The Bullish And Bearish Case For 2026

The year ahead presents both a bullish and bearish case for investors. Will 2026 be another year of above-average returns, or will it be a year of disappointment? The bulls argue that the key ingredients for a sustained rally are in place. A powerful technology cycle, aggressive corporate spending, and supportive policy measures all point to further gains. Conversely, the bears argue that key drivers are weakening, market leadership is dangerously narrow, and signs of economic strain are becoming increasingly visible beneath the surface.

Following a strong 2025, many investors are now facing a different market regime. Liquidity remains ample, but concerns around valuation, employment pressure, and consumer health are rising. The outcome depends on how long optimism can prevail over reality, and whether the hoped-for gains from artificial intelligence and capital expenditures materialize in time to offset the economic drag from debt, interest rates, and inequality.

Sentiment indeed remains positive, although not universally so. Equity strategists are divided, and bond markets are pricing in both rate cuts and the risk of a recession. Furthermore, while fiscal stimulus could delay any downturn, it also adds to long-term imbalances. The challenge for investors is staying objective. While both the bull and bear cases have merit, the timing of outcomes will be critical, and the reality is that in 2026, both the bullish and bearish cases could be correct. Therefore, the right strategy will be the one that adapts.

Let’s break down both the bullish and bearish scenarios for 2026 and examine the arguments on each side. By assessing the macro and market drivers that shape each outlook, we can lay out clear, practical tactics to prepare your portfolio for either path. Whether the bullish or bearish case prevails in 2026, your edge will come from disciplined risk management, not from guessing the future.

The Bullish Case

The bullish case thesis is built on a few key pillars: a new wave of tech-driven investment, supportive fiscal policy, renewed liquidity, and the resilience of corporate and retail behavior. Combined, these forces have helped push markets higher, and bulls believe they will continue to do so well into 2026.

At the heart of the bull case is the emergence of a transformational technology cycle, anchored by artificial intelligence and infrastructure upgrades. Unlike past hype-driven tech cycles, this one is already producing real capital expenditure. The “Magnificent Seven” mega-cap firms have committed more than $600 billion toward data centers, semiconductors, and AI services. This spending has knock-on effects through software, energy, and industrial supply chains. If productivity gains follow, as many expect, earnings will expand and justify higher valuations.

Fiscal policy is also aligned with growth. Under a Trump-led government, tax cuts and direct payments are expected to stimulate both corporate and consumer sectors. The promise of $2,000 stimulus checks may not sound radical, but it boosts near-term consumption and supports small business revenues. Combined with income tax reductions, these measures provide a tailwind for GDP and investor sentiment. As shown, since the 2022 market correction and recession calls, fiscal stimulus has continued to provide steady support for economic growth.

The monetary backdrop is also shifting in favor of the bulls. Quantitative tightening ended in December 2025, and the Federal Reserve is now engaging in “Quantitative Easing Lite” as they continue to cut interest rates and buy $40 billion in short-dated Treasuries. The stated goal is “reserve management,” which is Fed-speak for ensuring there is ample liquidity in the financial system. As the Federal Reserve cuts rates, credit markets should ease, providing risk assets with a tailwind, and liquidity is expected to increase. This dynamic has historically driven higher equity multiples, particularly in technology and growth names.

Corporate behavior reinforces the trend. Share buyback authorizations are set to hit a new record of more than $1.2 trillion in 2026. While often quoted as a “capital return strategy,” which it isn’t, there is a clear correlation between buybacks and stock market performance. Particularly, since 2000, corporate buybacks have comprised nearly 100% of all net equity purchases.

Notably, the narrative that buybacks represent a confidence in future earnings is false; buybacks are being aggressively used to manipulate earnings to exceed Wall Street estimates. Financial engineering is set to expand further in 2026, providing additional support to operating earnings growth and the bullish case.

Lastly, there’s deregulation coming from the “Big Beautiful Bill,” which will ease capital rules on banks, allowing them to hold more collateral. While this provides a tailwind for the Treasury bond market, it also means more lending capacity will be available. Such lending capacity will find its way into leverage for hedge funds and Wall Street trading desks, as looser constraints will translate into an expansion of risk-taking.

The bullish case hinges on a tight feedback loop: innovation drives capital expenditures, which in turn boost earnings, policy injects liquidity, and investors respond with increased risk exposure. So long as each part holds, the trend can continue.

The Bearish Case

The bearish case begins with a critical point: many of the forces that drove 2025’s rally are either fading or already fully priced in. Notably, whether it is valuations, weakening economic indicators, or building speculative risks, the current market momentum may be blinding market participants to deeper structural cracks. However, let’s dig into a few of the issues.

