The “Mystery Liquidator Revealed” Stock Market (And Sentiment Results)

Last week, not only in my article of the week (The “Forced Seller” Stock Market (and Sentiment Results)…) but in my appearance on Fox Business – The Claman Countdown – I referenced the unnatural “forced selling” that was cascading and had to flush through the system before we found a bottom. Thanks to Liz Claman and Ellie Terrett for having me on.

I communicated that the selling was not natural and it felt like a liquidation. Here were my notes ahead of the segment:

Not a Crypto Winter as much as a MARGIN Winter

RATES: As the 10yr yield skyrocketed from 1.37% in December 2021 to 3.19% earlier this week, money has come out of:

Crypto, Innovation Stocks, Tech, Biotech, China Tech.

This is due to:

- The higher cost for margin.

- Margin Calls as “long duration”/speculative assets decline in price.

- Concentrated Fund Redemptions.

As yields stabilize (now down to 2.84%) I think you may start to see some stabilization in these groups – with particular emphasis on Biotech.

2015-2016 BIOTECH PATTERN

-Biotech (XBI) followed the same pattern into the last tightening cycle from 2015-2016. The XBI fell 50% in anticipation of rate hikes 2015-2016. From 2016-2018 WHILE THE FED TIGHTENED from .25% to 2.25% (and started balance sheet reduction), XBI rose 140% off the lows.

-This cycle, Biotech (XBI fell ~60%) in anticipation of the tightening. Now that we have a couple of hikes under our belt, we may be finding a bottom in the near-term.

ANIMAL SPIRITS

-PFE buying BHVN earlier this week for $11.6B may have ignited animal spirits in the group as “big Pharma” has a ton of cash coupled with impending patent cliffs. They will have to BUY innovation from the Biotech sector to maintain growth and Boards were put on notice this week, IF THEY DON’T START BUYING these biotech companies, their competitors will.

INFLATION

-Rate Stabilization will be a function of inflation expectations. PPI and CPI “peaked” last month – as this week’s reads were in fact LOWER. Base effects should help more in May than it did for April as the comps are much higher from May of last year (when the inflation spike began).

EARNINGS/MULTIPLES

-The 5 average multiple on the S&P 500 (WHICH INCLUDES THE LAST TIGHTENING CYCLE) is 18.6x. We are currently trading at 17.22x 2022 EPS and 15.7x 2023 consensus EPS. Could multiples go lower? YES, but rates would have to go much higher to justify that magnitude of multiple contraction. Rates were 6.82% in 2000 BIG DIFFERENCE.

-While we did spike up to ~3.19% on the 10yr for a few minutes earlier this week, it is consistent with the peaks in October 2018 of 3.25% and Jan 2014 at 3.03% – before receding aggressively.

-Despite all of the pressure this week, one green shoot is the fact that bonds started to find a small bid this week (and rates backed off).

-Can’t pick a bottom, but can start to nibble in sectors that can perform in a slowing growth environment and are trading at or below the low end of their long-term multiples. Biotech fits this bill.

Clearing the Toilet

We have now identified the clog in the toilet and the plunger may have finally freed up the problem on Wednesday.

Gabe Plotkin’s Melvin Capital sent a letter to investors yesterday that he was liquidating the $7.8B (excluding a few extra turns of leverage) fund. The thing about a liquidation is that you don’t send the letter until AFTER you’ve done the selling or the vultures will come in and pick you off like a super slow “warrior” at a paintball park. Here are the key points of Wednesday’s (after the bell) announcement via (Bloomberg):

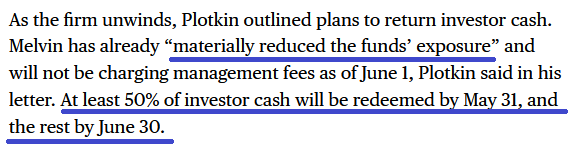

If you pull up each of the fund’s holdings from the latest filing you can see the massive selling pressure from his liquidation and those who likely got a whiff and were shooting against him. It only takes a handful of his 30 analysts circulating their resumes to other funds to tell the whole story. Loose lips sink ships:

(Click on image to enlarge)

If you were wondering why Amazon, Expedia, and Uber were selling off like they were going out of business – when the exact opposite is true (they are leaders in their fields), now you know. Selling begets more selling and no reading of financials or drawing squiggly lines on charts will give you an edge. You simply have to know the underlying business and wait for the mania (forced liquidation) to end before the stock ultimately finds its level. In the short term, the market is a voting machine based on emotion. In the long term, it is a weighing machine based on fundamentals.

