Buckle Up, The Fed Is Losing Control Of The Bond Market Again

Are you ready for the next crisis?

You better be… because the Fed is losing control of inflation and the bond market… again.

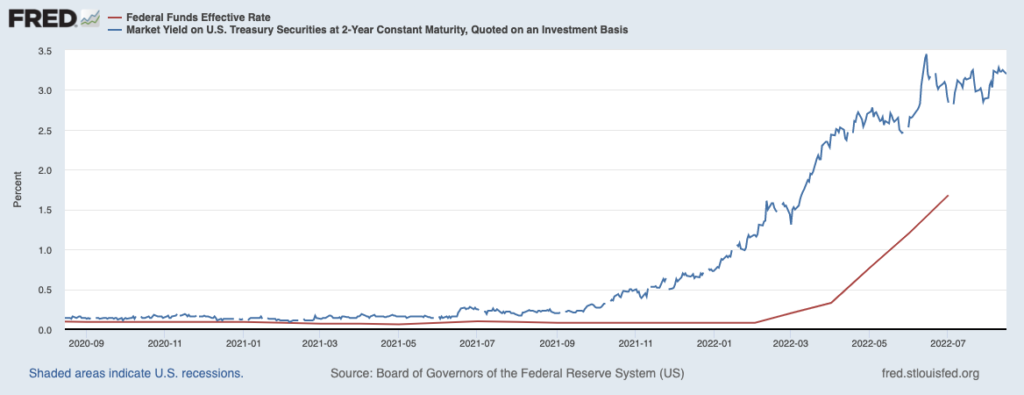

Historically, the Fed has taken its cues on where rates should be based on where the yield on the 2-Year U.S. Treasury is trading. In this context, it is easy to see how badly the Fed screwed up earlier this year. The gap between the yield on the 2-Year U.S. Treasury (blue line in the chart below) and the Effective Federal Funds Rate (red line in the chart below) is massive.

(Click on image to enlarge)

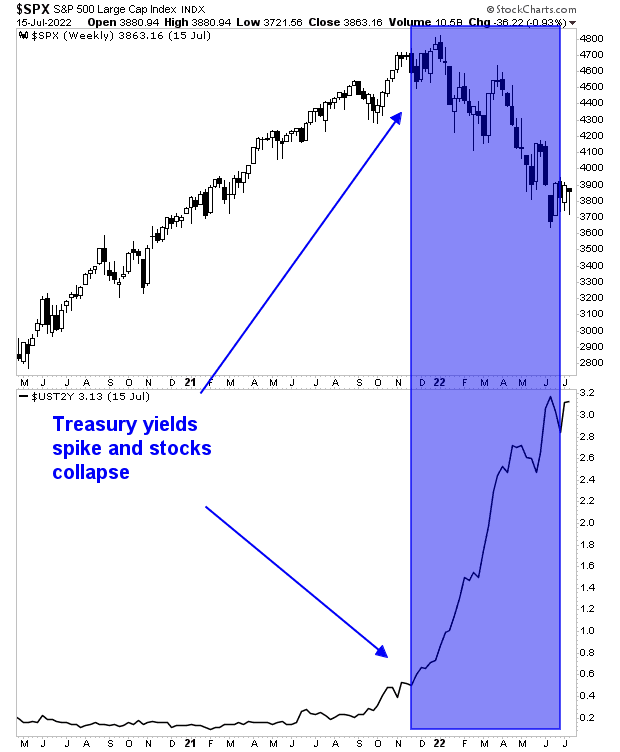

This is why the stock market collapsed earlier this year. Stocks are priced based on Treasury yields, so when the yield on the 2-Year U.S. Treasury spiked earlier this year, the stock market took it on the chin.

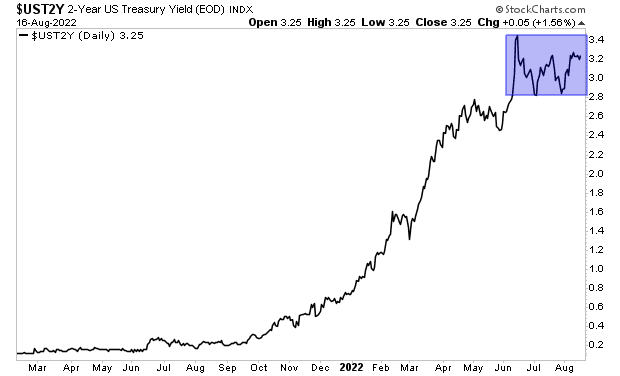

The Fed attempted to get this under control this summer, by hiking rates by 0.75%. The history of Fed rate hikes during its most recent monetary tightening up until that point is below

· March 17, 2022: Fed raises rates 0.25%.

· May 5, 2022: Fed raises rates 0.5%.

· June 16, 2022: Fed raises rates 0.75%.

When the bond market saw this, it began to calm down and the yield on the 2-Year U.S. Treasury stabilized.

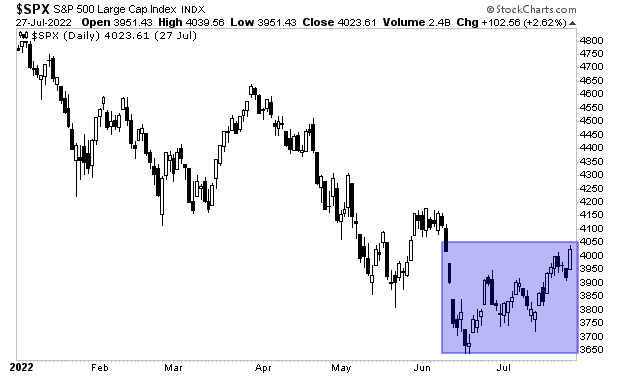

This stability in bond yields is what allowed the stock market to rally this summer.

But the Fed just screwed this up BIG TIME.

More By This Author:

The Bear Market Rally Is Over… The Next Leg Down Is HereWhy The Market Is Exploding Higher… And What Comes Next

The Market Just Gave Us A Major Signal… Did You Catch It?