Sea Limited: Massive Growth Opportunities Ahead

Sea Limited (SE) is a high growth player in online games, e-commerce, and digital payments in South East Asia. The company operates in industries with enormous potential for growth, and it is well-positioned in countries with attractive opportunities. Management is executing well and revenue growth has been spectacular recently.

The company is not profitable yet and Sea Limited is relatively unknown by U.S. investors, so the stock could be vulnerable to the downside if global stock markets make another leg down. But the business will probably benefit from the coronavirus pandemic in the long term and it offers massive potential or appreciation over the years ahead.

The Right Industries In The Right Countries

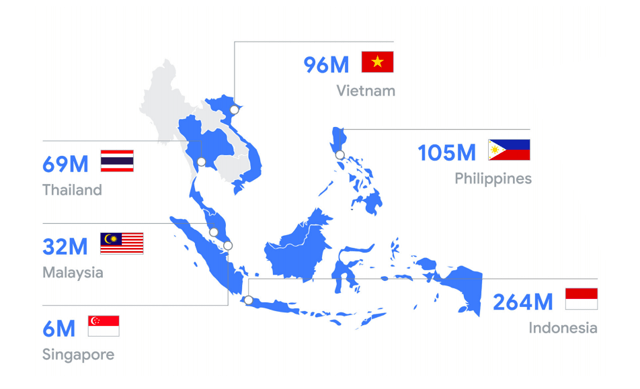

Southeast Asia includes Indonesia, Malaysia, the Philippines, Thailand, Vietnam, and Singapore. This region covers a population of 570 million people, and it is one of the fastest-growing regions in the world. Economic growth in South East Asia has averaged 5% a year in the last five years, widely outperforming other regions.

Source: Google, Temasek, and Bain & Company. e-Conomy SEA 2019

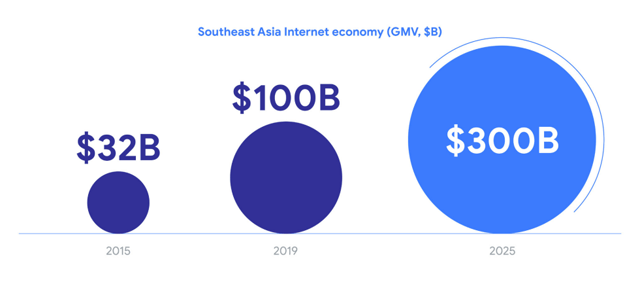

The internet economy in Southeast Asia grew 40% in 2019, exceeding $100 billion in gross merchandise value across the online travel, e-commerce, online media, and ride-hailing sectors. The industry is on track to generate $300 billion by 2025.

Source: Google, Temasek, and Bain & Company. e-Conomy SEA 2019

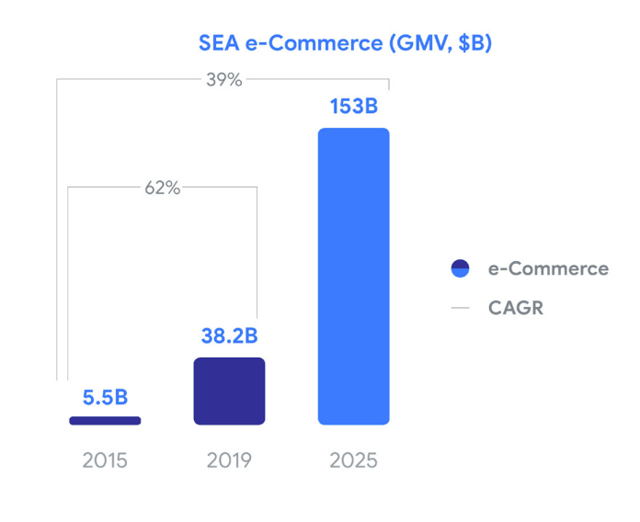

Growth in e-commerce has exceeded expectations in recent years, and consumer behavior is fundamentally changing. Consumers in the region are not only buying items such as electronics online, but also increasingly more everyday items such as groceries and personal care products. This trend should accelerate due to the coronavirus pandemic in the short term.

In the past four years, the e-commerce industry in South East Asia has jumped seven times, from $5.5 billion in 2015 to over $38 billion in 2019. The sector is reportedly on track to exceed $150 billion by 2025.

