Southwest Airlines Is Primed For Growth

Company Description

Southwest Airlines Co. (LUV), founded in 1967, is the largest domestic carrier in the United States with a leisure-focused low-cost business model. The company serves 121 destinations flying to 42 states with its 728 narrow-bodied Boeing 737 aircraft, and the carrier also serves a few international markets. In 2021 alone, Southwest launched its services in 14 additional markets. The majority of Southwest's revenue comes from the passenger segment - around 89.1% in 2021- and the rest from the Freight segment.

Despite being a low-cost carrier, the company is known for its high customer satisfaction. As per the latest American customer satisfaction index, Southwest shares the number one position with Delta Air Lines Inc. (DAL). The company was also ranked 14 in Fortune's 2021 list of the world's most admired companies.

Industry Analysis and Financial Performance

The U.S. airline industry consists of legacy carriers such as Delta Air Lines, American Airlines (AAL), United Airlines (UAL), and Southwest along with smaller players such as Spirit Airlines Incorporated (SAVE), Frontier Group Holdings Inc. (ULCC), Alaska Air Group, Inc. (ALK), JetBlue Airways Corporation (JBLU), and SkyWest, Inc. (SKYW). While legacy carriers are well-positioned to reap the rewards of rebounding travel trends, smaller peers are focused on merger deals to expand their scale and maintain the sustainability of earnings.

The airline industry faced many challenges over the last couple of years.

The coronavirus pandemic completely halted air travel, making life difficult for airline companies in every part of the world. As much as people were reluctant to travel due to the rapidly spreading virus which came in three different waves, entry bans imposed by many countries also affected air travel. During this time, almost all airlines including Southwest performed very poorly. Financial devastation across the aviation industry has made investors lose their confidence in the industry, and Southwest is still suffering from this negative development although the company has come a long way since 2020 to reignite growth. Airline carriers with a strong focus on freight forwarding and cargo were able to minimize their losses, while airlines focused on international markets suffered the worst.

Not surprisingly, the domestic market is recovering faster than the international market, and this is good news for Southwest because of its strong focus on the domestic market. So far this year, Southwest stock has outperformed the U.S. Global Jets ETF (JETS), which gives reason to believe investors are increasingly turning bullish on domestic carriers.

Exhibit 1: Southwest Airlines stock vs U.S. Global Jets ETF

(Click on image to enlarge)

Source: Yahoo Finance

Following two years of pandemic woes, many countries are reopening their borders for international travelers. On the other hand, with the emergence of vaccines, people's fear of traveling has eased off. This has brought new hope for all airlines alike, and Southwest, as illustrated below, has staged a strong recovery from pandemic lows in the last few quarters.

Exhibit 2: Southwest Airlines' quarterly revenue and net income

Source: Finbox

Southwest’s earnings turned positive in the fourth quarter of 2021 backed by a strong rebound in revenue. Despite geopolitical and macroeconomic challenges, the company reported good numbers for the first quarter of 2022 as well, aided by the success of its cost-management strategies.

The headwinds for the industry did not end with the relaxation of travel restrictions. Towards the end of 2021, U.S. inflation reached the highest levels seen since the 1980s, with energy costs becoming the driver of inflation.

Exhibit 3: U.S. inflation – all items and energy

(Click on image to enlarge)

