia is one of the main exporters of natural gas and coal to Europe, and the recent ban imposed by the European Union on Russian energy exports has led to a disruption of trade between Russia and EU members. As illustrated below, Russia generally accounts for more than 40% of EU coal imports, and trade disruptions resulting from the EU’s ban have played a massive role in the recent surge in coal prices.

Figure 2: Share of EU’s energy imports from Russia

Source: World Bank

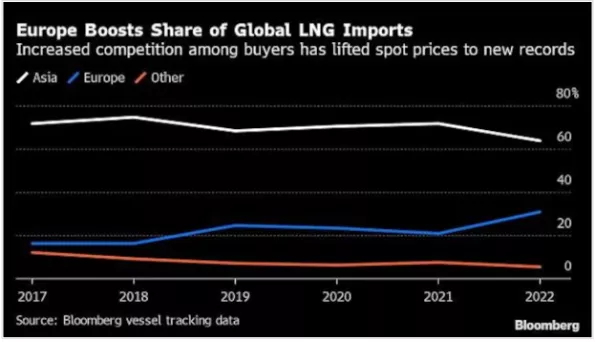

European countries are aggressively building their LNG inventories ahead of the winter season, and the increased competition in the global energy market has already pushed many Asian countries to consider coal as a viable, economical alternative to LNG. With demand for LNG expected to remain sky-high in Europe, populous Asian nations including China, India, South Korea, and Japan are likely to depend on coal to meet their energy requirements. Europe, on the other hand, will be forced to compete for coal as well since its inventory of LNG will not be sufficient to keep households warm in the coming winter, and this will inevitably result in higher coal prices.

Figure 3: Share of global LNG imports

Source: Business Standard/Bloomberg

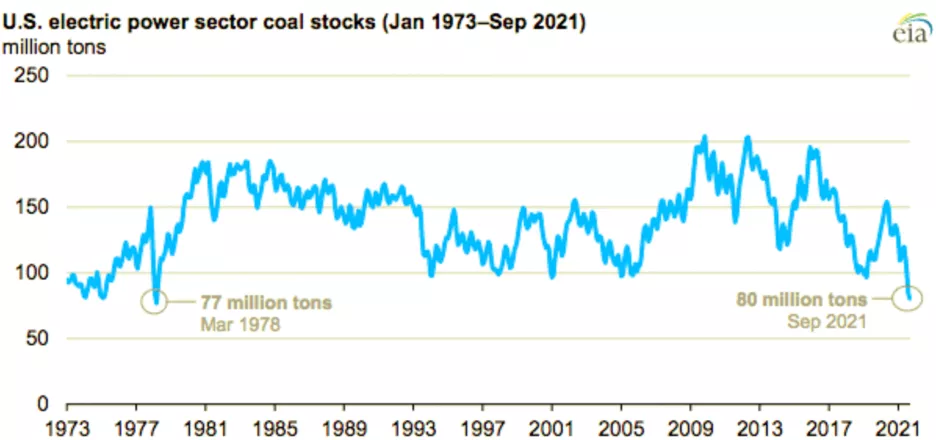

Since the beginning of the pandemic, many countries have turned to coal to keep up with the massive demand for power amid supply-chain challenges experienced by the global energy industry. Late last year, coal inventories at U.S. power plants reached their lowest level in more than 40 years as the demand for coal substantially outpaced the supply of coal. This imbalance between supply and demand is expected to continue in the foreseeable future as demand remains elevated.

Figure 4: Coal inventories at U.S. power plants

Source: Power Mag

With inventories continuing to hover around 40-year lows, the demand for coal coming stemming from the American power sector will remain high in the next few years. This will exert upward pressure on coal prices.

According to data from World Bank, leading coal producers in the world such as China and India have already ramped up coal production on the back of dwindling coal supplies. However, these production increases are forecast to be insufficient to meet the elevated demand for coal.

Figure 5: YoY percentage change in Coal production (China and India)

.webp)

Source: World Bank

With the global energy sector continuing to be under pressure due to geopolitical tensions, coal prices are likely to remain elevated as coal is considered the most reliable and cost-efficient source of energy for industrial purposes. Coal prices are currently hovering around the $410 mark per metric ton, and Rystad Energy believes coal prices could surge to $500 by the end of this year. With industry dynamics pointing to higher coal prices, opportunistic investors may want to gain exposure to this sector.

3 Companies to Look Out For

To make the most of the expected surge in coal prices, investors should consider adding a few coal companies to their investment portfolios. As always, it makes sense to strike a balance between investing in small-cap and large-cap stocks as small companies could offer lucrative risk-adjusted returns while large, established companies could help investors steady the ship. Below are 3 companies that could help investors make the most of rising coal prices.

Peabody Energy Corporation (BTU)

Peabody is the largest coal producer in the United States with operations in Japan, Taiwan, Australia, and a few other Asian countries. The company is one of the largest thermal coal suppliers to electric utilities in the U.S. and owns a total of 17 coal mining operations with approximately 2.5 billion tons of probable coal reserves spread across 450,000 acres of surface property. Peabody has a long history going back to its establishment in 1883, and its stock price has increased a staggering 104% this year against a 10%+ decline in the S&P 500 Index. Even on the back of this stellar stock market performance, Peabody is still valued at a forward P/E ratio of just 3.69, which opens the doors for investors to invest in the company at a very attractive valuation level.

Silver Elephant Mining Corp. (SILEF)

Silver Elephant is a Canadian exploration-stage mineral company that has an interest in silver mining projects in Bolivia and coal production facilities in Mongolia. The company also owns a 37% stake in Battery Metals Royalties which engages in nickel and vanadium mining. Mega Thermal Coal is a wholly-owned subsidiary of Silver Elephant which is preparing to commence coal production at its Ulaan Ovoo project in Mongolia in the fourth quarter of this year. According to company filings, the Ulaan Ovoo project is capable of producing 30,000 tons of coal per month once production begins. What makes Silver Elephant attractive to investors is the diversified business of the company as this will negate any negative impact resulting from a possible decline in coal prices in the long run.

Arch Resources, Inc. (ARCH)

Arch Resources, previously known as Arch Coal, has consistently featured among the top coal producers in the United States in the last few years. The company controls coal lands through long-term leases in Ohio, Maryland, Virginia, Wyoming, Kentucky, Montana, Pennsylvania, and Colorado. Similar to Peabody, Arch Resources is valued at a very cheap forward earnings multiple of 3.05 despite its stock surging more than 75% this year amid the favorable outlook for the coal sector. Arch is one of the few coal production companies that pay a consistent dividend, and its quarterly dividend of 25 cents per share converts to an annual yield of 0.65% at today’s stock prices. Arch’s shareholder-friendly capital allocation policy makes it a coal company suitable for income investors as well as contrarian investors looking to make the most of the positive outlook for the coal sector.

Conclusion

The global energy crisis continues with the available supply of energy sources continuing to be insufficient to meet the massive energy demand today. Coal’s resurgence, therefore, is gaining traction as many countries are relying on coal to meet their energy demands. With no slowdown in demand expected soon, investing in coal companies could help investors yield lucrative returns in the future.

More By This Author:

Pinterest: The Monetization Phase Begins

Southwest Airlines Is Primed For Growth

Adobe Continues To Penetrate The NFT Market Opportunity

Disclosure: The author did not own any shares mentioned in this article at the time of publication.

Some good companies here.