Texas Instruments' Powerful Free Cash Flow Makes The Stock Look Cheap Here

Texas Instruments (TXN) reported strong Q2 results and expects to show good revenue growth in Q3. But recently TXN stock has taken a dip this year and is down 11% YTD, including 4.4% as of Friday, Aug. 26.

Now the stock looks very interesting to value investors. It trades for just 17.7x estimates for this year's earnings and its dividend yield is 2.71%. Moreover, its free cash flow (FCF) yield is 3.80%.

So why is TXN stock so cheap now?

Texas Instruments Has Issues

One problem that investors have with this chipmaker is that a large portion of its sales go to China. In fact, $2.8 billion of its $5.2 billion revenue in Q2 was shipped to China, or 53.8%. Many of these customers ultimately embed the TI chips into their products and then export them again out of China.

This is based on page 7 of the company's latest quarterly 10-Q filing. For the last six months, China represented 52.39% of its total sales, so the shipments to China seem to be increasing.

This has weighed down the stock. On the other hand, Texas Instruments has very valuable production facilities.

In fact, Texas Instruments is different than many of its competitors in the industry. It is not a fabless semiconductor maker. It designs and makes its own wafers, including several 300-millimeter wafer production facilities, the latest in the technology, in the U.S.

That actually helps lower its gross and operating margins and makes the stock more valuable.

Why Texas Instruments Is Valuable

One reason is that the company generates a large amount of free cash flow (FCF). And it is using that to benefit its shareholders.

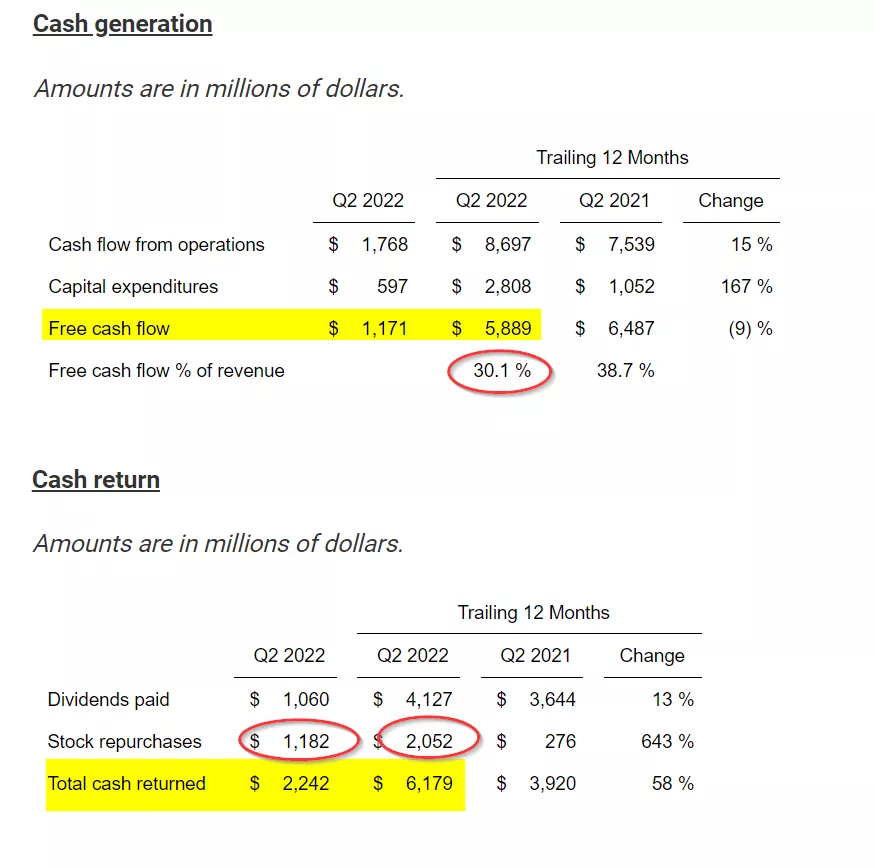

For example, its cash flow from operations was $8.7 billion for the trailing 12 months ending June 30. After capex spending its trailing 12-month (TTM) FCF was $5.889 billion.

As a result, the company enjoys relatively high FCF margins, including 30.1% in the last 12 months, according to the company's latest earnings report.

Where This Leaves TXN Stock

Texas Instruments used that FCF to pay $4.1 billion in dividends to its shareholders and also bought back $2.05 billion of its common stock shares. That includes $1.18 billion in Q2 alone.

That totals over $6.179 billion in total shareholder payments in the LTM to June 30. Compare this to its present market capitalization of $154.8 billion. That represents a total yield of almost 4.0% (3.99%) including dividends and buybacks.

In fact, it seems likely that Texas Instruments may lift its dividend per share soon. It has already paid out $1.15 per share for the past 4 quarters and has a history over the past 16 years of annually hiking the dividend. That could happen in mid-Sept. I estimate the new dividend could rise from $4.60 annually to at least $5.00 per share.

This will give the stock a dividend yield of 2.95% (i.e., $5.00/$169.49 as of Friday, Aug. 26). This is important since the average yield TXN has had over the last 4 years was lower at 2.50%, according to Seeking Alpha.

So, for example, if we divide $5.00 by 2.50%, the new target price for TXN stock is $200.00 per share. That means that if Texas Instruments raises its dividend in Sept., and the stock subsequently rises to its average dividend yield, the potential upside is +18.0% (i.e., $200/$169.49-1 = +0.18).

So, value investors may actually see the stock's recent tumble as a buying opportunity.

More By This Author:

KB Home Stock Is A Good Value With Attractive Put And Call Income Plays

Disclosure:None

Mark R. Hake, CFA, does not provide financial advice and you should not rely on my analysis to buy or sell any stock. I am not undertaking to induce you to buy or sell any ...

more

Thanks, Mark. How will the current move to re-shoring affect TI's overall business? Do they have a leg-up on some of their competitors?