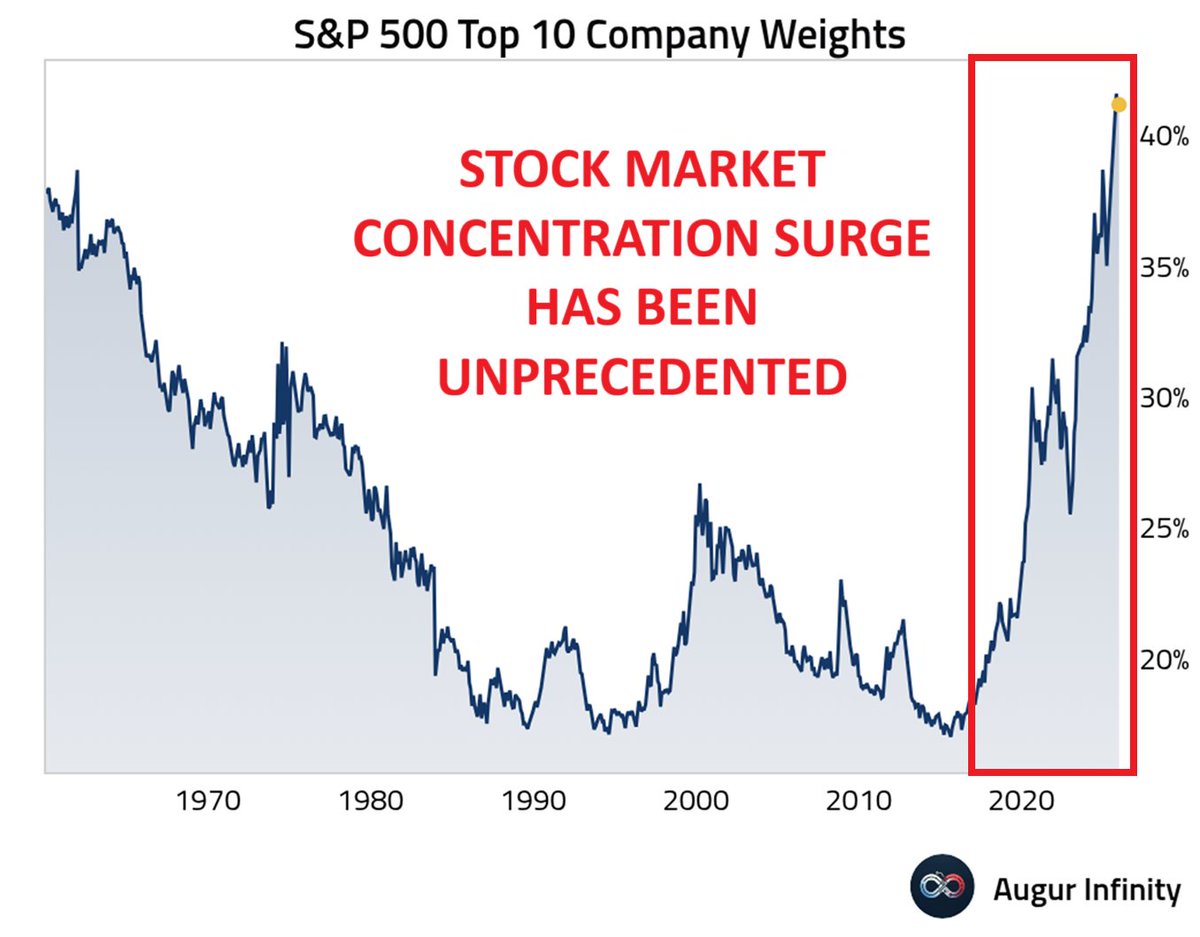

Yes, one of the most obvious concerns is market concentration. Most of the gains in 2025 came from just 10 companies, on a market capitalization-weighted basis, which the massive shift into passive ETF investing fuels.

“Passive investing has grown from a niche strategy into the dominant force in equity markets. Index funds and ETFs now account for over half of U.S. equity ownership. These vehicles allocate capital based on market capitalization, not valuation, fundamentals, or business quality. As more money flows into these funds, the largest companies receive the lion’s share of new capital. That’s created a powerful feedback loop, where price drives flows, and flows drive price.“

This narrow leadership is inherently unsustainable. If something occurs that causes investor flows into ETFs to reverse, every dollar sold will pull 40% out of those same 10 companies. History shows that when markets rely on a few names for returns, volatility rises, and drawdowns can be severe.

Valuations are another warning sign. Price-to-earnings ratios on the S&P 500 remain near cycle highs. Growth expectations are lofty, and any disappointment could lead to repricing. AI enthusiasm has fueled a massive wave of investment, but much of it is circular, meaning that firms are spending on AI tools to sell AI products. That feedback loop may eventually hit limits, especially if demand softens or costs outpace returns.

