The Fed’s Worst Nightmare Has Officially Arrived

The Fed’s worst nightmare has arrived. That nightmare?

Sticky inflation in the form of a wage spiral. Inflation doesn’t enter the financial system all at once; it arrives in stages. Those stages are:

Stage 1: Price increases in raw materials

Stage 2: Price increases in factory gate prices

Stage 3: Price increases in retail prices/ consumer prices

Stage 4: Employees/workers demand higher wages to meet higher costs of living.

The Fed can deal with stage 1 or stage 2 of inflation relatively easily. However, once we get into stages 3 and 4, inflation becomes a LOT harder for the Fed to kill.

Indeed, for the Fed, stage 4 is the most dreaded phase of inflation as it usually requires a deep recession to kill it.

And the U.S. economy just entered it.

The ADP national employment report released last Wednesday reveals that private sector employment increased by 132,000 jobs in August.

That’s the good news. The bad news?

Annual pay increased by 7.6%.

In simple terms, employees/ workers are now demanding higher wages due to inflation. This means the Fed’s worst nightmare has arrived. It will need to raise rates much higher than anyone believes… and trigger a deeper recession than anyone expects in order to bring inflation to heel.

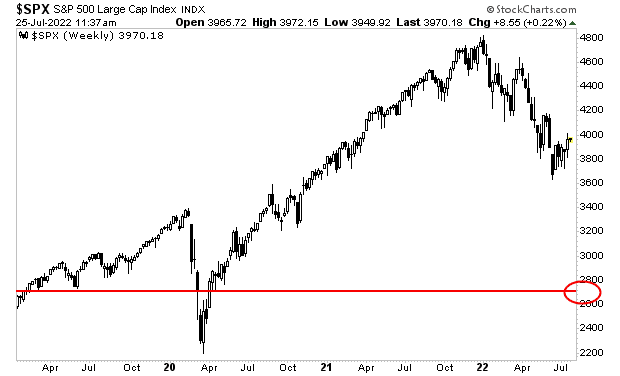

Our downside target for the S&P 500 remains below 3,000 as noted on the chart below.

More By This Author:

Are Stocks About To Crash?

Buckle Up, The Fed Is Losing Control Of The Bond Market Again

The Bear Market Rally Is Over… The Next Leg Down Is Here