The Ducks Are Quacking – Most Selling I’ve Done Since 2022

There is an old expression in the markets. When the ducks quack, feed them. It means that when investors crave something, give it to them. Those rare times usually fall at market peaks as the masses are not known for good timing. As bad as Merrill Lynch may be at a whole host of business things, I will give them credit for creating all sorts of Dotcom products in 1999 and 2000 to feed the insatiable appetite of investors in what turned out to be the greatest bubble since 1929. You may recall the HOLDR product suite.

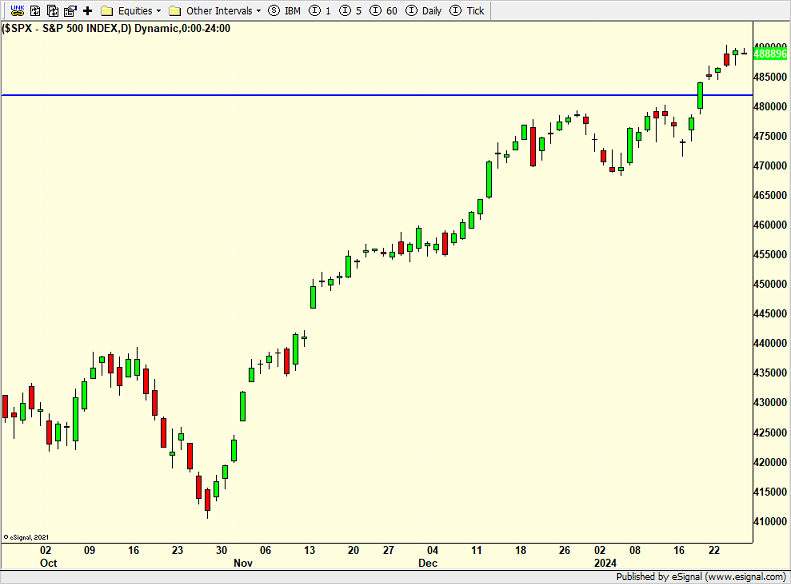

Anyway, it is no secret that stocks have basically melted up lately and we have enjoyed every single minute of it. I has been fun to sit back not only since the October 2023 bottom and watch stocks go vertical, but really, since the end of September 2022. Many times, I said 2023 was one of, if not the easiest year I have seen in 34 years in the business. Okay. Maybe 2013 or 1995 were easier, but I stumbled a bit in March 1995.

(Click on image to enlarge)

As I wrote in my 2024 Fearless Forecast for equities, I don’t think 2024 will resemble 2023. I see some bumps, bruises and turbulence in the first 4-5 months and then smoother sailing to an +11-15% year.

This week, the ducks have been quacking, and sometimes loudly. Sentiment has become a bit giddy and greedy which is a far cry from the fear, terror and despondency 15 months ago. Investors have been craving a select few stocks that have melted up. They can have them and I have no trouble feeding them. Remember the old expression? Bull make money. Bears make money. Pigs get slaughtered. I always try not to be a pig, but I have to admit to being guilty a few times in my career with the scars to prove it.

I think I have done more selling than at any time since Q3 2022 and we also reduced beta in many portfolios which essentially reduces risk. However, to be fair, I really didn’t do a lot of selling in 2023. You can see the trades we made this week at the bottom. Now, before people start calling and emailing about me being so negative, please wait. I am just not bearish. My stance may morph into being negative, but I am not right now.

So why did I make so many portfolio changes?

First, our global macro portfolio did a huge rebalance which accounted for four large trades. We have also been active the gold equities all week. Aside from that, we greatly reduced our exposure in our sector model which was well above 100% for some time. Some sectors it was just time to exit while others, like semiconductors, had melted up and began to pause. On the index side, our models reduced equity exposure from what has been 100% for a while as well as buying an ETF that has built in downside protection. On the stock side I had been looking to lighten up on the highfliers and it was just a good set up.

A good example is below with the semis. You just don’t see that kind of action very often, both in the past few weeks as well as months.

(Click on image to enlarge)

If I am early (wrong) I am okay watching things continue to spiral higher like they did in March 2000. We have still plenty of risk on the table. However, prudence and good management dictate that some action be taken where appropriate. I am often early when it comes to these moves. Perhaps we will trade around it. Perhaps we will stand pat or reduce exposure a bit more. As I always say, it’s okay to be wrong. It’s not okay to stay wrong, like so many people did throughout 2023.

On Monday we bought FENY and NUGT. We sold FUTY and DRN. On Tuesday we bought CWB and some levered, inverse S&P 500. We sold XRT, IJS and LABU. On Wednesday we sold ONTO, NUGT, BIPIX and some WEBL. On Thursday we bought EAPR, RYPMX, PMPIX, DXHYX and FDEM. We sold TLT, FMAG, MRVL, some SOXL and some levered NDX.

More By This Author:

BUT BUT BUT For The Bears - Not All Rainbows & Unicorns For The Bulls

For All The Negative Fanfare, Stocks Remain A Whisker From All-Time Highs

Fearless Forecast 2024 – Stock Market To Tack On Another 11-15%

Please see HC's full disclosure here.