The Carvana Comeback

Image Source: Pexels

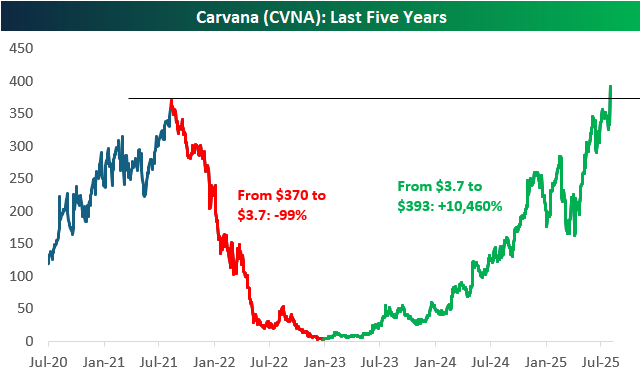

Even if you've been following markets for decades, you've likely never seen anything as crazy as the comeback that online used-car company Carvana (CVNA) has experienced in the last couple of years. Big stocks like Netflix (NFLX) and Meta (META) saw massive drawdowns of 75%+ during the bear market of 2021 and 2022, but Carvana (CVNA) was on another level with a decline of 99% from a peak of $370/share to its closing low of $3.72 made on 12/27/22.

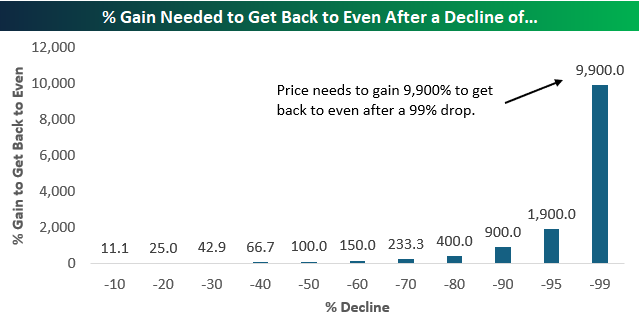

As shown below, a stock that falls 70% needs to gain 233% to get back to even. That's a tall task, but it at least seems do-able. A stock that falls 99%, however, needs to gain 9,900% to get back to even. That seems downright impossible!

Below is a price chart of Carvana (CVNA) over the last five years. As of today, with the stock currently up 17% on earnings to $393/share, CVNA has not only fully recovered its 99% drawdown, but it has also eclipsed its prior highs. In less than three years, the stock has gained 10,460%! Maybe you have, but we've never seen any recovery quite this remarkable.

More By This Author:

New York And Chicago On TopPowell Fed Days: 7 Left

Tech Sector Now 1/3rd Of S&P

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more