The Best Way To Build Wealth In The Long Term

Creating wealth is the main reason why we invest in the stock market. We just want to turn every dollar invested today into a large sum in the future, always keeping risk under consideration in the process.

I am not going to say that creating wealth is easy to do by any means, because it is not. However, creating life-changing wealth is far from impossible when investing in high-quality growth stocks over long periods of time.

Creating Life-Changing Wealth

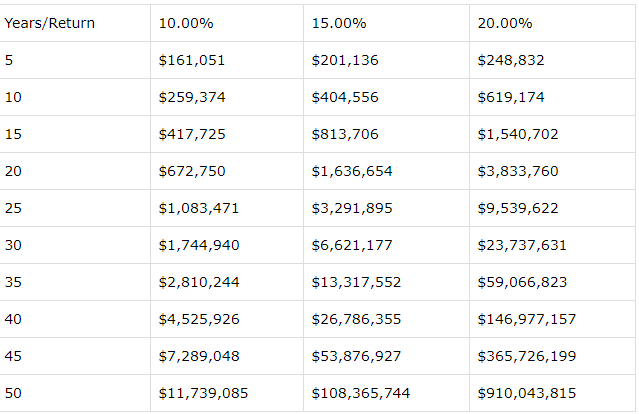

The table below shows the future value of $100.000 invested at different rates of return over different periods of time. We go from 5 years to 50 years and from 10% annual returns to 20% annual returns.

When you remain invested over 15 or 20 years, the chances of transforming $100,000 into $1 million are pretty reasonable, and you don't even need extraordinary returns to achieve this target. Even better, once you go beyond 25 years, the effects of compounding are downright astonishing.

Even 10% annual returns can turn $100,000 into $1.08 million in 25 years, and the future value grows to $3.3 million and to $9.5 million if the return increases to 15% and 20% respectively.

Over longer periods of time, the impact of compounding can be mind-blowing for investors who are not familiarized with these numbers.

(Click on image to enlarge)

Source: Author's calculations

Maybe you are thinking that you don't have enough time to achieve this kind of performance, but it is important to keep in mind that medical advancements are offering enormous possibilities for life extension in the years ahead. Besides, when you start thinking about creating wealth for your children or grandchildren, the time horizon of your investment increases exponentially.

I am not going to get a Nobel Prize in economics for saying that generating strong rates of return over long periods of time can create enormous amounts of wealth. However, the point is that most investors tend to lose sight of the big picture when focusing too much on the short-term.

The Power Of Growth Stocks

We know that we want to achieve high rates of return over long periods of time; this is beyond discussion. The big question then is how do we do that.

There are all kinds of possibilities, and different strategies are better suited for different kinds of people. In my opinion, investing in top-quality growth stocks for the long term is one of the best ways to maximize your chances of success in this fascinating endeavor of wealth creation.

This is not an easy path because it requires a long-term view, a strategic mindset, and conviction. However, long-term growth investing does not require you to be an expert in forensic accounting or to be watching stock prices every second of the day. It is a viable strategy for high-conviction investors who are not investment professionals or even full-time investors.

Stock prices are very volatile in the short term, but over the long term, prices go in the same direction as revenue and profits. In essence, a stock is a share in the ownership of a business, so shares in businesses that deliver superior growth over long periods of time tend to deliver superior returns too.

Many investors tend to worry about the fact that high-quality growth stocks generally trade at above-average valuation levels. This is a valid reason for concern, and we need to always consider valuation in the decision-making process, especially in the current market environment.

However, it is unreasonable to expect the best businesses in the world to trade at discounted valuations. If you focus solely on the price tag and you don't pay enough attention to quality, you may end up missing many of the most promising opportunities for wealth creation in the stock market.

More importantly, if you find the right companies and hold them for the long term, then the quality of the business is much more important than your entry price.

We could say that the price return depends on two main variables, the change in fundamentals and the change in valuation levels. Let's focus on the price to sales ratio since sales are generally a cleaner metric than earnings. The price of the stock will depend on how the sales of the company evolve and how the price to sales ratio evolves.

Price = Sales x Price/Sales

Then

Change in Price = Change in Sales x Change in Price to sales

It is very difficult to know how the price to sales ratio will move because this depends on general market conditions and the opinion of other investors to a good degree. However, if the company's sales increase exponentially over the years, there is a good chance that the investor will be rewarded with attractive returns, even if the price to sales ratio declines.

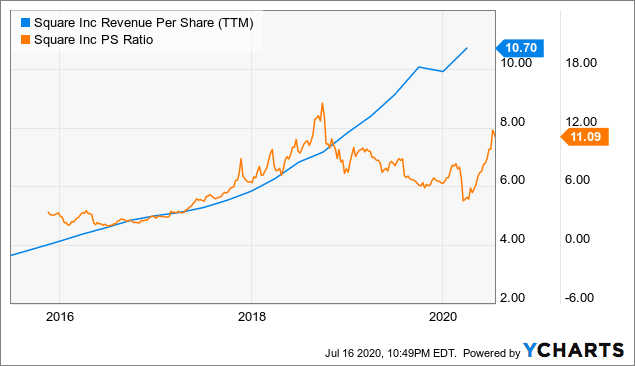

The chart below shows revenue per share and the price to sales ratio for Square (NYSE: SQ) over the past several years. Revenue growth has been very strong, but the price-to-sales ratio is currently below the highs from 2018.

