The Bears Are Aiming These Key Levels For A Big Drop In S&P 500

Image Source: Unsplash

These are the key levels the bears are watching and could form a great opportunity for shorting in anticipation of a big drop in the S&P 500. Watch the video below to find out the trading plan for shorting S&P 500 based on the Wyckoff method and the long and short-term directional bias.

Video Length: 00:07:18

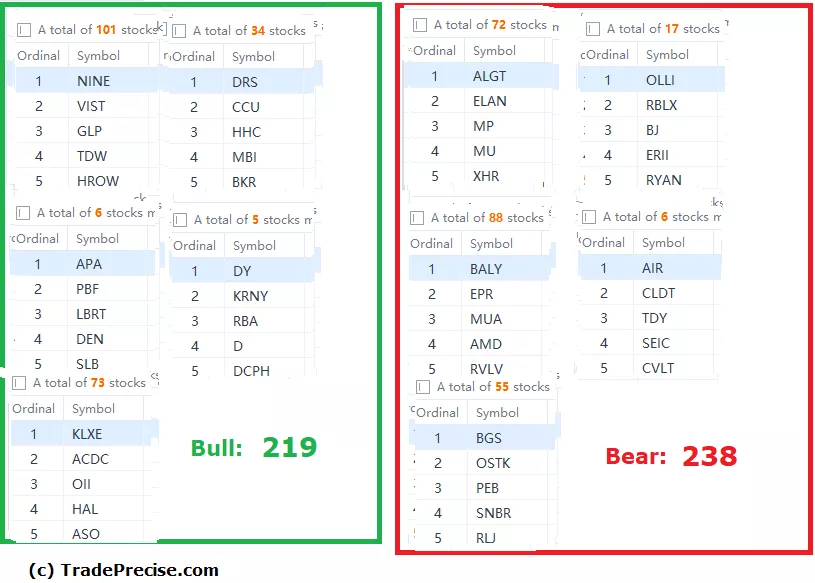

The bullish setup vs. the bearish setup is 219 to 238 from the screenshot of my stock screener below. Since the market is still weak, I will be very selective in initiating long positions and only focus on the outperforming industry groups like home builders (ITB) and precious metals (XME).

There is increasing volatility in the market since I mentioned the perfect short-selling entry 2 weeks ago. There are still plenty of shorting opportunities as the bias is still to the downside. Do pay attention to the key levels mentioned in the video.

More By This Author:

PepsiCo - The Hidden Gem You Can’t Afford To Miss

Nasdaq Could Break Down Soon Based On The Leading Indicator For Growth Stocks

More Bearish Ahead For Tesla: A Wyckoff Take

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.