The Fed's Competence, Not Its Independence, Should Be The Issue

Two sided coin picture from Depositphotos

Lack of competence...

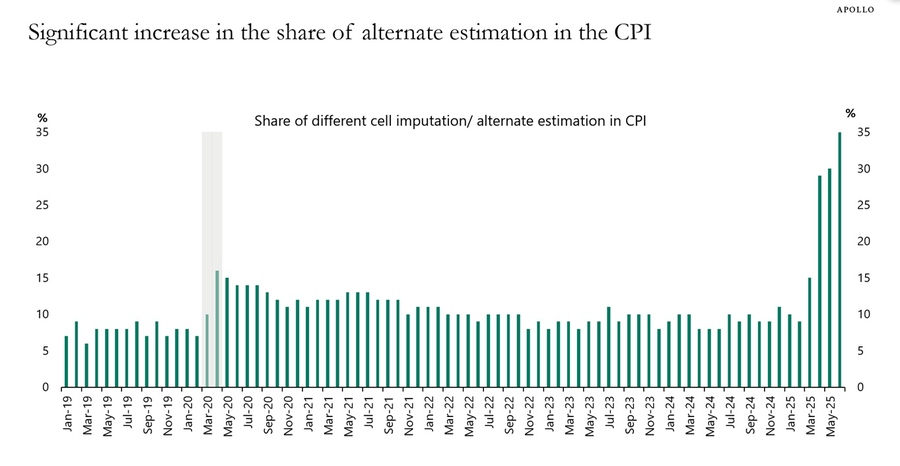

shows in the Fed's exclusion of "volatile" food and energy prices from its preferred inflation gauge, yet when egg prices went up due to a chicken disease, it tried to fix that disease by keeping interest rates high! Food prices anyway, have not been particularly volatile - basics like bread had relatively stable prices rising at around the general rate of inflation of 3.3% pa over a long period, and cows have not ever demanded a pay increase for their milk production. Energy prices - especially oil - have come down considerably, and so would lower real inflation prices if the Fed included those. To make matters worse, a new report shows that 30% of CPI data is guesswork. More on that later - first, a bit of history.

Since its formation in 1913, the US Federal Reserve Bank - the Fed - has rarely achieved its reason for being; to promote maximum employment and stable prices and to enhance the stability of the American banking system. Despite that the Depression in the 1930s was blamed on the Fed by many economists. It failed to stop The Great Inflation in the 1970s, the dotcom bubble and bust of 2000 caused by venture capitalists, investment banks and brokerage houses. Behind all three stood the Fed. The Great Recession of 2007/8 was caused by banks under its watch with their credit default swap/subprime mortgage "innovations".

The 2020 Covid pandemic caused supply chain breakages that increased inflation and the Fed attempted to control that with very high interest rates instead of lowering them to ensure investment in new supply. That led to the worst four years of inflation in many years and caused the first decline in "real" consumer incomes since the late 1970s.

Among other damaging things that also directly created a US home ownership affordability problem, homes are now less affordable for many than at any time since the 1960s with high mortgage rates making matters worse. A concomitant of that has been rental increases that Fed directly into inflation and thus meant the Fed has kept interest rates high; a self feeding negative cycle that is also pushing the US government debt mountain to unsustainable highs - costing the country $1 trillion this year in interest rates alone - something the Fed itself warns about.

Actual inflation targets are not in the Fed's mandate but it self-decided to explicitly target a 2% inflation rate in 2012. The 2 per cent figure is totally nebulous. It had — and has — no scientific base. That subsequently suppressed GDP growth and the strong economy that its policies should be supporting. Facts show that US inflation averaged 3.3 per cent over 100 years from 1914 to 2014, during which time the economy did well despite a sometimes “high” level of inflation as the average real (inflation-adjusted) economic growth rate of the US economy over those 100 years was approximately 3 per cent, according to the Bureau of Economic Analysis. During the years since 2014, while the Fed has strenuously attempted to keep inflation at or below its 2 percent 2012 target, the average growth rate has been well below 3% and forecasted to drop to around 1.4% this year. Hardly the sign of an economy growing enough to reduce the government's debt mountain yet the Fed continues to refuse to low rates because tariffs might increase prices.