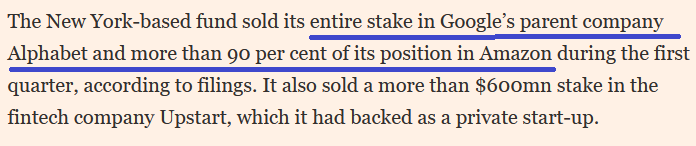

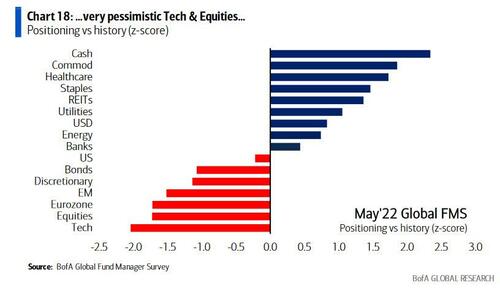

With this news we may be there. Sure, there may be other smaller liquidations, and we know many of the Tiger Cubs have been selling billions of tech “in the hole” to meet redemptions, but these guys don’t wait around. Source: (Financial Times)

When they’re out, they want to beat their competition to the exit and it seems they all moved at once in April and early May. The acute pain is now likely in the rearview mirror now that the source of the clog has been revealed. We may get a few aftershocks, but the cat is out of the bag at this point.

Plotkin simply didn’t want to come out of pocket to pay for the overhead while he worked back up to his high watermark to get paid a carry once again. Given enough time he would of recovered, but he decided he didn’t want to work for free for two years and left his investors holding the bag.

Chase Coleman on the other hand will come back and probably stronger than ever. It will just take time. Go through this list and you’ll see that no amount of fundamental or technical analysis would help with these elephants engaged in weeks upon weeks of “forced selling.” Tiger had to puke out China Tech all quarter long, so if you were wondering why the selling felt unnatural and un-tethered from fundamentals/technicals, now you know. By the time it is public it is usually over, and it may very well be the case that we’re there or close.

The irony is that the time to invest in a great manager is when they are down and have to make up their watermark. If I were an institution looking to put money to work today, I would be meeting with Tiger Global and Chase Coleman because I know they’ve got to be up 100% plus before they start getting paid again – and they have the skills to do it. The problem is the 12-year-old consultants (with no experience) – running around with their little clipboard asking for sharpe ratios to cover their ass – are missing the best timing to enter. They’ll be begging to get back into the fund in 3 years from now after it’s up 100%+ and earning money again – after retaking the high watermark, but they’ll have missed it (the big move). All because the institutional game is more about CYA and checking all the boxes than it is about common sense and seeing the big picture.

Watch What Warren DOES, Not What He Says…

Warren Buffett put ~1/3 of his cash hoard (approximately ~$50B) to work since the beginning of the year. While others were puking, Warren was shopping. On Tuesday I discussed this and other opportunities to buy deeply discounted stocks/sectors on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Liz and Ellie Terrett for having me on.

Show Notes for the segment:

Not the time to go “all-in” wholesale, but 100% the time to buy high-quality companies and sectors trading at deep discounts due to rates and tightening fears.

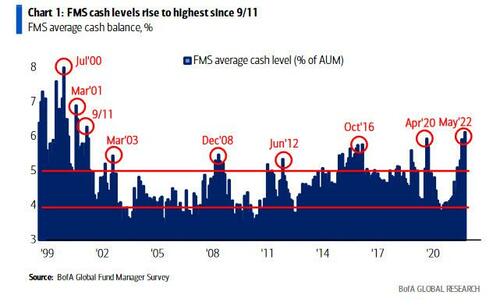

SENTIMENT: BofA Global Fund Manager Survey

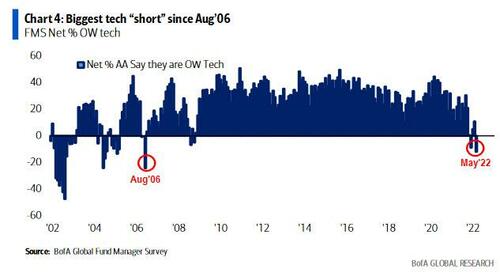

-Managers have the highest cash balances since 9/11 in 2001

–Most Underweight stocks since May 2020

-Too Crowded: Biggest tech “short” since August 2006 (Rallied 42% next 1.5yrs)

–Most Crowded Trades: Long Oil/Commodities (28%), Short 10y Tsy (25%)

EARNINGS/MULTIPLES

-The 5yr average multiple on the S&P 500 (WHICH INCLUDES THE LAST TIGHTENING CYCLE) is 18.6x. We are currently trading at 17.5x 2022 EPS and 16x 2023 consensus EPS. Could multiples go lower? YES, but rates would have to go much higher to justify that magnitude of multiple contraction. Rates (10yr yield) were 6.82% in 2000 BIG DIFFERENCE.