Much of the current investment cycle is also debt-funded as companies borrow to invest, buy back shares, and maintain dividend levels. If rates stay elevated or credit conditions tighten, the cost of that debt could overwhelm earnings gains.

The larger economic concern is that the shift in capital allocation toward tech and automation may leave significant portions of the labor force behind. Yes, during the construction of “data centers,” we may see 5000 people employed, but only 500 are needed post-construction to operate the center. The long-term drag on employment growth will exert upward pressure on demand destruction, and we may already be seeing early signs of that.

Of course, this is the entire basis of the “K-shaped economy.“ In the current economy, high-income consumers and asset owners are doing well, but lower-income households are under pressure. As a result, consumption patterns are diverging, as lower-tier consumers reduce their spending. That leaves the top 20% of income earners to drive nearly 50% of current consumption. Already, defaults on auto loans and credit cards are rising, and real wages for many workers remain stagnant, even as housing and essential goods continue to be expensive.

Finally, there’s a growing risk in the credit system, especially in the private markets. Private credit has experienced significant growth in recent years, but the lack of transparency hinders its assessment of systemic risk. Regulators have begun to scrutinize this segment, and default rates in middle-market lending are rising. If defaults spread, the ripple effects could hit banks, hedge funds, and pension portfolios alike.

The bear case is not about imminent collapse. It’s about fragility. Beneath the headline gains lies a market vulnerable to earnings misses, credit tightening, and consumer weakness.

Here is the real catch: in 2026, we could see both the bullish and bearish cases. So, being prepared will be key.

Navigating Whatever Comes Our Way

Investors should approach 2026 as a year where both the bullish and bearish cases are proven correct. In the first half, bullish momentum is likely to continue driving gains. Sentiment remains strong, liquidity is ample, and corporate spending continues to ramp up. AI optimism, fiscal stimulus, and a potential pause in tightening may push indexes higher. However, by the second half, cracks could emerge. Valuation pressures are a concern as the risk of an earnings disappointment increases. Economic inequality puts pressure on future outlooks, particularly for corporate revenues. If that happens, sentiment could shift quickly.

To navigate a split-year effectively, investors need to be tactical. The focus will be on capturing early-year upside without overexposing ourselves to potential second-half risks.

Early 2026: Ride Momentum, but Watch Position Size

- Tilt toward sectors benefiting from capex and liquidity, such as technology, industrials, and energy.

- Focus on high-quality growth stocks with strong earnings and cash flows, not hype.

- Use trailing stop-losses to lock in gains if sentiment reverses.

- Take advantage of short-term dislocations by adding during volatility, but reduce sizing as valuations expand.

- Avoid overconcentration in AI names, even during rallies — dispersion risk rises with crowding.

Mid-to-Late 2026: Shift Toward Defense and Cash Flow Stability

- Gradually rotate into value-oriented sectors such as healthcare, consumer staples, and utilities.

- Increase exposure to dividend-paying companies with strong balance sheets.

- Raise cash levels or short-duration Treasuries to maintain flexibility.

- Allocate selectively to high-quality credit, while reducing exposure to private or high-yield debt.

- Monitor consumer credit, employment trends, and bank earnings for early signs of stress.

Throughout the Year: Stay Disciplined and Objective

- Stick to valuation rules regardless of narrative shifts.

- Maintain a diversified portfolio that can absorb both volatility and rotation.

- Use data, not headlines, to guide allocations.

- Rebalance regularly, primarily if the first half produces substantial gains that overweight specific sectors.

Tactical flexibility, risk awareness, and discipline will matter more in 2026 than simple bullish or bearish positioning. It is a year where potentially both bulls and bears could be wrong. Historically, markets may not follow a straight line, but your management process should.

2026 will test investors in terms of increased volatility as both the bullish and bearish cases have substance. Yes, a new technology cycle creates real economic momentum, but it also brings risks associated with overstretched valuations, debt-driven growth, and growing social inequality. Markets are pricing in perfection, and historically speaking, such rarely ends as expected.

Whether the year brings another rally or a sharp correction, your results will depend on how well you manage risk. Don’t anchor to either narrative; watch the data, follow your signals, and adjust as needed.

Remember, your investment goal isn’t to chase market returns, but rather to survive and prosper over the range of market cycles.

Trade accordingly.

More By This Author:

The Reflation Narrative Stumbles Out Of The GateInvestment Risk Is Underappreciated

The South Park Market Of 2026

Disclaimer: Click here to read the full disclaimer.