The Importance Of Dividends And My Strategy

Background

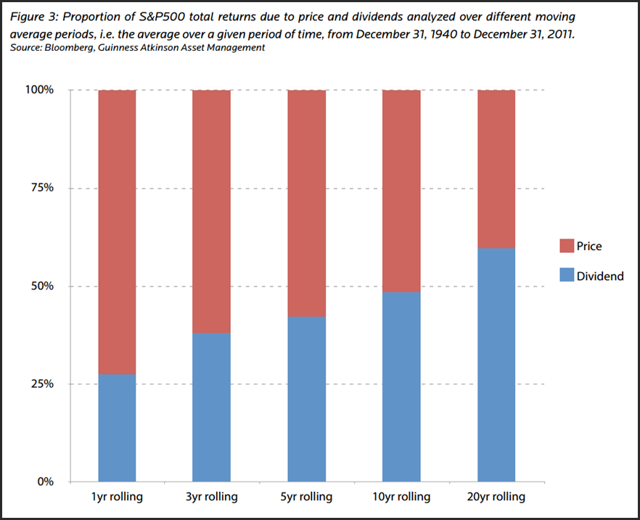

"Buy low sell high," the dominant doctrine on Wall Street has put many investors' focus onto price movements alone, while statistics show that as high as over 50% of the total stock returns could come from dividends over the long-term investing horizon.

Source: GuruFocus.

Conceptually, dividend payout should be the most direct way of shareholder returns; the other 2 ways are share buybacks (i.e., reducing the share counts and hence increasing EPS) and valuation multiple expansion (e.g., P/E).

Compounding

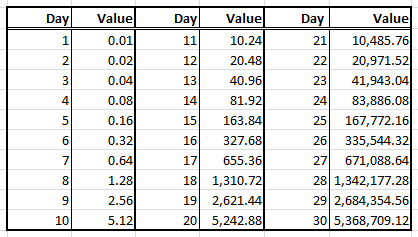

It is often said, "Compounding Interest is the 8th Wonder of the World." If you, as an investor, still have any doubt here, check out this scenario.

Suppose someone asks you if you would rather be given one million USD today, or be given one cent that would double in value every day for 30 days. At first glance, it appears that the one million would be the better choice. Some simple excel calculation, however, proves you would be better off taking the one cent and watching it grow for 30 days, as shown in the following table:

I always recommend dividend reinvestment strategy, even starting from small. Major U.S. brokerages, such as Fidelity, Schwab and eTrade, now enable investors to have their dividend dollars automatically reinvest into shares (even fractional shares). Do check this feature out if not yet!

What about buybacks?

Many investors would wonder if share buybacks are as good as dividends to benefit shareholders. In theory, the impact of the same amount of cash (for share buyback vs. paying out dividend) should be identical. However, in the real financial world, the followings should be taken into consideration:

- Taxation is a big plus for buybacks while dividend payments are taxed as personal income and usually double-taxed (i.e., at both corporate level and at investor level);

- Regardless of the theoretically higher after-tax returns through buybacks, the future reward to shareholders is anything but assured as buybacks cannot guarantee an upward movement in stock prices; in terms of dividends, investors are guaranteed payments; as the old saying points out, "a bird in the hand is worth two in the bush;"

- Dividend cuts are usually regarded as bad signals by the market; on the contrary, a company that initiates a dividend policy or has a track record of growing its dividends would demonstrate more confidence in its long-term business prospects in front of shareholders; Buybacks are relatively shorter-term programs; this mostly applies to Corporate America;

- It is more difficult to track share buybacks than dividend payments; investors should also be aware that the buyback does not necessarily lead to a decrease in the total number of outstanding shares as the company may issue new shares to cover its employee compensation program;

- As Warren Buffett often mentioned, share buybacks only make sense when the stock being repurchased is traded below its intrinsic value; otherwise, it would cause value destruction; dividend payments, however, give the flexibility to investors in terms of allocating this capital.

My Strategy

My strategy of picking dividend players is part of my factor-based stock quality ranking. See below for details of criteria.

- Consecutive dividend payments for at least 10 years;

- Annual dividend payment at least doubled for the past decade;

- Free cash flow at least doubled for the past decade;

- Net income at least doubled for the past decade;

- The free cash flow dividend coverage is greater than 2x;

- The payout ratio is less than 66%;

- Recent 3-year dividend CAGR at more than 10%;

- Cashflow return on capital invested above 20%;

- Debt/equity is less than 1x;

- The current ratio is greater than 1.2x.

The criteria 1 is the most important here, demonstrating management's willingness to reward its owners through dividend growth. 2, 3, 4 and 7 imply the track record of business growth in line with the dividend hikes. 5, 6 and 8 indicate the business strength relative to current dividend payout level. 9 and 10 demonstrate the financial strength to support further dividend increases.

Now check out my picks of some dividend-paying stocks below. Each of them also earns a high overall score based on my stock quality ranking.