FEAR OF TIGHTENING IS WORSE THAT TIGHTENING ITSELF (2 examples):

-2015-early 2016: 2 sectors were DECIMATED in ANTICIPATION/FEAR OF THE TIGHTENING CYCLE that started in 2016: China Tech and Biotech.

-Alibaba (BABA) sold off 53%, and Biotech (XBI) sold off 52% in the 12 months ahead of the hikes (2015).

-After the first rate hike in December 2015, both Biotech and BABA found their bottoms in early 2016. The Fed raised 8 more times over the next 2 years. Biotech was up 140% and Alibaba was up 258% in this 2-year period of tightening (8 hikes).

Moral of the Story: The fear of tightening can be WORSE than the actual tightening itself. We’ve been early on these two but adding into weakness regularly as we see a longer-term major inflection starting. They are simply too cheap at these levels.

Sentiment Washed Out

On Tuesday, Bank of America put out its monthly “Fund Manager Survey” which surveys ~300 managers with ~$900B AUM. Here is my full summary:

The three key points I want to focus on are:

1. Managers are the most SHORT the TECH sector since August 2006.

The Nasdaq rallied 42% off the August 2006 lows in the next 18 months:

2. Managers have a higher level of cash than they did at the pandemic lows and the Great Financial Crisis. Were they times to sell or buy?

3. They have puked out of Tech and Bonds (at the lows) and bought into Commodities (at the highs) and Cash:

We expect to see this reversing in coming months. The boat has become too crowded. We know the culprits and now that it’s public the drain should be cleared.

Money Mitch

If you missed my chat with “Money Mitch” on Benzinga, you definitely want to check it out. These always get a ton of great feedback as Benzinga has become a huge platform. Thanks to Mitch Hoch for having me on.

Now onto the shorter term view for the General Market:

