New Pure-Play Critical Minerals Mining Stocks Portfolio

Image Source: Unsplash

What Are Critical Minerals?

- Critical minerals are minerals that are essential to the generation, transmission, and storage of clean energy. Demand for these materials from advanced technologies, urbanization/industrialization, and the energy transition may be set to outpace supply, creating a supply deficit.

- Critical minerals are a category defined by their strategic economic importance and potential supply risks. While all rare earth elements are considered critical minerals, not all critical minerals are rare earths. The key difference lies in their economic significance and the potential challenges in obtaining them.

- Geologically, these minerals are distinguished by their complexity in extraction. Rare earth elements often require intricate processing to separate individual elements, while critical minerals might be more straightforward to extract. The chemistry behind rare earth elements (REEs) is particularly complex, with their similar atomic structures making separation a sophisticated scientific challenge.

- The U.S. Department of Energy (DOE) officially added copper to its critical materials list in August 2023, marking the first time a U.S. government agency has included copper on one of its official “critical” lists, following the examples of the European Union, Japan, India, Canada, and China.

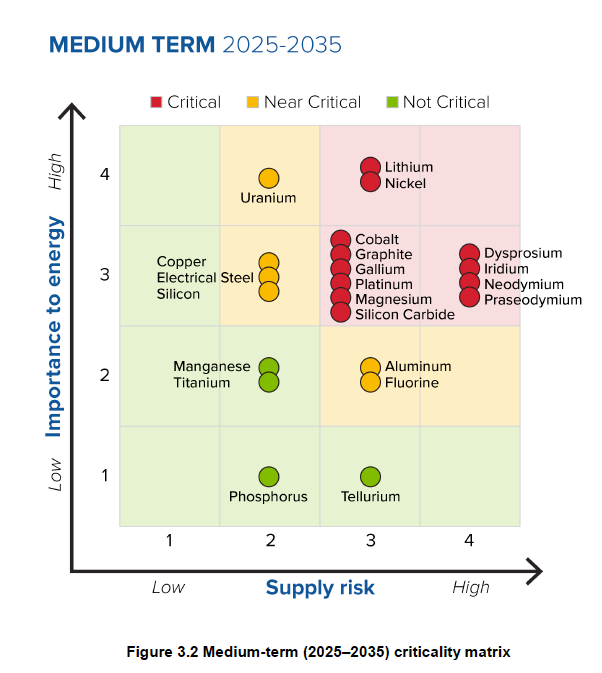

- Below is a list of 22 critical minerals (out of a total of 32) outlining the degree of supply risk of each.

Our Model Pure-play Critical Minerals Mining Stocks Portfolio

Below is a list of the 9 pure-play miners of critical minerals with market caps in excess of $100M, other than rare earth metals, with their market caps, minerals mined, and their stock performances in October, and YTD.

- Uranium Energy (UEC): UP 13.4% in October; UP 126.2% YTD

- Market Capitalization: $6.3B

- Minerals Mined: uranium, titanium

- Standard Lithium (SLI): UP 12.2% in October; UP 158.9% YTD

- Market Capitalization: $852M

- Minerals Mined: lithium

- American Lithium (AMLIF): UP 8.3% in October; UP 40.5% YTD

- Market Capitalization: $168M

- Minerals Mined: lithium

- Talga Group (TLGRF): UP 6.7% in October; UP 23.1% YTD

- Market Capitalization: $134M

- Minerals Mined: graphite

- Nouveau Monde Graphite (NMG): UP 6.3% in October; UP 89.9% YTD

- Market Capitalization: $376M

- Minerals Mined: graphite

- Sigma Lithium (SGML): UP 1.2% in October; DOWN 42.2% YTD

- Market Capitalization: $596M

- Minerals Mined: lithium

- Lithium Americas (LAC): DOWN 3.7% in October; UP 85.2% YTD

- Market Capitalization: $1.3B

- Minerals Mined: lithium

- Piedmont Lithium (PLLTL): on Hold in October; UP 62.5% YTD

- Market Capitalization: $200M

- Minerals Mined: lithium

Sub Total: UP 6.7% in October; UP 41.0% YTD.

Given the massive market capitalization of Cameco, it is presented below separately, as follows:

- Cameco Corporation (CCJ): UP 21.9% in October; UP 98.9% YTD

- Market Capitalization: $43.9B

- Minerals Mined: uranium

In total, the Portfolio was UP 17.6% in October and is UP 80.1% YTD.

Please Note: The following 10 critical mineral stocks are not included in the above portfolio as they had market caps of less than $100M or are not 100% pure-play: ELBM, CRE, NSRCF, FTEL, LMR, FTMDF, VRBFF and AA, RIO and CENX.

More By This Author:

Plant-Based Food Stock, Guru Organic, Soared 22% On October 28th - Here's Why

Rare Earth Metals Stocks Are Down 14% So Far This Week - Here's Why

Qualcomm Popped 11% Yesterday - Here's Why

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.