Source: Google, Temasek, and Bain & Company. e-Conomy SEA 2019

Industries such as online games, e-commerce, and digital payments are high growth businesses all over the world, and the opportunities for expansion in South East Asia are particularly attractive due to strong economic growth, rising income levels for the middle class, and changing consumer habits.

No company is better positioned than Sea Limited to benefit from these outstanding opportunities.

Sea Limited Is Firing On All Cylinders

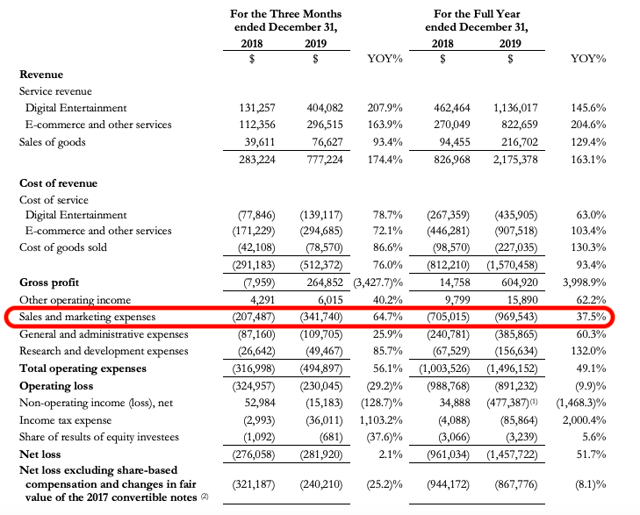

The company operates through three main segments, Garena in online games, Shopee in e-commerce, and SeaMoney in online payments and digital wallets. Financial Performance for the fourth quarter of 2019 was truly outstanding in terms of revenue growth, but the company is still losing money, even if some profitability metrics are moving in the right direction.

Total adjusted revenue reached $909.1 million during the quarter, an increase of 133.5% year over year. Gross profit was $264.9 million versus a small loss in the same quarter of the prior year. The company reported an operating loss of $230 million versus a larger operating loss of $325 million in the same quarter last year.

Sales and marketing expenses are taking a considerable toll on profit margins. Considering how rapidly the business is growing and its long term potential, management is doing the right thing by prioritizing long term growth above current profitability, but lack of profitability is a key risk factor for investors to watch going forward.

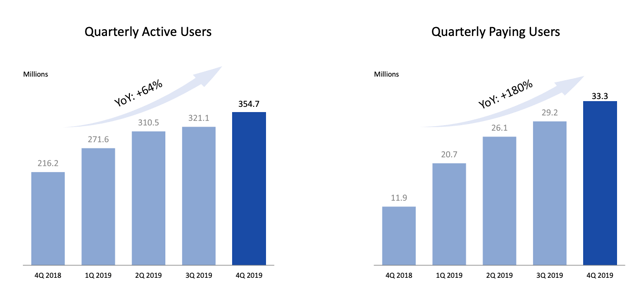

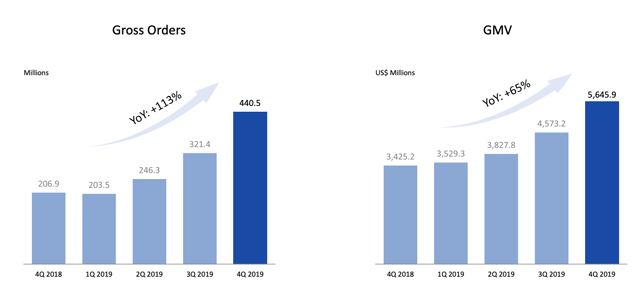

Source: Sea Limited Annual Report

In the online entertainment business, adjusted revenue was $479.9 million, up 107.4%. Adjusted EBITDA was $266.4 million, an increase of 153.2% Quarterly active users reached 354.7 million during the quarter, growing by 64.1%.

The company's self-developed global hit game, Free Fire, was the most downloaded mobile game globally in 2019 and recently hit a new record of 60 million peak daily active users. Free Fire was also the highest-grossing mobile game in Latin America and in Southeast Asia in the fourth quarter and in the full year of 2019.

