The “Forced Seller” Stock Market (And Sentiment Results)

The selling we are seeing in recent days is not orderly or natural, it is forced selling from fund liquidations and margin calls. It will flush through the system and then we can find a bottom and start to recover.

The only true defense in these type of environments is to own companies with a large enough margin of safety to weather it out until the sellers and margin clerks are done. You can’t own stocks that have dropped from 40x sales to 20x sales and pray it is a bottom. You have to own stocks with proven, historic, and relatively predictable earnings power that are now trading at discounts to both the market multiple and their own historic multiple range.

With that, you simply wait until the wind is done blowing and your businesses will rise first coming out of it. Very few recoveries are led by speculative high-priced stocks. They gain traction in the second phase of the move after the bargains have been snatched up.

When the market behaves like this, there is no reason to look for “why” as correlations approach 1 (i.e. everything trades together). You need only wait, pull out your shopping list, and begin the search for value.

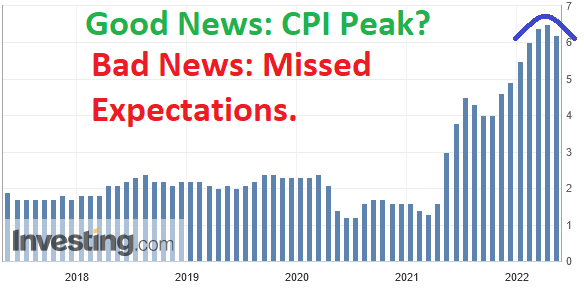

Many people pointed to the inflation report as the catalyst for yesterday’s weakness. It was a mixed report. The bad news is inflation came in higher than expected. The good news is it came in lower than last month – supporting the “peak inflation” narrative.

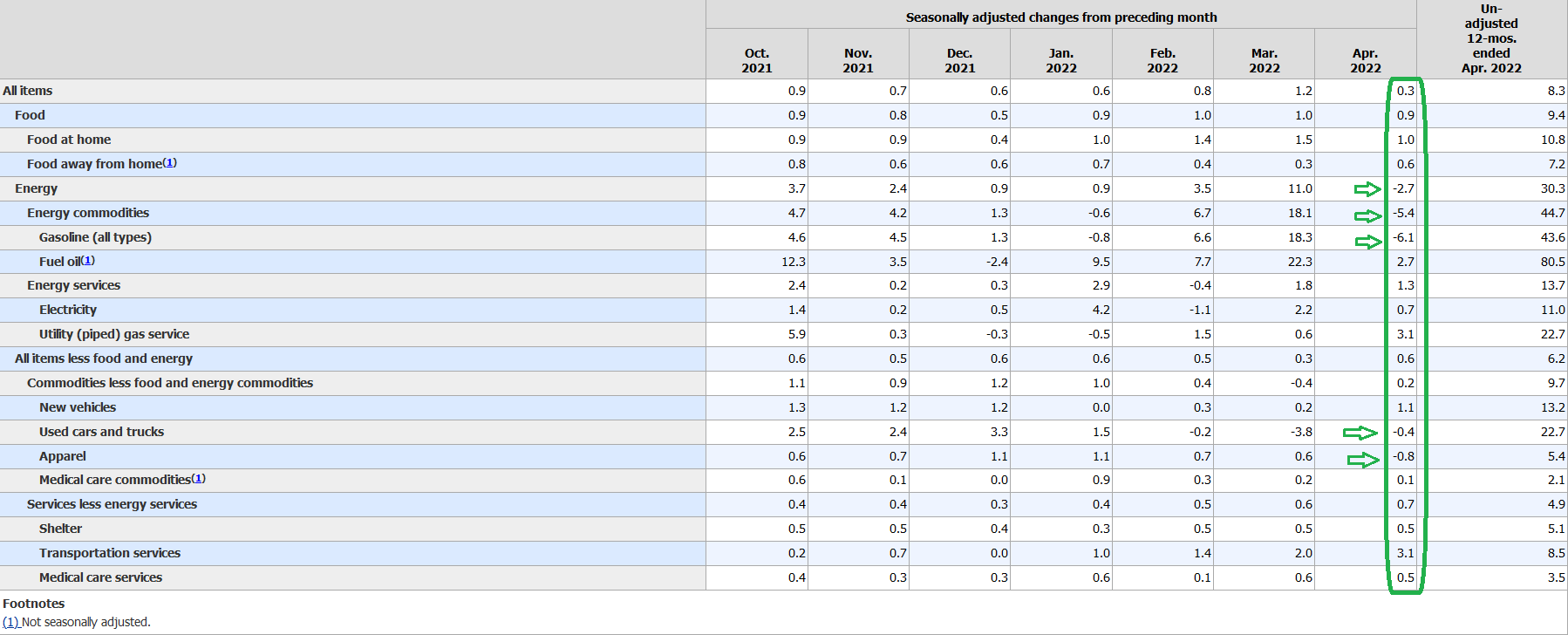

We are starting to see some positives in this report for the first time. Energy and Used Cars were drivers on the way up (CPI). They will also be drivers on the way down. Look at the number of KEY components DOWN month on month. Compare that to previous months where there were rarely any negatives month on month:

