The Key Market Flows Behind "Yet Another Quick Selloff"

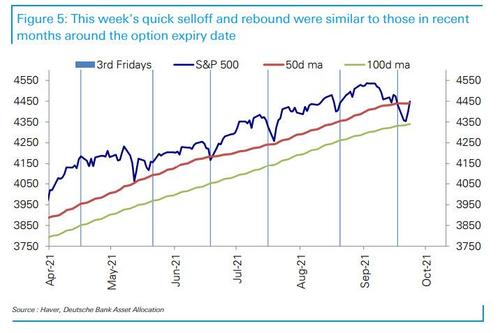

As has been the case for much of the past six months, equities saw another modest selloff (-4%) around the option expiry date similar to those in recent months (2-3% selloffs in the last three months), albeit exacerbated this time by fears around an Evergrande default.

Similar to the previous occasions, equities rebounded almost instantly as market technicals took over, with the 50-DMA proving once again to be stalwart support, and equities are now barely 2% below record highs.

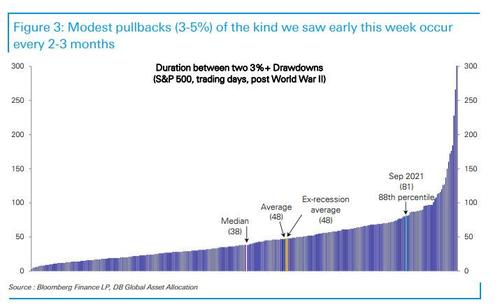

Moreover, US equities have historically seen modest sell-offs of 3-5% every two to three months on average. In that context, the selloff this week was fairly typical.

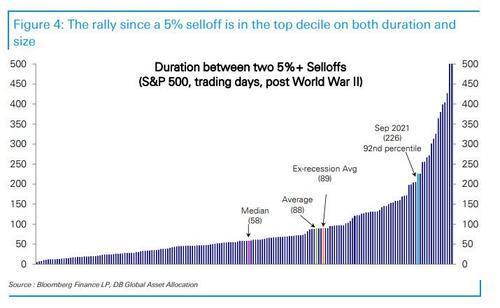

We have yet to see a more substantive selloff (5%+) since October of last year -- although we did very briefly see a 5% drawdown last Monday which faded just as quickly -- putting the duration (92nd percentile) as well as the size (93rd percentile) of this rally in the top decile.

Courtesy of Deutsche Bank, here are some notable positioning indicators:

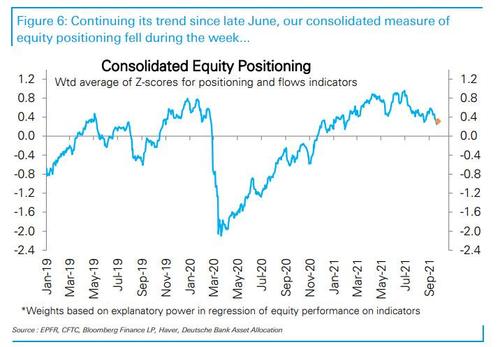

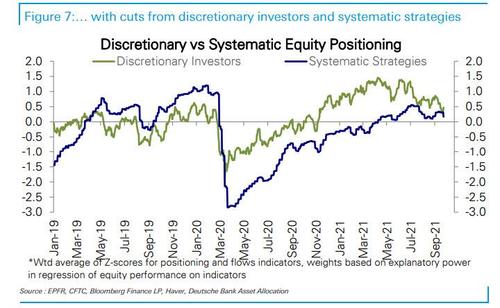

- The consolidated measure of equity positioning has been falling since late June (from the 97th to the 60th percentile).

- Both discretionary investors (72nd percentile) and systematic strategies (46th percentile) have cut exposure, with discretionary positioning now at the lowest since the post-election rally, while systematic positioning is at the lowest since May.

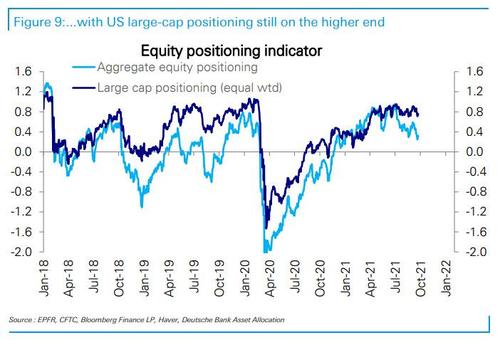

- However, there is a divergence between equity positioning for US large-caps (huge tech names), which has remained very robust, and that for others which has declined.

- A subset of positioning indicators specifically tracking large-caps has remained at the higher end since mid-July, even as our aggregate measure has steadily moved lower.

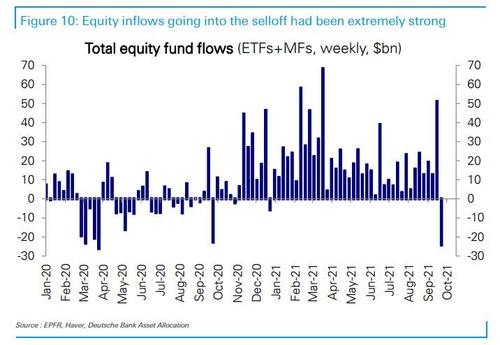

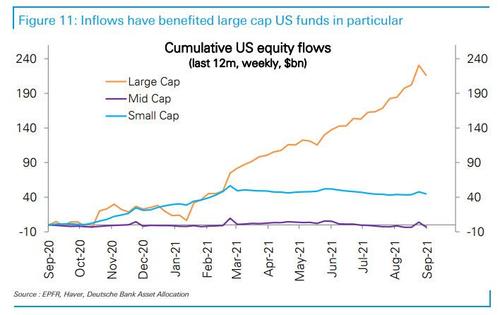

- Equity inflows had been extremely strong going into the selloff, clocking in at over $50 billion last week, the largest since March, and primarily benefiting US large-caps. A significant proportion of last week’s huge flows then reversed over Friday (-$20 billion) and Monday (-$16 billion), but inflows have resumed since.

