The Most Important Article You’ll Ever Read On Investing

There are few topics that have as much written about them and as much contrasting information as investing.

Just knowing that is enough to scare most people away from investing at all.

Is it really that difficult? Do you really need to devote years of your life to studying the most efficient way to invest?

It would seem that way, but in reality, not at all.

The problem with most investing advice is that someone is profiting (or attempting to profit) from it.

Investing is actually much easier to understand than you may think.

You’re about to learn everything you need to know to be a successful investor…

Stop Trying to Pick Hot Stocks

Turn on any business TV show and you’re going to see all kinds of people touting hot stock picks and attempting to explain the method to their madness. I can assure you, it’s mostly just madness, with some greed on top.

The vast majority of people in the world are terrible at picking stocks. You probably are too. I’m not that great at it.

So should we just give up on the stock market?

Absolutely not! It’s the most efficient way to invest for your retirement.

But picking individual stocks isn’t the answer. Unless you’re willing to devote hours (I’m talking at least 15 or 20 each week) to studying companies and picking winning stocks.

Simple is Better

So what’s the answer? You may have already guessed the answer, but I’m going to let you hear it from Warren Buffett first. When Buffett passes away, he wants his Berkshire Hathaway shares to be distributed to charity. This is what he wants done with the remaining cash:

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers.”

Did you hear that? Index funds.

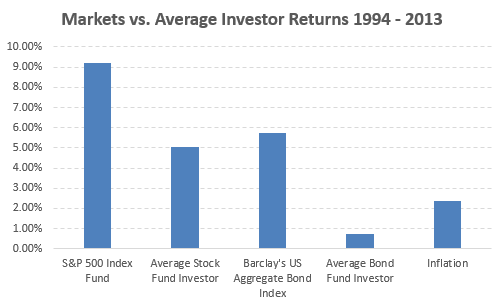

Most people who devote much of their time to picking stocks don’t beat the index. Why buy individual companies when you can buy the whole market? Or at least most of it.

It’s easy for a beginner investor to start picking stocks and see a few gains. Then they think they must be good at this. I know I did. Until I realized that my small gains were nowhere close to the massive gains of the market since we were in a very bull market at the time.

You must always compare your earnings to the index. The index is the standard. And to consider yourself a good stock picker, you’ve got to beat the index consistently.

6 Simple Principles of Investing

There are some important things to know about investing, but once you know these rules and understand them, you are in the clear.

- Invest in index funds. I know I sound like a broken record, but the average investor should be investing in index funds. It takes a lot of time to research individual stocks and spending all that time doesn’t guarantee your success. Also, index funds provide automatic diversification within the stock market and they save your time!

- Spend your time elsewhere. You’re better off devoting your time to earning more money, improving yourself and doing the things you love. Even if you could beat the index by a few points, is it really worth the time you spend?

- Avoid paying high fees. One of the best things about index funds is the low fees. You shouldn’t be paying more than 0.5% on a good index fund. And honestly, you shouldn’t even be paying that much.

- Avoid taxes as much as possible. You’ll be avoiding high fees, but don’t let Uncle Sam take it either. Find the best ways to shelter your money, legally, from paying taxes. Your company’s 401k and/or an IRA is your best bet.

- Follow Buffet’s first rule. Buffett says the first rule is to not lose money. Why? Probably because a 50% decline fully offsets a 100% gain. Index funds are pretty well protected. Take more risks when you’re young, but don’t be stupid.

- Time, not timing, is everything. Don’t try to time the market. You can’t. I can’t. Can George Soros? It’s debatable, but we are not George Soros and buying low and selling high never happens consistently. Save yourself the stress and buy low-cost index funds. Think long term growth over time.

If it really is this easy, why don’t we hear this information coming from Wall Street? Simple! Because you can’t get rich and famous on Wall Street by telling people to passivly invest in low-cost index funds, avoid fees and shelter from taxes. Jim Cramer would have a very short show if he started promoting this idea.

It’s Easy, Right?

Yes and no. The idea is easy, but the discipline and practice isn’t. That’s why you set up an automatic investing plan.

Not to mention it seems a lot funner to try to pick winning stocks, doesn’t it? It’s not. Earning a higher return over the long haul will lead to much more fun down the road. But you know that.

That’s it. In less than 1,000 words, you know the most efficient way to invest for retirement. This isn’t the begin all, end all advice to investing, but it almost is. I know several dividend investors that do well investing in large cap individual dividend stocks. I also know that owning Berkshire Hathaway isn’t a bad idea and I actually recommend it.

But all you really need to take away and remember is this:

Invest in low-cost index funds, avoid high fees and shelter from taxes. You’re not going to hear that on TV.

Find the best index funds based on your age. Build a rock solid retirement portfolio. And get started now if you haven’t already. Even if you don’t think you can afford to get started, you can. There are many ways to start investing for retirement with under $100.

Picking individual stocks is essentially gambling. You may see an initial gain but eventually it will be wiped away. So I completely agree with you on using your money to invest in index funds which is a much safer investment strategy.

Thanks for the comment, Nick! Over the long term, index funds are the easiest, least time-consuming option for investing and they tend to outperform actively trading or active mutual funds. I prefer to spend my time making more money to pour into index funds vs trying to pick winning stocks.

Thanks, Ayelet! I think people overcomplicate investing, often to the point of not doing it at all. Index funds are a great way to get started. From there, if you find interest in individual stocks, I would recommend it more for the fun or the game, than for the return. You can definitely profit from individual stocks, but when you consider the amount of time you must spend to do so, index funds make more sense mathematically.

Sounds like a wise strategy. Any other tips?