(Click on image to enlarge)

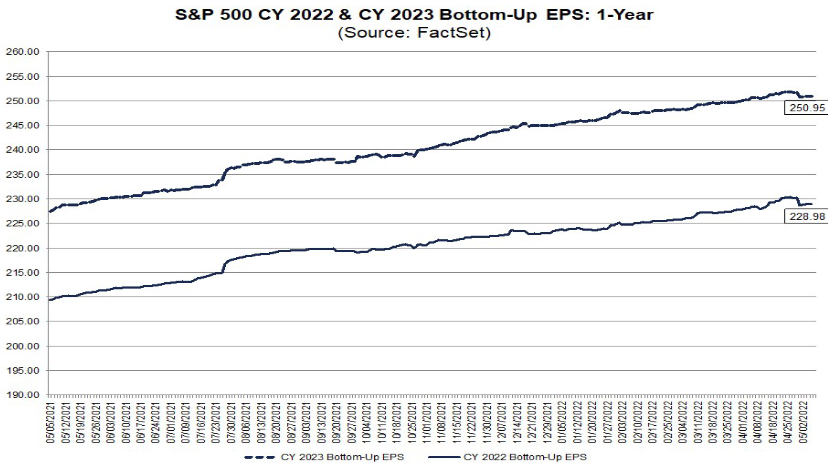

One the bad side of the ledger, consensus earnings estimates came down ~$1 last week for the first time since December:

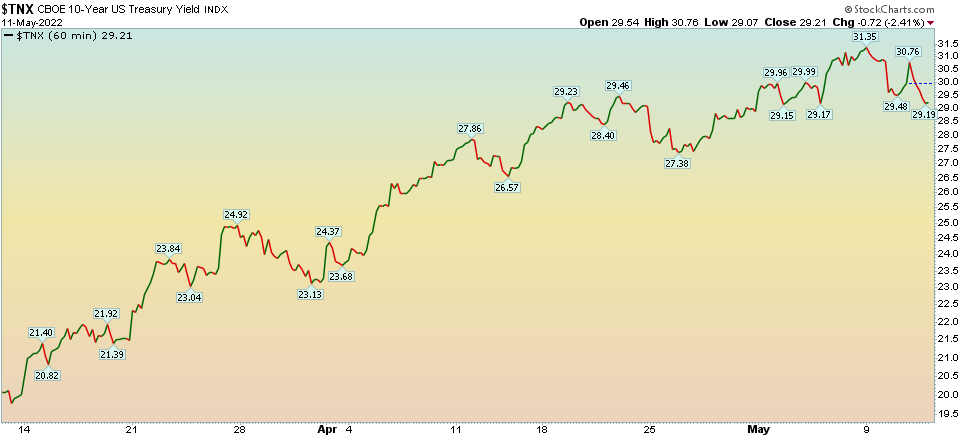

While this is an unwelcome development, earnings are still holding above 10% growth for 2022. Considering the S&P peaked at 4800 last year, the market multiple would have to contract significantly from here to justify current prices. Interest rates – although elevated – still do not support further multiple contraction from these levels. While we did spike up to ~3.19% on the 10yr for a few minutes earlier this week, it is consistent with the peaks in October 2018 of 3.25% and Jan 2014 at 3.03% – before receding aggressively.

The five-year average multiple on the S&P 500 (WHICH INCLUDES THE LAST TIGHTENING CYCLE) is 18.6x. We are currently trading at 17.22x 2022 EPS and 15.7x 2023 consensus EPS. Could multiples go lower? YES, but rates would have to go much higher to justify that magnitude of multiple contraction. Despite all of the pressure this week, one green shoot is the fact that bonds started to find a small bid this week (and rates backed off):

(Click on image to enlarge)

The 10yr yield backed off to 2.92% at the close yesterday. When the dust settles – and yields continue to stabilize at these levels – we will likely begin to see a move back into Biotech, Value Tech and China Tech. Until then we wait…

IF you have purchased businesses and sectors trading AT or BELOW the low end of their normalized earnings multiple, there is nothing to panic over – unless you are on margin. You just sit on your holdings, add at the margins if you want, and wait until the forced selling is completed. Just as prices overshoot (sometimes aggressively) to the downside, when things turn and they begin to rally back to intrinsic value, they will overshoot on the upside as well.