Data by YCharts

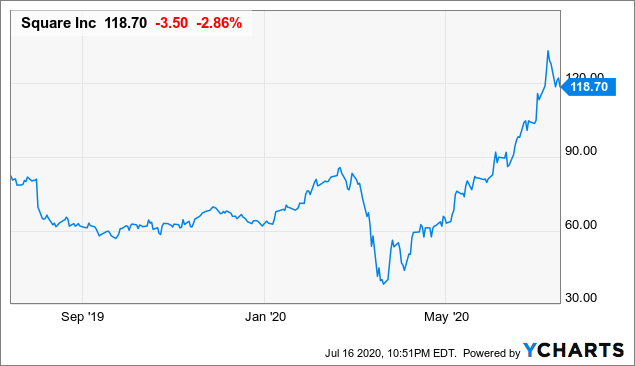

The point is that the stock has still produced massive gains for investors over the years. There has been a lot of volatility along the way, but growing sales and earnings generally produce price gains over the long haul, even if valuation levels can fluctuate in either direction.

Data by YCharts

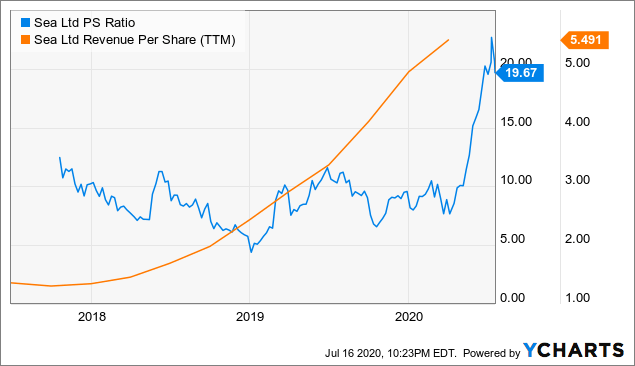

It is very important to understand that current valuation ratios reflect market expectations about the future of a business. If the company can outperform those expectations and build new growth engines over time, valuation ratios will tend to increase. In these cases, investors win both ways: revenue increases and the price-to-sales ratio raises, too.

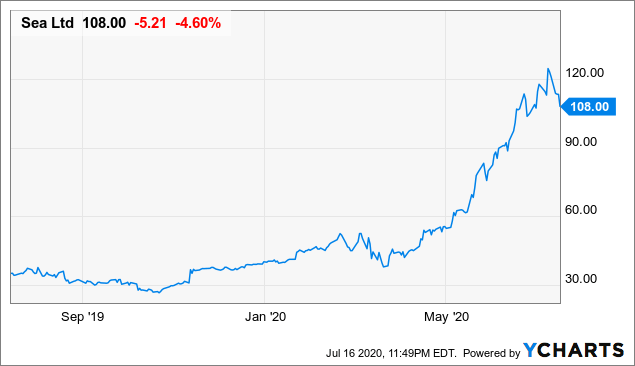

Sea Limited (NYSE: SE) has long been a leading online games platform in South East Asia, and the company is now successfully expanding into online commerce and fintech. These new markets are opening many exciting doors for Sea Limited, so revenues are growing strongly and the price-to-sales ratio has more than doubled in the past year due to increased expectations for further growth.

Data by YCharts

Because of these factors, the stock has delivered explosive returns for shareholders, and it still has plenty of room for gains if management plays its cards well and continues executing in the years ahead.

Data by YCharts

In simple terms, you want to buy companies with strong competitive advantages, visionary management teams, and operating in industries with plenty of potential for sustained growth and innovation.

Valuation should not be disregarded, but when you hold positions over several years and the company can exceed market expectations while building new growth engines over time, valuation is generally not as important as picking the right business.

If you are right about what to buy, and you hold it for the long term, then when to buy it is generally less important than you think. Unless the stock price is egregiously overvalued, the sooner you can start buying a high-quality business, the better.

Managing Risk

Many investors consider growth stocks too risky and volatile. In this regard, it is important to understand that risk can always be managed with position size. Buying the right growth stocks and holding on to them over the long term can produce huge returns with a relatively small amount of capital.

You can keep a large share of your savings in low-volatility investments and aim for superior returns with long-term positions in high-octane stocks. Risk is not only what you buy, but, more importantly, also how much you buy.

Also, investing for the long term does not mean "buy and forget". If the fundamental thesis is broken or valuation does not provide any room for upside, then the smart thing to do is selling the position. Risk and return should be assessed with a long-term mindset, but it is still important to actively follow the company and adjust your investment thesis accordingly.

Building large amounts of wealth is not easy, and trying to do it quickly can do more harm than good. However, for investors with patience and a long-term horizon, investing in high-quality growth stocks can be a powerful strategy for wealth creation.

Disclosure: I am/we are long SQ, SE.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more

I enjoyed this article

Good read, thanks.