Source: U.S. Bureau of Labor Statistics

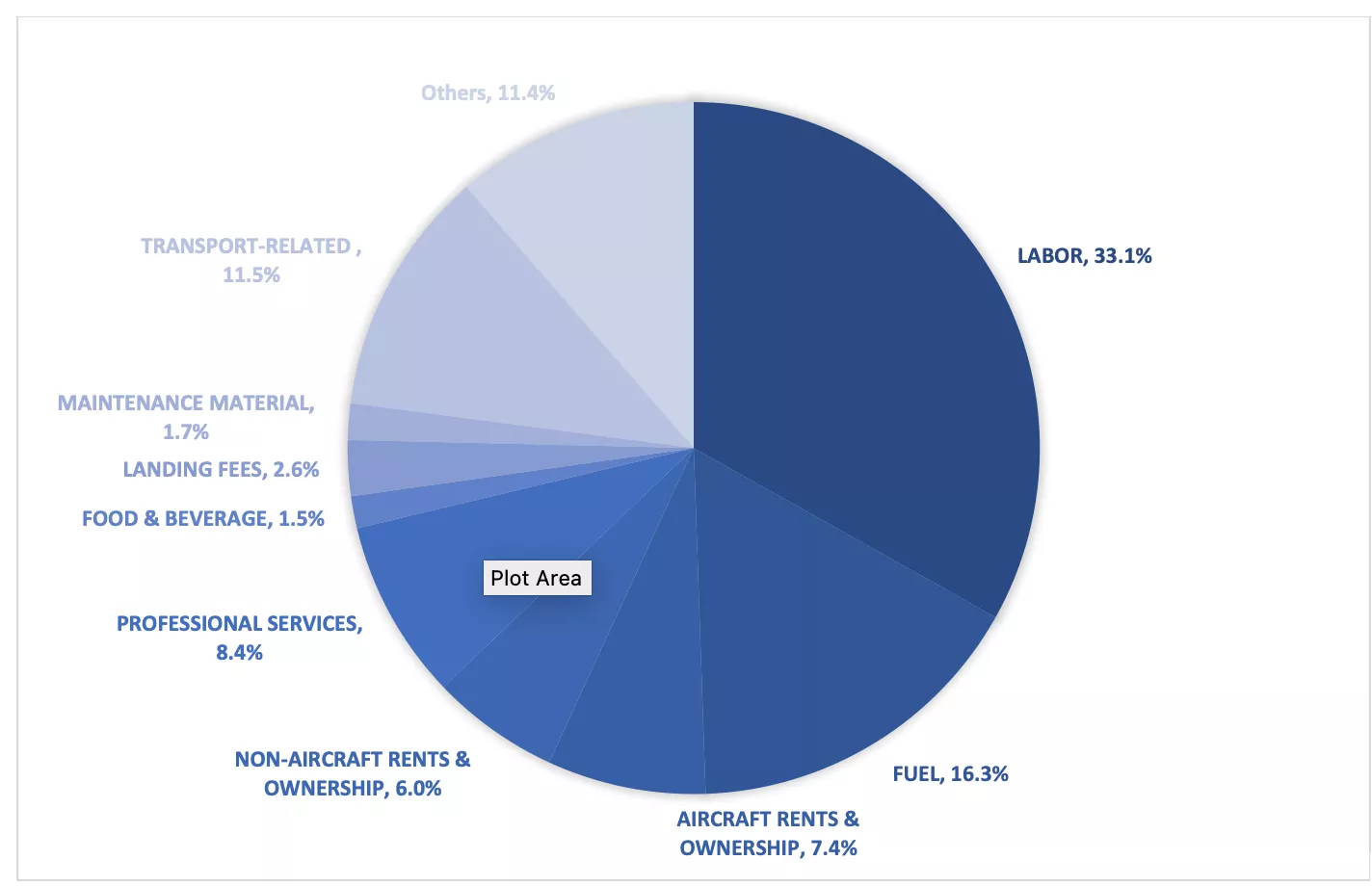

Rising energy costs are a major concern for the airline industry as labor and fuel take up a large chunk of operating costs for airlines as illustrated below.

Exhibit 4: U.S. passenger airlines operating costs breakdown (2021)

Source: Airlines for America

Amid all these challenges, geopolitical tensions emerged in Europe last February with the breakout of the war between Russia and Ukraine. These tensions triggered another rally in oil prices given that Russia is one of the largest producers and importers of oil. All types of oil and gas products reached the highest levels seen since 2008 before cooling down marginally. Also, the Russian air space ban by America means that carriers will be flying longer routes and will need more fuel.

Southwest has hedged against oil price increases, and this will reduce the burden of rising fuel prices. For now, Southwest has hedged 59% of its expected consumption for the rest of 2022, 37% for 2023, and 17% for 2024. To cope with the rising demand, the company deployed its latest fuel-efficient aircraft, the Boeing 737-700 into service along with the Boeing 737 Max, and this will further help mitigate some cost headwinds.

Overall, the industry is continuing to face challenges due to many reasons, but Southwest seems to be managing these challenges better than its peers, which comes down to the quality of its management team and its industry-leading liquidity position.

Moving in the Right Direction

Southwest is dedicated to its environmental sustainability goals with plans to become carbon neutral by 2050. Fleet modernization has a substantial role to play in fuel efficiency and carbon footprint reduction. The company has ambitious plans for fleet modernization and currently has a total of 660 aircraft in the order book. The airline has signed an agreement with Boeing Company (BA) for 100 737 MAX aircraft of which 34 will be delivered in 2022. More than half of the MAX aircraft in its order book will replace a significant amount of less-fuel-efficient 700 aircraft. These replacements should help Southwest Airlines report better-operating margins in the future.