Currently, the jobs situation is healthy partly due to fiscal initiatives, so the Fed is likely to keep interest rates high until those high rates make it unhealthy and this wreck, repair, repeat cycle starts again.

One wonders why the Fed exist at all. It claims to be "data dependent". The data for the Fed's mandate of maximum employment comes from the Bureau of Labor Statistics, BLS, which measures labor market activity, working conditions, price changes, and productivity in the U.S. economy. For its preferred measure on inflation - the personal consumption expenditure (PCE) - the data is provided by the Bureau of Economic Analysis (BEA).

The BEA has about 500 employees and an annual budget of approximately $101 million. The BLS has around 2,100 employees and a budget of around $800 million. The Fed's in 2023 was $5,646.2 million.

In its website, the Fed states it has 23,974 employees and "employs more than 500 researchers, including more than 400 Ph.D. economists, who represent an exceptionally diverse range of interests and specific areas of expertise. Our researchers produce a wide variety of economic analyses and forecasts for the Board of Governors and the Federal Open Market Committee". Now comes a report from Apollo Academy that the measure of inflation - CPI - from the BLS that the Fed's thousands use is over 30% guesswork...

Plus, that vast number of employees cannot even keep the Fed's own costs under control!

Fed's internal inflation...

From its actual 2013 costs to 2023 the total operating expenses of the Fed have increased an average of 4.6 percent annually. In 2023 it cost $5,646.2 million. It increased that by 10.3% in 2024 and that is projected to be10.4% higher in 2025 thus showing it is incapable of keeping its own inflation rate at or below 2%. Plus we now have the news of a massive $600 million - 30%! - cost overrun on its building renovations. The total cost of renovating the Fed palace for elites is estimated to be $2.5 billion. That amount would buy over 9,000 homes built by low cost home builder LGI Homes (LGIH) that those Fed elites prevent people from buying with high interest rates plus it would ensure more jobs aiding the Fed's mandate to ensure maximum employment as for every person employed directly in building those homes many more are employed - I have seen estimates of six - in the supply chain.

The Fed is supposedly accountable to Congress but in practice it is answerable to know one. Its own lack of cost control indicates the same internally. If the US is to return to that 100 year growth rate of 3% - but without the crises - the Fed needs a top down restructuring to deserve continued independence.

Failing that the Fed's life should be ended with future policies being made by the Treasury. Its huge costs would instead go towards lowering the government debt mountain, companies and people will be able to plan with a degree of certainty and the markets will overturn any Treasury attempts to do anything too risky.

That would also make sense since fiscal and monetary matters are two sides of the same coin. The opening picture above shows that. Around 700 B.C., a people called the Lydians became the first Western culture to make coins. Others followed until in 1907 - after a bank run on US dollar coins - Congress decided to split those coins into two halves called money and fiscal and created an independent Federal reserve system to establish economic stability via monetary means. Fiscal matters were the responsibility of others Politicians being politicians they ignored over 2000 years of history that proved those two halves are inseparable parts of a whole. The result has been chaotic and costly and must end.

I had thought its out-of-touch high interest rate policy would end earlier this year, so bought back into a homebuilder - LGI Homes (LGIH) - that I had sold at a high point in 2021. More here on its website. My optimism proved that I was out of touch with Fed "reality" and the share price has dropped since then. However it can only be a matter of time now before the Fed is forced into the real world and brings interest rates down. The ECB has a 2% rate for the eurozone. The BOJ has 0.5% for Japan. PBOC has 3% for China. The SNB has 0% for Switzerland. The Fed sits on a high 4.25% - 4.5%!

IF the Fed does lower rates by a sensible amount this year then LGIH's share price will soar even higher than these predictions by analysts at the Financial Times...

Share price forecast in USD

| High | 145.6% | 140.00 |

| Med | 56.1% | 89.00 |

| Low | -1.8% | 56.00 |

Readers ideas in Comments below will be appreciated as we all learn more from sharing such knowledge.

More By This Author:

Invest In France - A New Leader Of The Western World

Prepare For The Next Fed Led Crash

That Was The Year That Was

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. More ...

more