The Dividend Payer That’s Up 3,000% And You Probably Didn’t Know It Pays Dividends

Video Length: 00:03:24

It feels like COVID-19 is stealing summer. With businesses closed, large gatherings banned, and no baseball (yet), we are in July, but it does not feel like summer should feel.

However, there is one traditional Fourth of July event that has not been canceled and may help you get that summer feeling.

Nathan’s Famous International Hot Dog Eating Contest, on Coney Island, will take place as scheduled on July 4. The event will give ESPN something to broadcast besides World Series games from 1987.

While you may be familiar with Nathan’s as the sponsor of the famous eating contest, you may not be aware that Nathan’s Famous Inc. (NATH) is a growth stock with a tremendous track record. A special thanks to our own Eddy Elfenbein for making us aware of this gem.

Nathan’s is a 104-year-old company that today distributes hot dogs and other food products through its own branded restaurant system and almost 80,000 retail locations such as supermarkets and club stores. The NATH shares have traded on the stock exchange since the early 1990s.

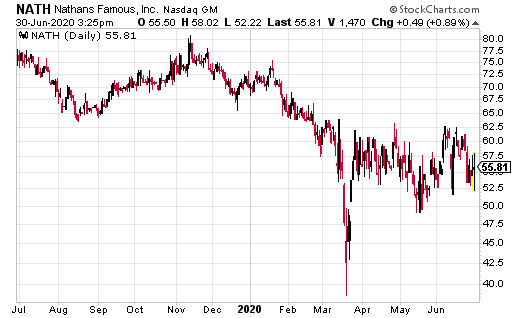

As a growth stock, NATH has outperformed many more famous names. The current $50 share price represents a 20-fold increase from the $2.50 value near the end of the year 2000. Over the last 10 years, Nathan’s investors realized a total return of 505%, which is double the 252% total return posted by the S&P 500 stock index.

Nathan’s stock price peaked at around $100 per share in mid-2018. At that point, the shares were likely overvalued, trading at 50 times the EPS reported for the fiscal year that ended in March 2018. Earnings grew nicely over the next two years, with the latest reported EPS up by 36% over that period. The P/E ratio is now a more palatable (pun intended) 17.5 times trailing earnings.

It is hard to predict how the COVID-19 crisis will affect the short term results for Nathan’s. The company’s restaurants were closed except for the stores that were able to offer pick up and delivery. However, the company reported significantly higher sales of branded products sold through grocery channels.

Once we get to the post-COVID world, Nathan’s will return growth stock status. A bonus for investors is that in June 2018, the company started to pay regular quarterly dividends. The initial $0.25 dividend was increased to $0.35 per share a year later. The current dividend rate is well covered by EPS, which was $0.76 per share for the quarter that ended on March 29,2020.

Nathan’s Famous is what my fellow TalkMarkets contributor, Eddy Elfenbein, calls a “Stealth Growth Stock.” It’s a growth company not followed by the Wall Street analysts. It is now a dividend-paying stock with attractive upside potential coming out of the pandemic driven crisis.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Is this affected by the meat cutting and packaging Covid problems? It hasn't done well last year. Is there something new about this stock? Otherwise it looks like it's going to continue to sit around.

If Nathan's meat packing plants haven't been impacted by the rapidly increasing infections rates, it will soon. Those plants are like a petri dish for the virus.

How will #Nathan's be hosting this event? Will there be social distancing? Seems very irresponsible of the company. $NATH