- Here, it's worth noting that most inflows have benefited almost exclusively large-cap US funds, with mid-caps hugging the flatline for the last year, and small-caps barely any higher.

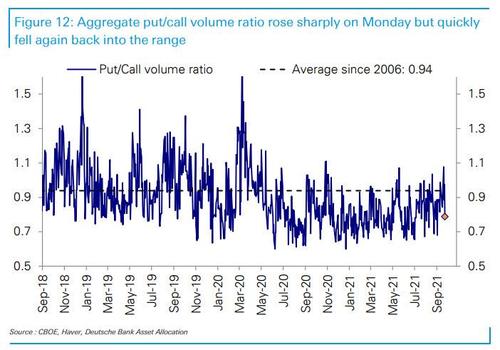

- The aggregate put/call volume ratio rose sharply on Monday as equities sold off, but quickly fell back again over the week into the low range that it has been in since last June. Both put and call volumes had spiked on Monday, but have normalized quickly.

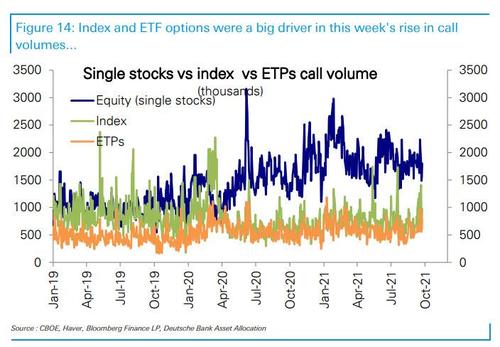

- Most of the pickup in option volumes came from index and ETF options.

- Within single stocks, puts and calls volumes fell last week across both large- and small-caps.

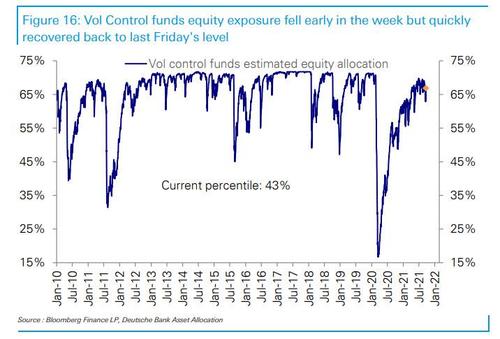

- Vol Control funds, which had already cut their equity allocations (mostly large-cap) last Friday (67% to 65%), accelerated their selling on Monday (to 62%, 27th percentile), but quickly started buying back over the next three days. Their allocations are now back to 67% (43rd percentile). A spike and subsequent reversal in implied vol was the primary driver of the round.

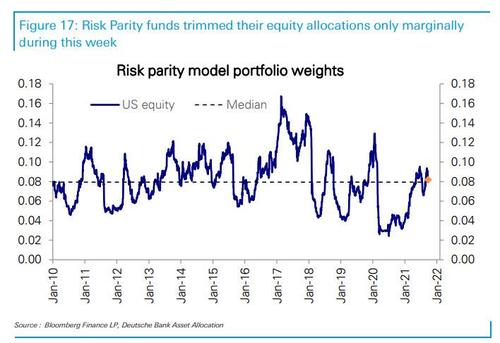

- Meanwhile, Risk Parity funds trimmed their equity allocations only marginally during this week.

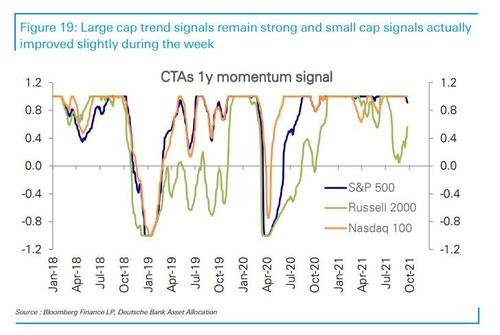

- Curiously, large-cap trend signals remain strong and small-cap signals actually improved slightly during the week.

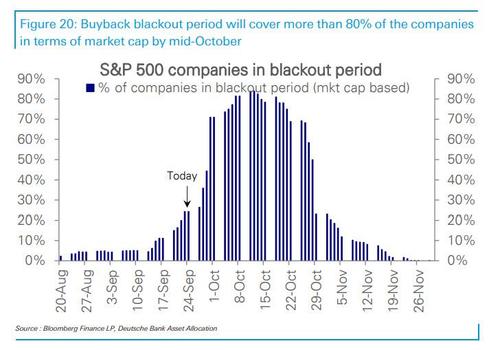

- One final observation: with Q3 earnings season coming on deck, some 25% of companies have now entered their buyback blackout period. This will peak in two to three weeks when 80% of companies will be in their blackout period.