The secret in this business is to not get shaken out on the downside overshoot (when you own historically inexpensive businesses and sectors), and don’t sell too soon on the upside when things begin to revert back to the mean. Recognize that reversion will not be from low end of range multiples to average multiples. Reversion will overshoot as aggressively in euphoria (too high multiple) as it did on the downside in despondency (ridiculously low multiple).

The key is to have staying power and know what you own. If you don’t have confidence in the future earning power of the businesses you own, you are likely in a “story stock” that is long on “promises” and short on “profits.” Then you are just hoping and praying versus having confidence in the underlying asset.

If you are in businesses and sectors trading below the lowest end of their historic multiple ranges and have demonstrated, predictable, historic earnings power, your only unease will come from not having more capital to add (or finding stocks that are up and you can use to add to your best ideas that are down).

Beyond those two scenarios, the only panacea is patience. Biding your time, sitting on your hands and waiting for the forced sellers (who had too much margin) to be liquidated so the market can clear and revert back to normalized valuations. Don’t get me wrong, there are a large group of recent IPOs, SPACs, and “story stocks” that will never recover or return to new highs. Others will take many years. But if you’re reading this, you’re likely not the type of investor who buys momentum stocks. You, like us, buy quality when it’s on sale – and don’t use margin. Therefore, you need only sit on your hands and wait. Time arbitrage heals all when you own a basket of high quality businesses with historic earnings power at low multiples.

Your best strategy is to likely go play golf and wait for time arbitrage to heal all wounds. If this makes sense to you, then you own the right businesses and sectors. If it does not, you got caught in the hype of easy money and are paying your market tuition. Everyone goes through that process and pays the piper in their first cycle or two. After the tuition is paid you always make sure 1) stay off leverage 2) buy high quality when it is on sale.

We have made no material changes in our portfolio beyond bulking up on a special situations auto-part supplier – as the market has served up the opportunity in recent days. Mr. Market is in his manic mood and we must take advantage when the window is open – knowing the “market” could go lower, but the underlying earnings power of our businesses is steadfast over time. Those are the type of businesses that enable you to live by the wise words of Rudyard Kipling:

If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too…Yours is the Earth and everything that’s in it,

And—which is more—you’ll be a Man, my son!

And if in fact, we are at peak inflation and yields – which may now be the case – that reversion may be coming sooner rather than later, so enjoy the golf/waiting time while it lasts!

Now onto the shorter term view for the General Market:

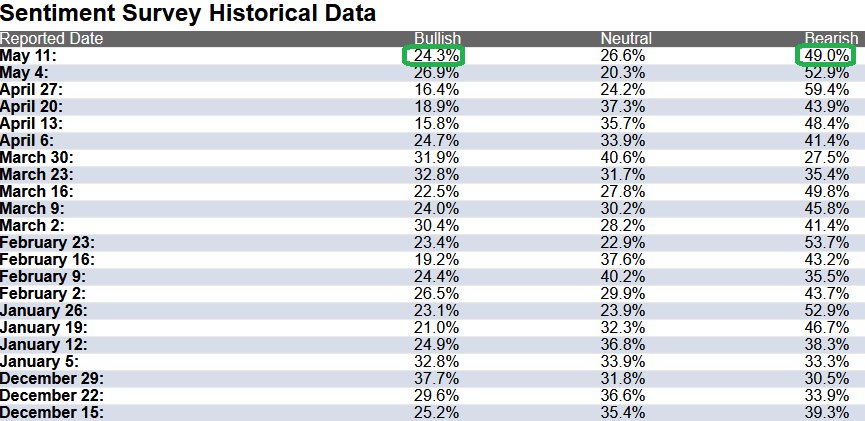

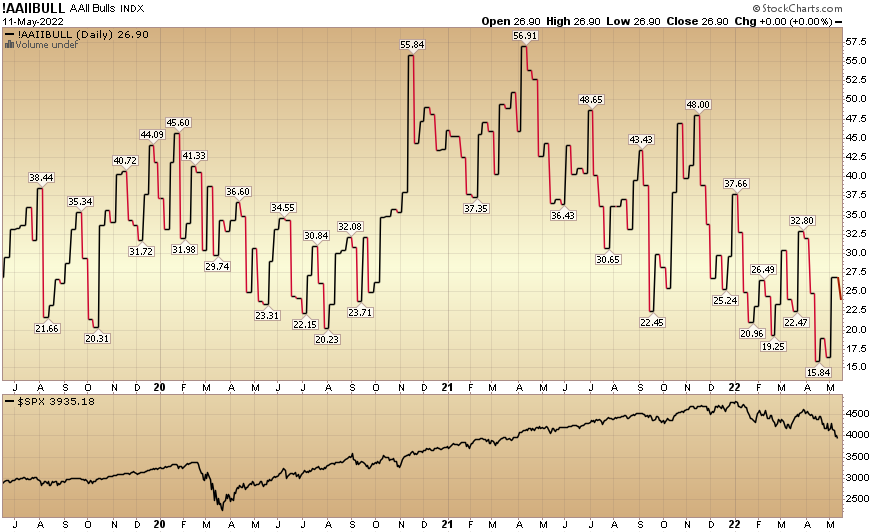

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) retreated to 24.3% this week from 26.9% last week. Bearish Percent declined to 49% from 52.9%. Retail sentiment is still fearful.

(Click on image to enlarge)

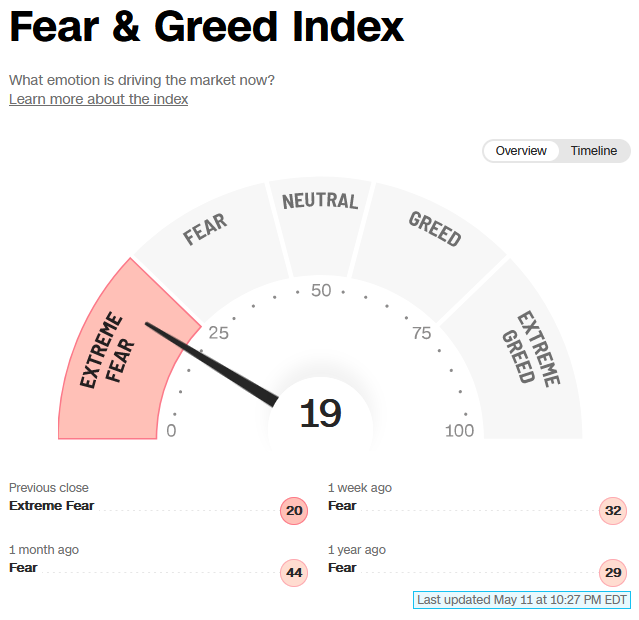

The CNN “Fear and Greed” collapsed from 39 last week to 19 this week. Sentiment is at/near maximum fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

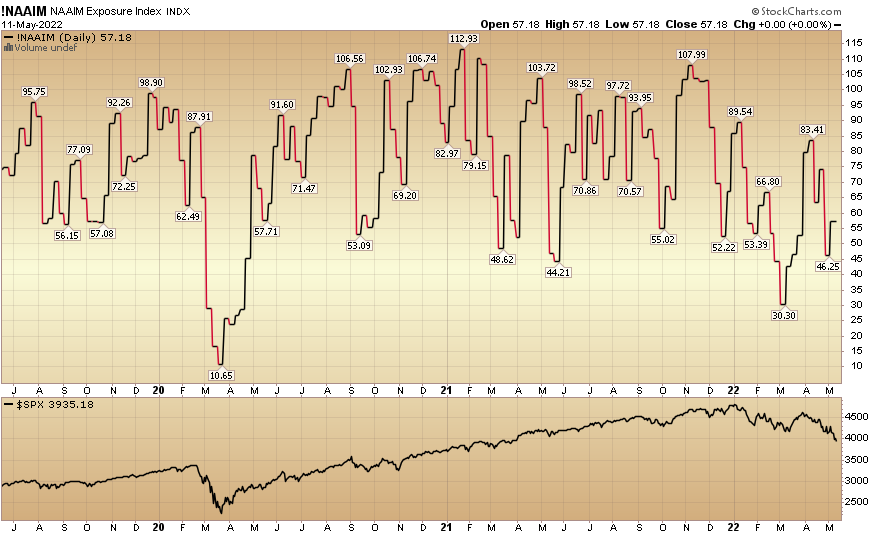

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 57.18% this week from 46.25% equity exposure last week.

(Click on image to enlarge)

Our podcast|videocast will be out on Thursday or Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.