The Bear Rally Is Over

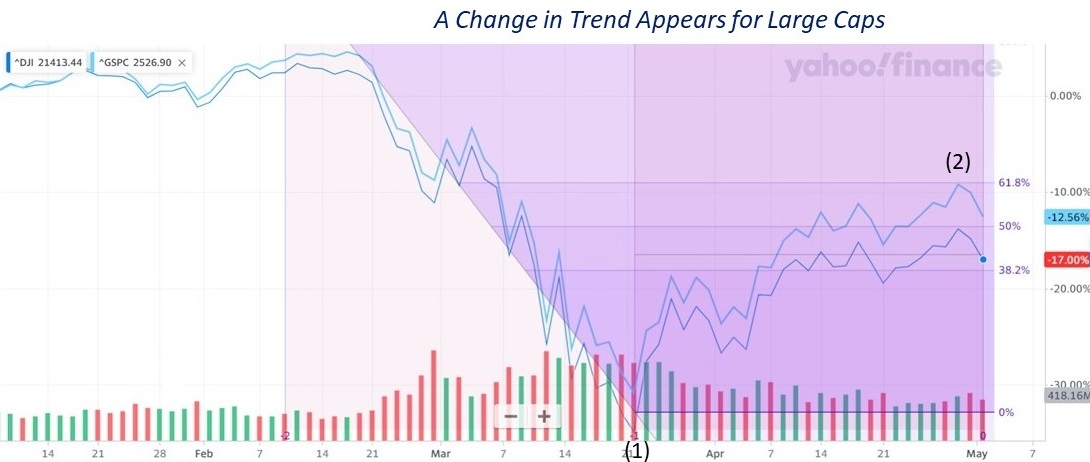

The retracement of US Large Cap Stocks appears complete in structure and time. Both the Dow and S&P 500 have rallied and met the retracement requirements of 50.0% and 61.8% respectively. The Dow's retracement time was 27 trading days for wave (1), 26 trading days for wave (2). With trading volume decreasing during the wave (2) rally, the start of wave (3) in earnest should see a pick-up in volume (and breadth). This is already evident in Small Caps.

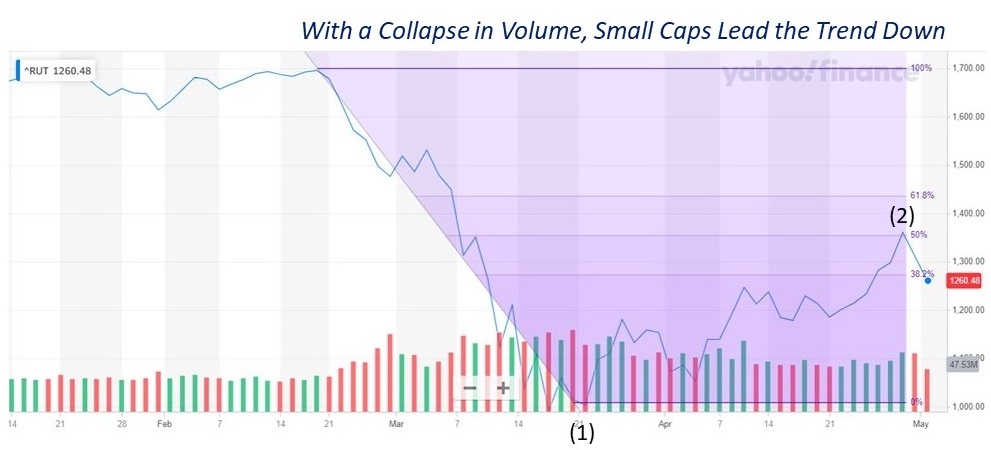

Small-Cap Stocks have met the Fibonacci retracement completion requirement of wave (2). With 90% of the breadth and volume to the downside this past Friday, small-caps by all appearances have started the next Primary wave (3) down for all stocks.

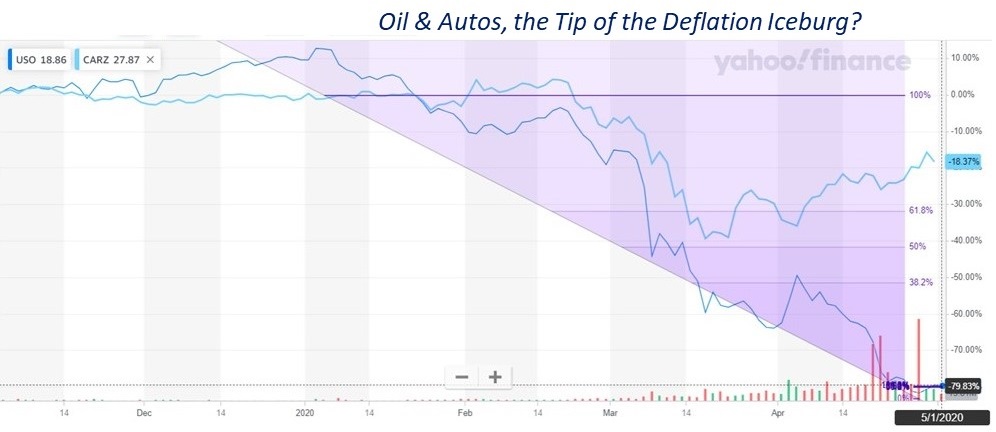

Recently the front-month price of oil futures turned negative without precedent, individual speculators then decided to buy the oil ETF (USO) in record flows. Bloomberg characterized it as an amateur hour in an effort “to make up for decreasing yields.” The deflationary headwind from oil is an anchor reverberating across the economy. It's reflected in the auto sector also.

Real estate in the form of REITs has mirrored autos. As wage growth falls off a cliff due to a historical lack of demand, private real estate will eventually fall into deflation.

Most importantly, just like we were all waiting to see how bad the first jobs report was, the next BLS inflation report on May 12, is even more fateful. Every asset class and capital market lays in the balance. It won't matter if it's deflationary (inflationary). if it shows any type of shock it will be detrimental to asset values. How will you know if there's a problem? If the Federal Reserve Bank takes action.

Disclosure: None.