The Outlook For Spotify After Losing Half Of Its Market Value In 2022

Image Source: Pexels

Spotify Technology S.A. (SPOT) has lost nearly 60% of its market value in the last 12 months, and 2022 was well and truly a year to forget. The stock is trending down over concerns about the company's profitability and intense competition. Spotify is a music streaming service that makes money through a combination of advertising revenue and subscription fees. Free users of the service can listen to music with ads interspersed, while paid subscribers pay a monthly fee for an ad-free experience and additional features like offline listening. Spotify also generates revenue through partnerships and by selling data to third parties. Additionally, Spotify also earns money by promoting and selling music on its platform. Given the current macroeconomic challenges, the subscription business and ad business have taken a hit. With changing consumer priorities amid high prices, it is no surprise that Spotify is reporting slow growth. However, Spotify stock remains a good long-term play with its strong market presence, diversified user base, and its entry into new markets.

Spotify continues to diversify its revenue streams

High inflation usually increases the cost of running a music streaming service. This could lead to higher subscription prices to make up for the added expenses. As consumer purchasing power is already low this could lead to fewer people being able to afford a subscription to the music streaming service. Consumers may opt for a cheaper or free alternative if subscription prices become too high for them. However, it's important to keep in mind that streaming services are often able to negotiate rates with record labels and artists that are tied to inflation, which can help offset some of these costs. It's also worth noting that the music streaming market is a highly competitive one and companies like Spotify are constantly looking for ways to differentiate themselves and keep their prices competitive to attract and retain customers. Spotify did raise the prices of some of its subscription plans in the United States, the United Kingdom, and all plans in Brazil, but the company reported no change in user churn since the price changes took effect.

Over the last five years, Spotify has made significant investments in expanding the content available on its platform, including investments in its advertising marketplace and the acquisition of several podcast studios. However, these expansion strategies have put financial pressure on the company and impacted profitability with its gross margins remaining relatively stable at around 25%. The management expects ad-supported gross margins to begin improving in 2023, helping to improve overall margins and the underlying profitability of the company.

Exhibit 1: Gross margin

(Click on image to enlarge)

Source: Spotify Quarterly Reports

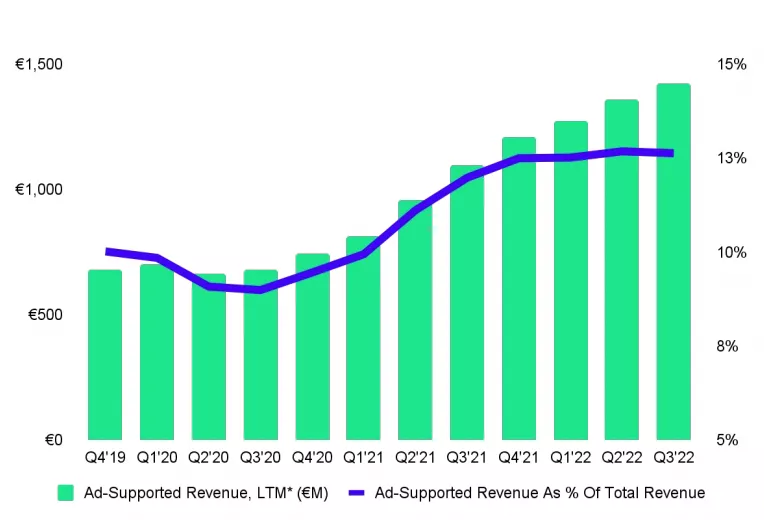

Despite a slowdown in global ad spending, Spotify's ad-supported revenue increased 19% YoY in Q3 and accounted for 13% of total revenue.

Exhibit 2: Ad-supported revenue growth

Source: Spotify Quarterly Reports

Although the audio streamer is not yet profitable, it is currently one of the world's largest and most popular music streaming services, with an impressive growth story. As of the third quarter of the fiscal year 2022, Spotify had over 456 million active users, including 195 million paying subscribers. Spotify has a strong presence in many countries worldwide and it is considered one of the top players in the music streaming market. Spotify's main competitors include other streaming services like Apple Music, Amazon Music, and YouTube Music, as well as Tidal, which is owned by Jay-Z. Spotify's most significant advantage over these competitors is its large user base and wide range of features, such as personalized playlists and recommendations, which have helped it to attract and retain customers.

Spotify is also constantly working to improve its platform and services by adding new features and partnerships with music labels, artists, and podcasts. Also, Spotify is investing in podcasts and non-music audio content to be more than just a music streaming service, which could help to attract new customers and generate additional revenue. Spotify's continuous investment in content and features has helped it quickly become the No. 1 podcast platform in the United States and many other markets around the world. According to Adroit Market Research, the podcast market is expected to reach $98.78 billion by 2030, growing at a compounded annual growth rate of 30.65%. Given Spotify's market position, rising demand for podcasts will be beneficial with the company scaling up its advertising capabilities.