Source: Sea Limited

In e-commerce, adjusted revenue was $358.3 million, up 182.3%. Gross merchandise value was $5.6 billion during the quarter, growing by 64.8%. Both in Southeast Asia and in Taiwan, Shopee ranked number one in the shopping category by average monthly active users and total time spent in-app on Android in the fourth quarter in for the full year of 2019.

Source: Sea Limited

SeaMoney was launched in 2014, and the company is focused on integrating the e-wallet services of SeaMoney with its Shopee platform across different markets. Quarterly paying users for e-Wallet services have recently exceeded 8 million, and in January 2020 over 30% of Shopee's gross orders in Indonesia were already paid using SeaMoney.

The company is expanding the e-wallet services outside of Sea’s platforms to include other online and offline merchants, along with a variety of third-party use cases. Sea Limited is also leveraging on Shopee’s organic user base and the wealth of data this provides to pilot consumer credit programs.

Three out of four adults in Southeast Asia have insufficient access to financial services and 49% are unbanked. These numbers show that the long term opportunities for financial services disruption and financial inclusion are truly outstanding in the region.

Reasonable Valuation

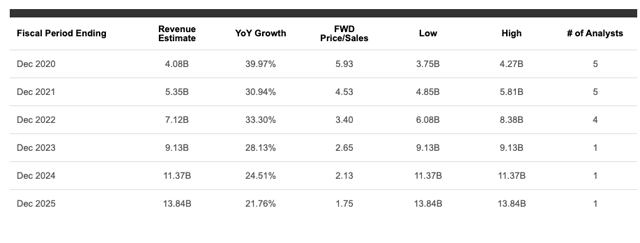

Considering the company's growth potential, Sea Limited is trading at pretty reasonable valuation levels. The table below shows forward revenue estimates for the company and the price to sales ratio implied by those estimates.

Source: Seeking Alpha

First of all, it is important to note that the analysts following the stock are expecting a substantial deceleration in revenue growth versus a 133.5% increase in the fourth quarter of 2019. It makes sense to assume some kind of slowdown in growth as the business gains scale over time, since it is obviously easier to generate vigorous growth from a relatively small revenue base.

However, Sea Limited has multiple growth engines, all of them firing on all cylinders, and the company operates in high growth businesses and in a high growth region. I wouldn't be surprised to see the company outperforming growth expectations in the future, which could provide vigorous upside fuel to the stock price.

In any case, even under modest growth assumptions for the business, a forward price to sales ratio below 6 is not excessive at all, and it is even attractive when considering the potential for the business to materially outperform those growth expectations going forward.

Risk And Reward

Online games, e-commerce, and digital payments are pretty resilient businesses during the coronavirus pandemic, and Sea Limited will actually benefit from increased demand for its services due to the social distancing policies in many countries.

However, management highlighted in the most recent annual report that the business is facing some disruptions due to the pandemic. In some markets, the company and its logistics partners were required to temporarily suspend their operations due to local government policies. Similarly, some of the sellers on the marketplace platform have reduced or suspended their activities due to operational constraints or global supply chain disruptions.

All in all, Sea Limited will most probably benefit from changing consumer habits during the pandemic in the long term, as the company will attract more users to its platforms and consolidate its leadership position. In the short term, however, the business can be affected by a recession and supply chain disruptions.

There are also considerable risks related to online games businesses from a fundamental perspective. Garena has been massively successful with its Free Fire tittle, but it is not easy to continue launching successful new games with consistency. Investors need to keep a close eye on new game launches and their success rate, because this factor can have a major impact on the company's performance, for better or for worse.

Sea Limited is a high growth company operating in emerging markets, and the company is not profitable at this stage. The stock price actually made all-time highs in recent days, and momentum can be a double-edged sword, meaning that the stocks that deliver superior gains on the way up are also many times the ones that fall harder if the trend changes direction. Sea Limited stock could be quite volatile in times of general stock market turmoil.

Those risk factors being acknowledged, Sea Limited is a market leader in remarkably attractive sectors and operating in corners of the world with plenty of opportunities for further growth. The business is clearly firing on all cylinders and successful expansion into e-commerce could deliver massive returns for investors if the company keeps executing well.

All this comes for a fairly reasonable price, as the stock is not too expensive at all when considering the company's growth prospects.

For investors who can handle the volatility that comes with a position in a high growth company in emerging markets, Sea Limited could offer attractive potential for big returns over the years ahead.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SE over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more