KB Home Stock Is A Good Value With Attractive Put And Call Income Plays

Image Source: kbhome.com

KB Home (KBH) stock is dirt cheap today at 3x forward earnings, well below its historical valuation metrics. In addition, it offers enterprising investors attractive short put and short call income plays.

The homebuilder reported sales up 19% YoY in Q2 for the period ending May 31 and plenty of cash on its balance sheet to weather a real estate storm, should it happen.

Moreover, its cash flow loss (outflow) narrowed from the prior quarter. This is important since it is still paying a dividend and buying back shares. Those activities can't be supported without the company generating positive free cash flow (FCF) in the long run.

In this regard, KB Home said its guidance for 2022 was $7.3 billion to $7.5 billion in revenue and an operating margin of between 16% and 16.6%, assuming no inventory-related charges.

That said, unless KB Home can increase its cash flow, the 60-cent annual dividend, which costs about $13 million per quarter would have to be financed through existing cash or debt increases. I don't see the management cutting the dividend, as this is not a huge drag on its cash flow as it stands now.

Cheap Valuation

At $30.28, as of Aug. 24, KBH stock looks very cheap, especially since it is below absolute and relative measures of value.

For example, its book value per share is $37.76 per share as of May 31, according to the company's Q2 earnings release. That puts it price-to-book value (P/BV) multiple at only 0.80x, or 20% below its book value per share.

Even after deducting intangibles of $165.878 million from deferred tax assets (which is debatable), or $1.90 per share, the tangible book value per share is still $35.86. This is 18.4% higher than today's stock price.

Moreover, analysts project earnings per share (EPS) for the year ending Nov. 30, 2022, of $10.18, putting the stock on a P/E multiple of just under 3.0x. For next year, the average of 16 analysts surveyed by Seeking Alpha is a forecast of $9.62 per share. This puts KBH stock on a 3.15x forward multiple.

Historically this is a very low multiple for KBH stock. For example, Morningstar reports that the average forward multiple for the last 5 years has been 8.73x. That implies that KBH stock is too cheap by at least 40%.

In addition, KBH stock's 60-cent annual dividend gives investors a 2.0% dividend yield. This is higher than the stock's historical average. For example, Morningstar reports that its five-year average yield has been 0.89%, implying the stock is too low now. Seeking Alpha reports that the average yield in the four yields has been 1.04%.

For example, if we divide the company's annual dividend of $0.60 by 1.0%, the price target would be $60 per share. That represents a potential upside of 98% in the stock price.

Put and Call Option Income Plays

This leaves enterprising investors with a good upside in the stock. In order to create additional income, they can sell out-of-the-money (OTM) calls and short cash-secured OTM puts. Here are two examples of how that would work today.

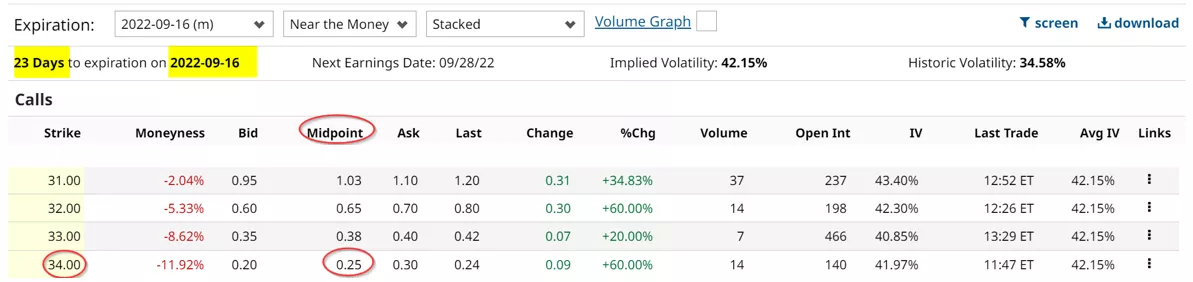

The table below of the Sept 16 call option chain. This shows that the $34 strike price offers calls with a 25-cent premium.

(Click on image to enlarge)

Here is what that means for the covered call income investor.

The investor buys 100 shares of KBH stock at $30.30 today for $3,030. Then he sells 1 call option at the $34.00 strike price and immediately receives $25 per call option sold. That works out to a 0.825% for the next 23 days, and annually that represents a 9.9% income return.

Assuming the stock does not rise to $34.00 by Sept. 23, the investor does not have to sell his 100 shares for $34.00. But even if it does, there would be a capital gain of 12.2%. This is on top of the 0.825% income received for the covered call sale. As a result, the total return could be as much as 13% for the next 23 days.

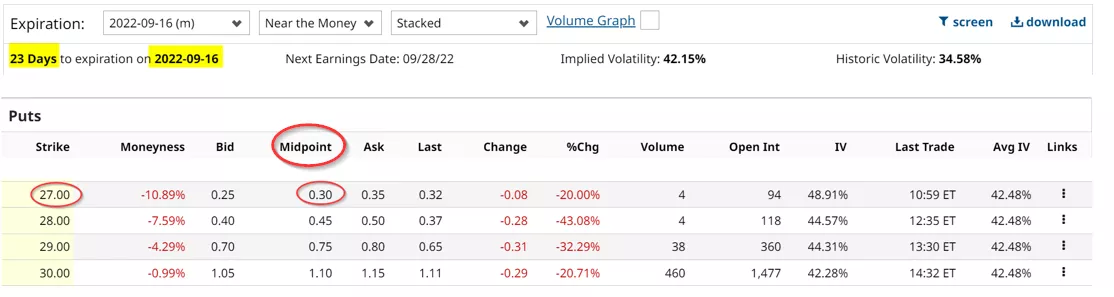

Another way to play this is to sell cash-secured puts that are out-of-the-money (OTM). For example, look at the put option table below for expiration on Sept. 23.

(Click on image to enlarge)

This shows that an investor could put up $2,700 with a brokerage firm and then sell 1 put option at the $27 strike price to receive $30 immediately. That means that if the stock falls to $27.00 the investor would automatically buy 100 shares at $27 per share. In that case, the return is 1.11% (i.e., $30/$2,700). This is a slightly better return than the call option play above. It represents an annualized return of 13.33%.

However, the short-put investor does not get to participate in any upside move in the stock from here. That is why sometimes investors play both sides of this income play.

The bottom line here is that enterprising investors can make money shorting OTM puts and calls in KBH stock, given that it looks to be too cheap here.

Mark R. Hake, CFA writes articles at InvestorPlace.com, Barchart.com, Medium.com, and Newsbreak.com

Disclosure: None

Mark R. Hake, CFA, does not provide financial advice and you should not rely on my analysis to buy or sell any stock. I am not undertaking to induce you to buy or sell any ...

more

Good stock pick, thanks.