The company did not stop only with Podcasts. Spotify maintains its lead in music streaming by constantly adding new products and monetization opportunities. The company launched audiobooks for its U.S. users in September 2022, with a library of over 300k titles. Audiobooks are a one-time purchase available to both free and Premium subscribers. This is a positive driver that provides a good opportunity to attract users. Another revenue opportunity to look out for is Spotify's paid marketplace tools for content creators. Despite challenging macroeconomic conditions, this has helped the platform maintain user growth.

Exhibit 3: Premium subscribers and monthly active users (MAUs)

Source: Spotify Quarterly Reports

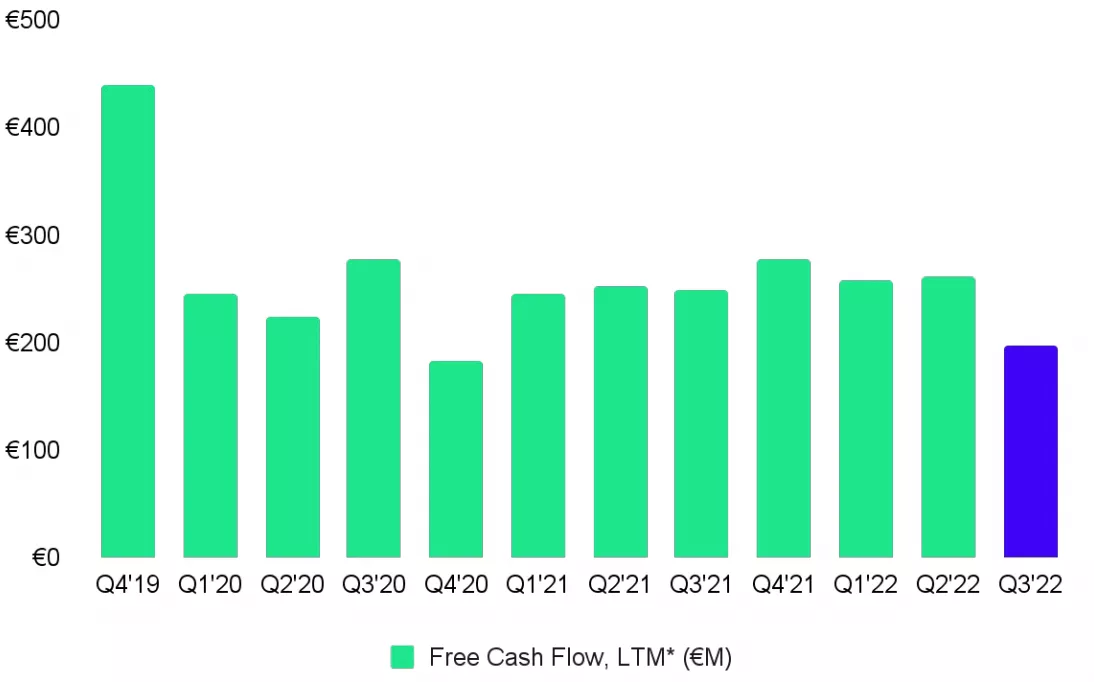

Spotify added 7 million net-new Premium subscribers in the third quarter, exceeding the company's internal guidance. This was driven by rapid growth in emerging markets, with Latin America outperforming in the third quarter. In the fourth quarter, the company expects to add 7 million Premium subscribers and 23 million new MAUs. Further, Spotify remained cash-flow positive despite pressure on its operating margins.

Exhibit 4: Free cash flow

Source: Spotify Quarterly Reports

Takeaway

Spotify's user growth, both Premium subscribers and MAUs, continues to expand, reflecting the strength of Spotify's global network. At the same time, the company continues to develop a growing range of monetizable products. By introducing new features and products, the company adds value to its subscribers, resulting in an increase in ARPUs (average revenue per user). Furthermore, Spotify's hiring freeze and "work from anywhere" policy are assisting the company in lowering its operating costs. The company has also been FCF-positive for many years. Spotify will be able to increase its gross and operating margins as the general economic situation improves.

The company is diversifying its non-subscription revenue stream and has room for further expansion. With years of growth ahead of the company, especially in emerging markets, Spotify seems cheaply valued today but investors might have to weather volatility in the stock price before enjoying healthy returns in the long run.

More By This Author:

Fiverr International: A Growth Gem Hidden In Plain Sight

The Promising Outlook For Thermal Coal And 3 Companies To Look Out For

Pinterest: The Monetization Phase Begins

Disclaimer: I do not have any positions in any of the stocks mentioned in this article.