The "Big 4" Psychedelic Compound-Based Drug Discovery Stocks Fell 14% Last Week - Here's Why

Image Source: Pixabay

Introduction

According to the latest data from the World Health Organization (see here):

- 1.2 billion people, or 14% of the global population - 14.8% female; 13.0% male - were living with some form of a mental health disorder in 2021, according to various estimates from WHO, as follows:

- anxiety disorders (359M); depressive disorders (332M); ADHD disorders (85M); autism disorders (62M); dementia (57M); bipolar disorder (37M); epilepsy (24M); schizophrenia (23M); and eating disorders (16M). In addition, approximately 400 million people (7% of people over 15 years of age) had alcohol use disorders in 2019 and 64 million people had other drug use disorders (not including tobacco) in 2022.

- The above detail is necessary to provide insight into the areas of research the companies in our portfolio (see below) are undertaking.

WHO notes that, while anxiety disorders and depressive disorders are the most common, addiction/substance abuse therapy provides the most long-term commercialization potential for psychedelic drugs given the more than 107 million alcoholics and 71 million drug use abusers worldwide and the more than 7.6 million deaths per year directly attributable to such substance abuse/addiction. In comparison, depression and PTSD lead to 727,000 suicide deaths per year, a shockingly high number, but dwarfed by the death toll from substance abuse.

The economic consequences of mental health conditions are enormous. Productivity losses and other indirect costs to society far outstrip health care costs. Financially, schizophrenia is the costliest mental disorder per person to society. Depressive and anxiety disorders are less costly per person; but since they are much more prevalent, these collectively contribute majorly to overall national costs. Annual global productivity losses for these two disorders alone are estimated to be US$1 trillion reports the WHO.

The Pure-play Psychedelic Compound-Based Drug Discovery Stocks Big 4

Of the 10 clinical-stage biopharmaceutical companies focused exclusively on developing psychedelic compound-based therapies for mental health disorders and addiction/substance abuse (see here) only 4 have market capitalizations in excess of $500M (averaging $796M), which I referred to as the "BIG 4".

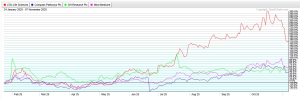

Below is a description of the focus of each constituent, their market cap, their performance week-ending November 7th, in descending order, and in October, the catalyst(s) for their stock price change week-ending November 7th, a chart comparing the performance of each and a chart of the performance of the portfolio YTD.

- GH Research PLC (GHRS): down 5.7% w/e November 7th; Unchanged in October

- Focus: Its pipeline is focused on 5-MeO-DMT (also known as mebufotenin).targeting treatment-resistant depression, bipolar II disorder, and postpartum depression.

- Market Cap: $837M

- Catalyst(s): fell due to a technical breakout, bullish analyst sentiment, and momentum-driven inflows despite conflicting valuation models.

- COMPASS Pathways pic (CMPS): down 13.8% w/e November 7th; up 10.3% in October

- Focus: Its entire pipeline is focused on a proprietary psilocybin formulation and is currently in Phase 3 clinical trials for treatment-resistant depression, with additional studies underway for PTSD and anorexia nervosa.

- Market Cap: $523M

- Catalyst(s): fell due to valuation concerns, sector-wide weakness in psychedelics, and mixed analyst sentiment despite long-term bullish forecasts.

- Mind Medicine (MindMed) Inc.(MNMD): down 17.6% w/e November 7th; up 20.4% in October

- Focus: Its pipeline is focused on a proprietary formulation of LSD, currently in Phase 3 trials for generalized anxiety disorder and major depressive disorder, and an MDMA-like compound in Phase 1 trials, targeting core symptoms of autism spectrum disorder.

- Market Cap: $890M

- Catalyst(s): fell due to investor caution ahead of its Q3 earnings call and broader weakness in the psychedelics sector, despite strong analyst forecasts.

- AtaiBeckley N.V (ATAI): down 25.3% w/e November 7th; up 10.4% in October

- Focus: It is generally considered a pure-play psychedelic stock, but unlike its peers, operates more like an incubator, investing in, and/or acquiring stakes in, promising psychedelic startups giving it broad exposure across the psychedelic landscape.

- Market Cap: $935M

- Catalyst(s): fell due to investor reaction to its Beckley Psytech acquisition on November 5th and name change from atai Life Sciences N.V., re-domiciliation plans, and broader volatility in the psychedelics sector.

Summary

The "BIG 4" were down 13.9%, on average, w/e November 7th after having gone up 9.6% in October.

A Comparison Chart Of The Performance Of The "Big 4" Constituents YTD

StockCharts.com

More By This Author:

New Pure-Play Critical Minerals Mining Stocks Portfolio

Plant-Based Food Stock, Guru Organic, Soared 22% On October 28th - Here's Why

Rare Earth Metals Stocks Are Down 14% So Far This Week - Here's Why

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.