The Latest (Court-Imposed) Tariff Pause

Image Source: Unsplash

Why the International Trade Court’s Tariff Ruling Could Spark a Shipping Rally

1. The ruling Wall Street called a “nothingburger”

On May 28, 2025, the U.S. Court of International Trade (CIT) struck down President Trump’s 10 percent post‑Liberation Day tariffs on consumer goods. Goldman Sachs dismissed the decision as a nothingburger, arguing the White House can simply re‑impose duties under other statutes.

2. Why it’s not a nothingburger

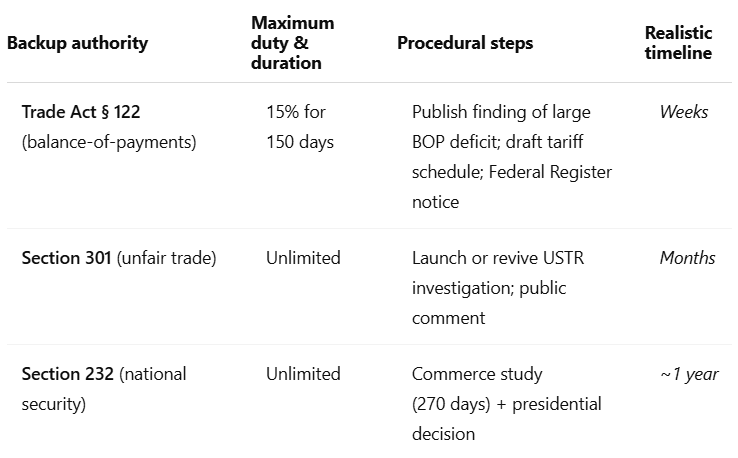

Yes, the president still has tariff levers—but none are instantaneous:

Even a two‑week gap is plenty for importers to front‑load orders, driving spot freight rates up before new duties kick in.

3. What a tariff pause does to trade

-

Booking surge: During the 90‑day China ceasefire earlier this year, Asia‑U.S. bookings tripled in the first week.

-

Spot rate pop: Asia‑US freight indices typically jump 10–15 percent overnight when volumes spike.

-

Equity beta: Container‑liner shares tend to move 2–3× the broader transport index on tariff headlines.

4. Meet ZIM Integrated Shipping

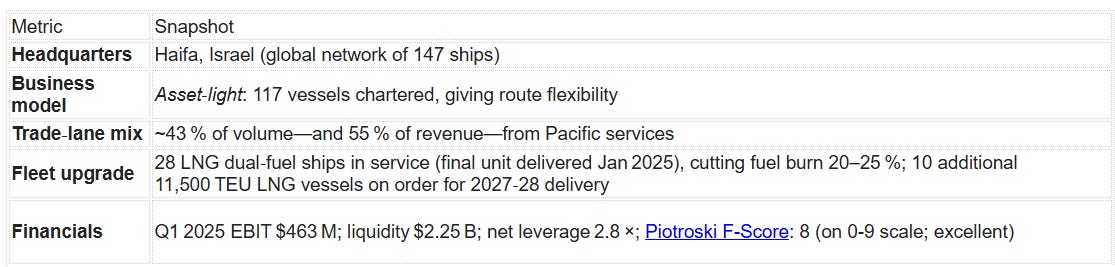

We entered a trade on ZIM Integrated Shipping (ZIM 0.00%↑) earlier this month. Read full story.

Think of ZIM as a nimble specialist in the lanes most sensitive to U.S.–Asia trade policy, one that's now running a cleaner, cheaper fleet than many legacy rivals.

5. Why ZIM stands to gain from a tariff hiatus

- Heavy Pacific exposure: More than half its revenue is tied to Trans‑Pacific routes—the first to rebound when tariffs ease.

- Charter agility: Because ZIM charters most ships, it can redeploy capacity quickly to the highest‑yield trades.

- Cost leverage: New LNG ships lower per‑box fuel costs, widening margins as spot rates climb.

- Fresh comeback: After a tough 2024, ZIM is already profitable again; incremental volume flows straight to the bottom line.

6. Risks to monitor

- Fast‑track § 122 tariffs: If the White House publishes a new schedule within a month, the rally could fade by late summer.

- China‑specific duties: A narrower tariff could hurt Pacific lanes again while sparing Atlantic trades.

- Charter cost inflation: ZIM’s asset‑light model also means it pays higher daily rates if ship owners regain pricing power.

- Regional security threats: Israel’s current conflict with Yemen‑based Houthi militants could potentially lead to disruptions to ZIM’s Haifa headquarters or eastern‑Mediterranean operations.

- If you want to hedge those risks: The Portfolio Armor iPhone app can help you find the optimal hedge given your time frame and risk tolerance. You can download it by aiming your iPhone camera at the QR code below (or tapping here, if you’re reading this on your iPhone).

7. The bottom line

The CIT decision likely delivers at least a short tariff hiatus—more than enough for a burst of U.S. import demand and a spike in Trans‑Pacific spot rates. Among listed container carriers, ZIM offers some of the purest exposure to that tailwind, backed by an increasingly efficient fleet and fresh profitability.

More By This Author:

Navigating A Roller Coaster MarketThe Spike In Treasury Yields

Longtime NVDA Observer Expects a Crash