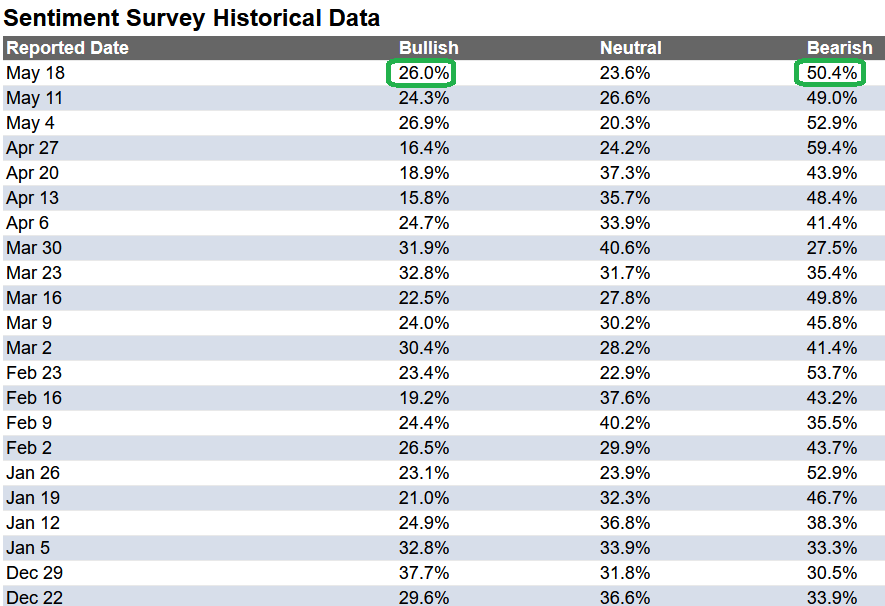

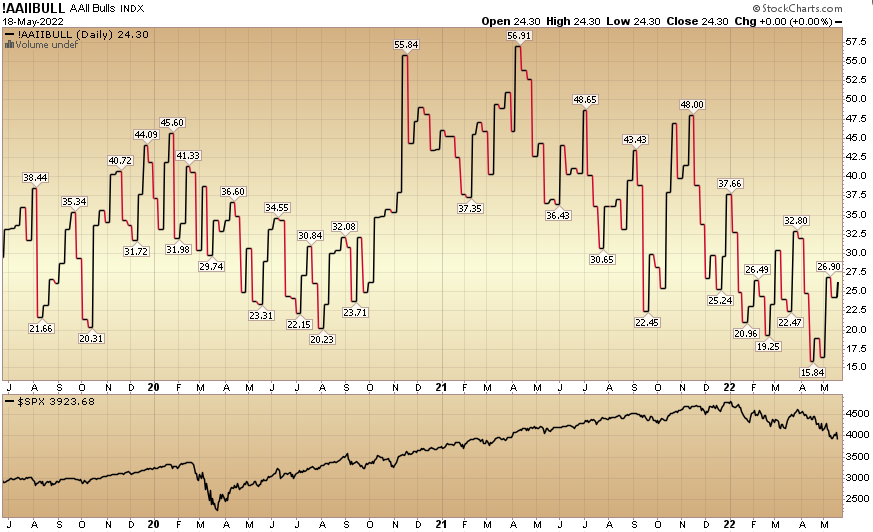

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up a hair to 26% this week from 24.3% last week. Bearish Percent rose to 50.4% from 49%. Retail sentiment is still fearful.

(Click on image to enlarge)

The CNN “Fear and Greed” collapsed from 19 last week to 9 this week. Sentiment is at maximum fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

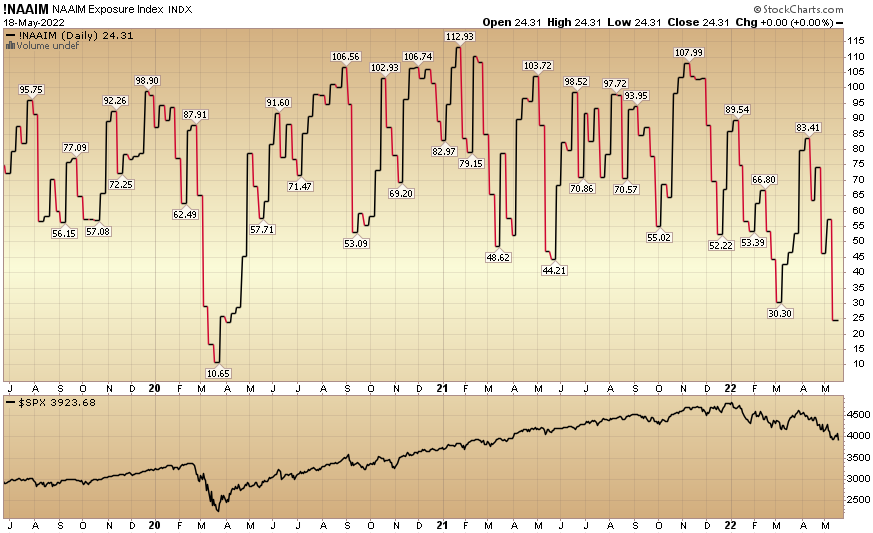

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) collapsed to 24.31% this week from 57.18% equity exposure last week.

So what does it all mean? I’ll tell you what I told a reporter from Bloomberg who asked the following this morning:

“Could I have a comment on the recent market sell off by any chance? How you see this progressing? Will it last? If so when do you see it bottoming out? How far down can it go in your opinion? How do you position in this environment? US stocks in particular, do you have a bottom in mind?”

To which I replied:

“Most of the recent selling in the market had to do with forced liquidations. We saw Melvin Capital release a letter to its investors yesterday that it was winding down the fund and that most of the positions had been liquidated in recent weeks. You saw a number of the Tiger Funds down big year-to-date and aggressively liquidating tech positions. If you go through the holdings of these funds alone you will see where most of the pain has been in recent weeks and months. They have been forced sellers and now that they have taken down billions of exposure the market can start to find some footing in coming weeks. If you step back and look at earnings, even with all of the geopolitical noise, Fed tightening, and inflation, earnings are still going to grow ~10% this year. We’re trading at around 17x 2022 earnings on the S&P and 15.5x 2023. This is below the five year average of 18.6x which includes multiples through the previous tightening cycle. We are net buyers of what the forced liquidators are selling. There is no way to pick a perfect bottom, but with sentiment washed out and much of the forced selling completed, there is opportunity on a company by company and sector by sector basis. A lot of inventory is on clearance sale these days and we’re shopping. It is our expectation that the next few months should look a lot better than the last few months.”

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.