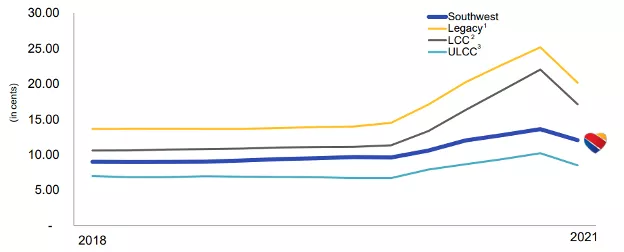

The success of Southwest is driven by its low-cost business model. Unlike other legacy carriers, Southwest operates in less popular airports which means the fees charged to their travelers are quite low compared to its peers. Domestic operating expenses per available seat mile excluding fuel of Southwest in 2021 have been comparatively lower than all legacy carriers and even low-cost carriers such as JetBlue and Alaska. Southwest’s fees are only higher than ultra-low-cost carriers such as Spirit, Allegiant, and Frontier.

Exhibit 5: Domestic operating expenses per available seat mile, excluding fuel

Source: Company presentation

The company’s excellent liquidity position is another strength that enables the company to weather economic downturns better than its peers. Many Wall Street analysts believe that Southwest has the best balance sheet among its peers, and this helps the company invest aggressively in securing new business as well.

Risks to Monitor

Travel demand has not fully recovered to pre-pandemic levels just yet. Southwest’s operating revenue for 2021 was 29.6% below the 2019 levels. Omicron, the latest variant of COVID-19, and unfavorable weather conditions affected the bookings in January and February as well. Geopolitical tensions in Europe are also proving to be a challenge, so a full recovery to pre-pandemic levels might not occur until the end of this year. This is a key risk to monitor as a delayed recovery might spook investors, thereby resulting in lower stock prices.

Leisure travel demand will eventually rebound but it seems like the pandemic has left a permanent scar on business travel. After many companies discovered the benefits of remote working, they no longer see the benefit of explicitly traveling to meet clients unless it is essential. In 2021, business travel revenue remained 50% below the 2019 levels, and a full recovery seems years away at this point.

Rising labor costs are another concern for Southwest and its peers. Due to labor shortages, many airlines in the industry have been forced to increase their salaries and wages. This happened as major airlines including Southwest laid off their employees with early retirement and buyout programs in large chunks which left them with a shortage of employees when business gradually started to recover at the beginning of 2021. As a result, amid the competition of rehiring, Southwest raised its minimum hourly pay rate to $15 for approximately 13% of its employees inclusive of call center operators, customer service agents, and skycaps with effect from August. Also, the base salary of a first officer was hiked to around $106,000 along with added benefits. Given that almost a third of the operating costs are represented by employee compensation, these developments are likely to hurt operating margins in the future.

Takeaway

Southwest Airlines is gradually recovering, and the company is expanding into new markets while being committed to reducing variable costs. The company is primed for growth in the post-pandemic era with its strong focus on the domestic market, but investors need to closely monitor a few risks to ensure the investment thesis will remain intact despite the challenges faced by the company.

Image Source: Unsplash

Disclosure: I am long Southwest Airlines stock.

ANy insight into when flight prices will come back down to pre-Covid levels?

These airlines are now charging a fortune for flights. But the service is so much worse than it used to be, as is their on-time performance. And the cancellations are out of control. Over a 1,000 flights cancelled so far this weekend!

$LUV is a great stock!

With the way airlines have been jacking up prices, I'm not surprised that $LUV is now raking in the cash! Unfortunately, it meant that for every day Americans like me, I had to completely cancel my family's summer vacation plans.

Ticket prices, to be honest, have gone up in almost all regions. This has a lot to do with the inflationary pressure these companies face from fuel to labor to food. I don't think it's going to improve soon either.

I do get that. But don't airlines lock in fuel prices way in advance, specifically so they can manage that cost and elimnate such surprises? Besides, as Susan Miller pointed out, their skyrocketing ticket prices seem to account for far more than infaltion, which has gone up. But not by the THAT much. Ticket prices have doubled from what I was looking at less than 6 months ago.

That is very good for the stock. But not good for Americans.

It's good for Americans if they own $LUV!

With surging fuel prices, the mark ups aren't all #Southwest's fault. But obviously airlines are goiing to try to bilk as much as they can. After over 2.5 years of losses from empty flights, Americans are ready to fly again and will pay whatever it takes to make up for those lost vacations. Can you blame these airlines for trying to make as much as they?

Now is the time to finally buy back those airline stocks like $LUV.