The Most Volatile Stocks On Earnings — July 2021

The Q2 2021 earnings reporting period starts up next week with five of the six major banks reporting their quarterly numbers. As we do ahead of each earnings season, below is a look at the most volatile stocks on earnings. These are the stocks that have historically experienced the biggest one-day moves in reaction to their earnings reports.

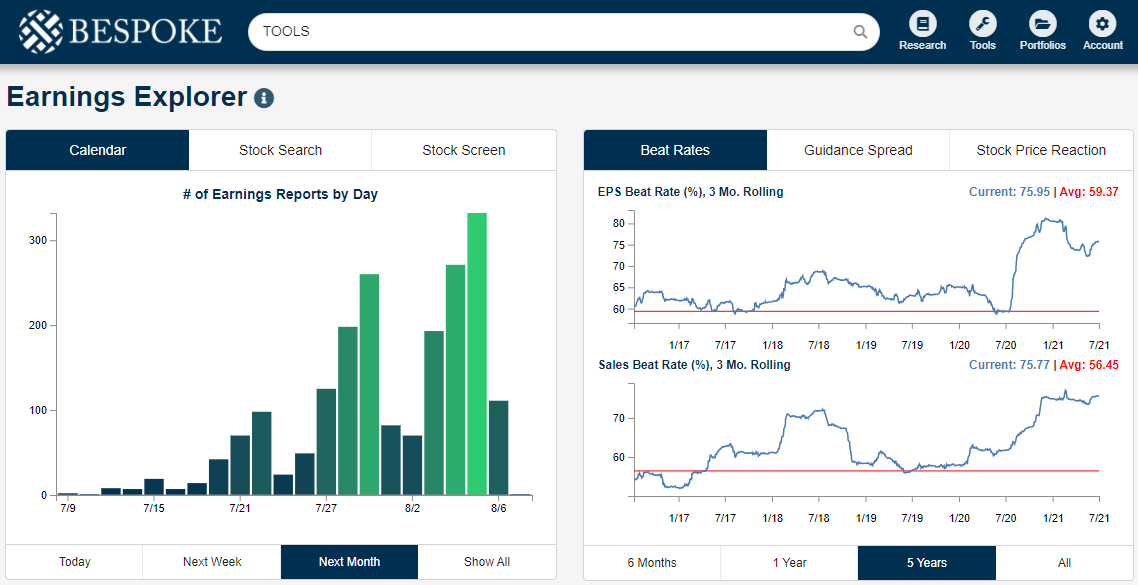

While earnings season starts up next week, we really don’t start seeing a large number of daily reports until the end of July and the first week of August. (Track upcoming earnings reports and monitor earnings-related trends using our Earnings Explorer tool.)

(Click on image to enlarge)

Below is a list of the most volatile stocks on earnings that have at least 8 quarters (2 years) of historical earnings reports. These stocks have historically seen the biggest share-price reactions to their earnings reports on the first trading day following the report. (For stocks that report before the open, we are looking at its one-day change on that trading day. For stocks that report after the close, we are looking at its one-day change on the next trading day.)

As shown, Stitch Fix (SFIX) ranks first with an average absolute one-day change of +/-18.62% in reaction to earnings. Cardlytics (CDLX), Pinterest (PINS), Snap (SNAP), and Roku (ROKU) rank two through five on this list, all with average one-day moves of +/-17%. Other notable stocks on the list include Lovesac (LOVE), Groupon (GRPN), The Trade Desk (TTD), Nio (NIO), Cloudera (CLDR), and ZScaler (ZS).

The list above included any stock that has at least 2 years of quarterly reports. Below we show a list of the most volatile stocks on earnings that have at least 5 years (20 reports) of quarterly reports. (Stocks typically see decreasing earnings volatility over time simply because of more data points.)

Of the stocks with at least 5 years of quarterly earnings data, The Container Store (TCS) ranks as the most volatile on earnings with an average absolute one-day move of 16.80%. Impinj (PI) ranks 2nd followed by Groupon (GRPN), At Home Group (HOME), Infinera (INFN), and Fluidigm (FLDM). Other notable stocks on this list include Enphase Energy (ENPH), Yelp (YELP), Stamps.com (STMP), LendingTree (TREE), Twitter (TWTR), RH (RH), Wayfair (W), Netflix (NFLX), iRobot (IRBT), Chegg (CHGG), 3D Systems (DDD), and Etsy (ETSY).

Our final list of volatile stocks on earnings only includes names that have at least 10 years (40 quarterly reports) of earnings history. Amazingly, despite being well-established companies, they still experience an average one-day move of at least +/-10% on their earnings reaction days. In other words, they normally see their market value rise or fall by at least 10% at least once per quarter when they report earnings.

At the top of this list are Infinera (INFN), Stamps.com (STMP), Conn’s (CONN), Netflix (NFLX), and Fossil (FOSL). Other notables include iRobot (IRBT), 3D Systems (DDD), Overstock.com (OSTK), Align Tech (ALGN), Guess? (GES), Crocs (CROX), and TravelCenters of America (TA).

If you’re looking for action this earnings season, you’ll likely find it in the names listed in these tables. Unfortunately, without a crystal ball, there’s no way to know whether the big moves will be to the upside or the downside!

Click here to start a trial to Bespoke Institutional and gain access to our more