FactSet Research Systems (FDS)

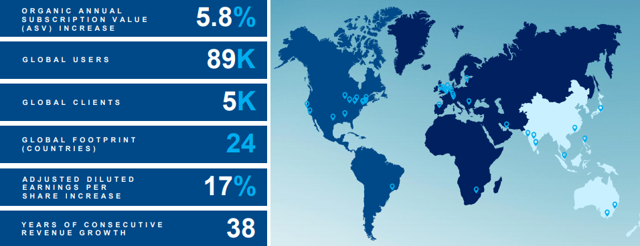

With annual sales of over $1.3 billion from over 5,000 clients in 24 countries, FactSet provides financial information and analytic software for analysts, portfolio managers, and investment bankers at global financial institutions. The company's shareholders benefit from its consistently high returns on capital and almost tripled free cash flow for the past 10 years.

Source: FDS 2018 Investor Day Presentation.

FDS has been increasing its dividends every year for almost two decades, with an even more fantastic track record of consecutive revenue growth for 38 years. The stock currently has a payout ratio of under 40%, a current ratio of over 2x, and free cash flow/net income of over 1x, implying its potential for further dividend hikes in the long run.

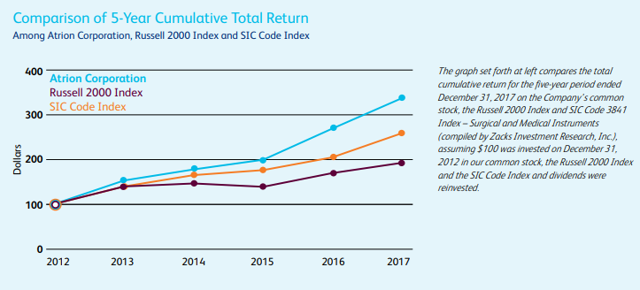

Atrion Corporation (ATRI)

Atrion is a leading supplier of medical devices and components to niche markets in the global healthcare and medical industry. While it is a comparatively small company in the sector, Atrion is the leading U.S. manufacturer of products in several market niches, including soft contact lens disinfection cases, clamps for IV sets, vacuum relief valves, surgical loops used in minimally invasive surgery, and check valves.

(Click on image to enlarge)

Source: Atrion Corporation Annual Report 2017.

The stock (as shown above) has consistently outperformed the market benchmark and the sector benchmark. It has its track record of raising dividends consecutively for 15 years now, with a super clean balance (i.e., no debt, plenty of cash, and a current ratio of over 9x).

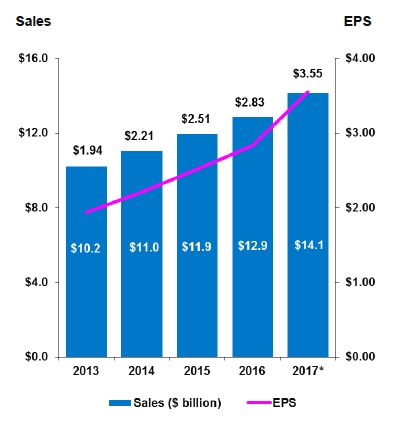

Ross Stores (ROST)

Ross is the largest off-price apparel and home fashion chain in the U.S. with over 1,600 stores through the Dress for Less and dd's DISCOUNTS brands. The company enjoys consistent long-term growth in sales and EPS in both healthy and challenging retail and macroeconomic environments.

Source: ROST Investor Presentation, 3/2018.

The company began increasing dividends in 1995 and has established an outstanding record of dividend growth. The stock is also on the list of the picks that should be least impacted by the trade war concern.

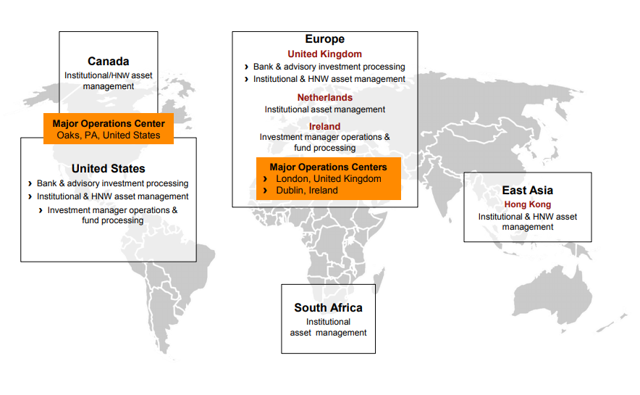

SEI Investments Company (SEIC)

SEI is a leading global provider of asset management, investment processing and investment operations solutions, helping professional wealth managers, institutional investors, investment management firms and private investors create and manage wealth.

(Click on image to enlarge)

Source: SEI Investor Presentation 2018.

The company has one of the best dividend growth records, compounding dividends at a 25% rate for over 25 years. For the past 10 years, SEIC doubled its free cash flow, net income and even return on assets. At the moment, the stock has a payout ratio of only 20%, with very little debt and abundant cash reserve.

Summary

In today's "exciting" stock market full, dividend strategy is often considered boring. However, dividends are the important part of total returns for long-term investors. The dividend players mentioned above have all great track records of rewarding their owners.

I also found this website pretty useful in tracking stocks' dividend records. If you have any recommendation of dividend strategies and/or dividend stocks, please do comment below.

Excellent read, thanks.

Thanks for the comment! Appreciate it!