The Illusion Of Trade Optimism

I have recently shared my view on how the stock market is reacting to trade deal news in an article with the title "Is the trade deal the real deal?". I see evidence that the continuous positive reactions on news of improving odds for a trade deal are masking the real market dynamics and wrongly depicting a scenario of optimism on the surface of the stock market that is not backed by a corresponding improvement in business optimism or in other areas of the stock market that should actually benefit more from a trade deal.

In particular, I highlighted how this continuous flow of positive trade news is pushing stocks higher day by day, while business sentiment and other leading indicators such as the manufacturing PMI are not showing a corresponding improvement. Overall, business optimism and other related indicators that reflect economic or business sentiment should benefit from increasing optimism just as the stock market has been reflecting for a while. This is clearly not the case, as in most major economies, such as the United States, Germany and Japan, business optimism and other indicators such as the manufacturing PMI are moving in opposite directions compared to the stock indexes.

In addition to this clear divergence, I found it strange that the stocks of some businesses that are more exposed to the positive effects of a trade deal have actually underperformed. This is what I wrote in that article:

I think it’s worth going deeper and analyzing whether it’s true that prospects for a trade resolution are actually driving increasing expectations. It makes sense to look inside the stock market.

If prospects of a trade deal were a real thing, I would expect companies more exposed to global trade, especially with China, to perform best. However, some data from Bloomberg Intelligence in a piece published recently shows that the best performers in the S&P 500 since the August low have been the stocks of companies with foreign sales between 10% and 20% while the companies with 70% average sales overseas underperformed this group by 230bps.

(Click on image to enlarge)

Moreover, the piece points out that domestic companies have outperformed multinationals by a median of 130bps.

The piece also mentions that while companies with sales to China have outperformed, those with imports from China have underperformed domestic rivals.

There is much more evidence that trade deal news is not having a significant fundamental impact, as the stocks of businesses more exposed to the potential benefit of improving conditions in trade aren't benefiting much.

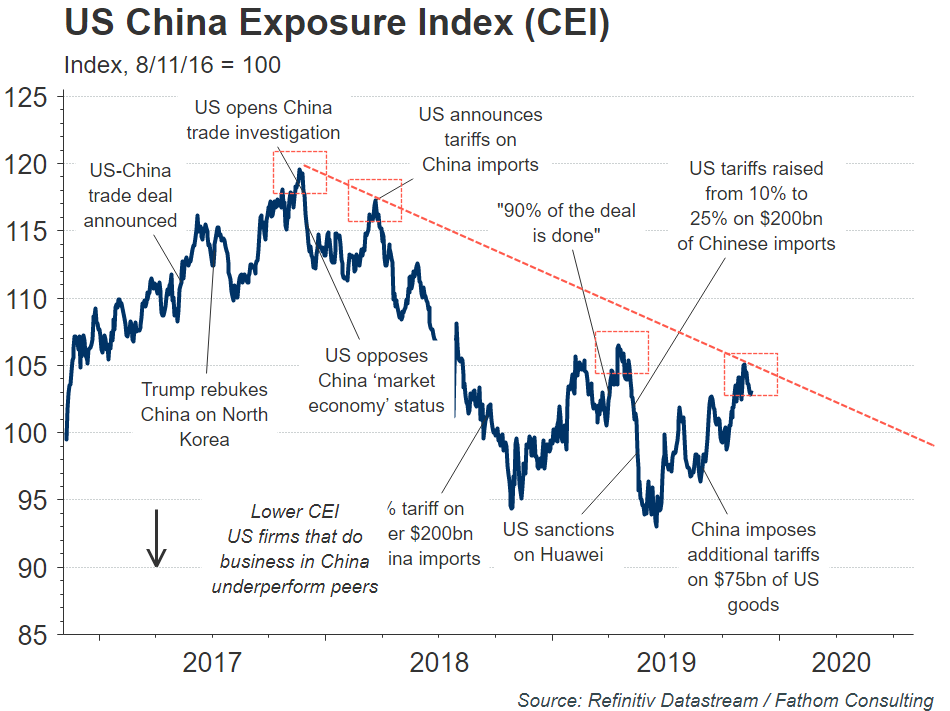

The Fathom's China Exposure Index (CEI) monitors the relative stock market performance of US-listed firms with significant revenue exposure to China, which looks like a perfect tool for our task here.

As shown in the chart below, lower CEI is due to investors selling US firms that do the most business in China, and CEI moves higher as trade optimism appears.

(Click on image to enlarge)

In the chart, we can actually see that while negative events such as US sanctions on Huawei and additional tariffs being raised correspond to short-term declines, a look at the longer-term trend shows a slow but constant deterioration, and the lower highs and lower lows have pictured a clear divergence with all the major indexes. Not even the recent trade deal/QE rally has been enough for these stocks to clear the Q2 2018 highs, while the major indexes have been in a rather strong rally and are currently just one or two percentage points below the new all-time highs recently marked.

While Trump tries to instill and fuel bullishness and optimism, the actual expectations around the trade deal and its impact on businesses have deteriorated over the months. This unconditional buying we have seen in recent weeks on top of the moderately bullish trends of the past months is the result of dumb money flowing into stocks based on pure headline-reading trading, helped by the massive injection of liquidity from the Fed in its non-QE program. The latter is actually the main driver of this rally, but that is a topic for another day.

Great article. Worth reading.

Hi Gary, thanks for taking the time to read it and for the kind words.

Very interesting, I found these results surprising.

Thanks a lot for the comment, Alpha Stockman.