Tesla's One Trillion-Dollar Valuation Is Just The Beginning

Justin Sullivan/Getty Images News

In my first ever Tesla (TSLA) article on Seeking Alpha, I asked a simple question, "Will Tesla Become A Trillion Dollar Company?" Now, less than five years later, that question has been definitively answered. Yesterday, Tesla officially crossed the trillion-dollar market cap mark, placing the company in the elite club of other tech titans like Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Microsoft (MSFT). However, a trillion-dollar valuation may not be the end for Tesla but merely another beginning.

Tesla is now up by about 30% since I put out my Q3 projections for the company just around two weeks ago. So, why is the stock up this much in just around two weeks? Well, the stock rallied into the company's record-shattering quarterly report, and the positive momentum has continued since. To cap things off, Hertz (OTCPK: HTZZ) announced an order for 100,000 Tesla Model 3s, which sent the company's market cap over the trillion-dollar mark for the first time.

Other big deals and massive growth are ahead for Tesla, and shares are getting bid up as more market participants get involved with the stock. In other news, Tesla put up a solid quarter last week, illustrating that the company will likely continue to become substantially more profitable in the future. Q4 should be another record-setting quarter for Tesla, and the company should continue to put up substantial growth numbers for years as we advance. Therefore, while the stock could go through a transitory pullback/consolidation phase after the recent run-up, shares should continue to trend higher into year-end 2022, and beyond.

Technical Setup

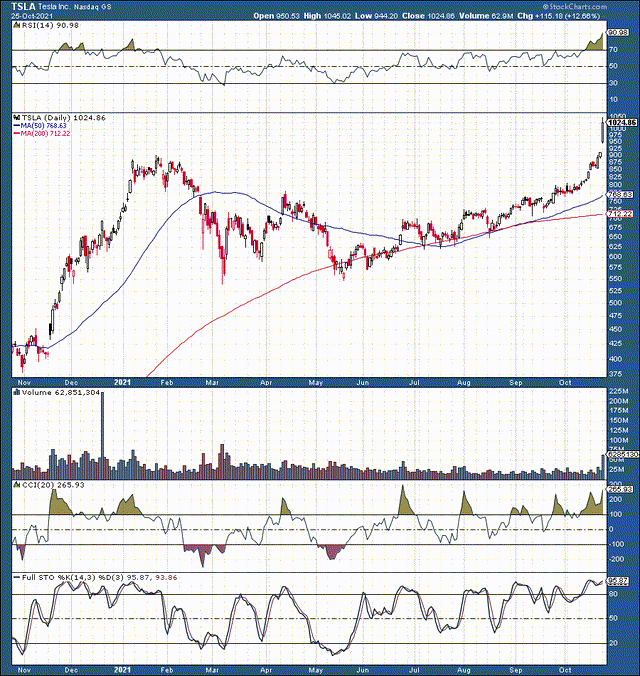

Source: StockCharts.com

Tesla's stock has appreciated a lot lately, and shares are around a new all-time high now. Tesla is up by about 85% from its most recent correction low, and the stock is roughly 172% higher than the company's 52-week low nearly a year ago. However, from a technical standpoint, Tesla is overbought on a short-term basis. The relative strength index ("RSI") is above 90 now, which is even higher than the highs around its last peak early in the year. Furthermore, the CCI and full stochastic are overextended here as well.

Therefore, in the near term, we will likely see a mild pullback and a consolidation phase at around $1,000. Nevertheless, longer-term, the technical image remains bullish, and Tesla should continue to trend higher. In my last analysis, I mentioned that $1,000 was an appropriate year-end price target. However, given the recent developments, I now think $1,200 is a better estimate for year-end.

So, Why are Shares Up So Much and Probably Heading Higher?

Tesla Delivers

In two simple words, "Tesla Delivers." While the company has had issues with delivering on its promises in the past, Tesla is executing much better now. Tesla delivered 241,300 total vehicles in its most recent quarter, roughly a 10% increase over the 220,900 car consensus estimate.

More recently, the company delivered a much better than expected earnings report. The company's EPS came in at $1.86 vs. the anticipated $1.56 estimate. GAAP net income came in at $1.62 billion, a whopping 389% YoY increase. For a closer analysis of Tesla's Q3 results, let's look at my recent estimates vs. the company's results and YoY changes in the company's financial dynamics.

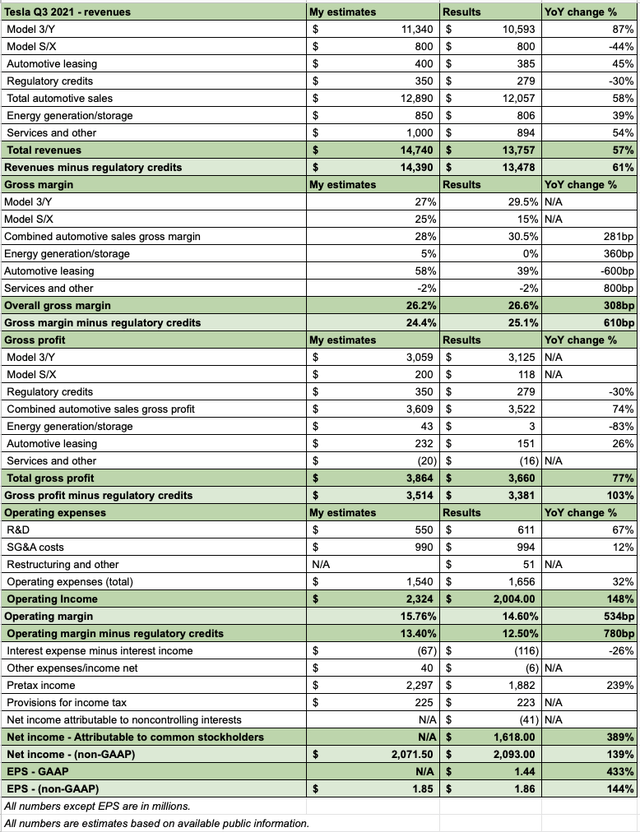

Tesla's Q3 Results Vs. My Estimates and YoY % Change

Source: Author's Material

I Was Off by One Cent

Just one cent is how close my non-GAAP EPS estimate came to Tesla's official result. $1.86 was the company's actual number, and it was 144% higher than the result one year ago. Perhaps more importantly, Tesla's GAAP EPS of $1.44 was a remarkable 433% YoY increase. My non-GAAP net income estimate was also extremely close, off by just $21.5 million or roughly 1%.

We see substantial YoY increases across the board in Tesla's bottom line, especially on the GAAP side, illustrating the company's extraordinary profitability growth potential. Operating income came in at more than $2 billion, with an operating margin rate of nearly 15% (slightly lower than my 15.76% estimate). This margin rate was about 5.34% above last year's and 7.8% higher if we look at the operating margin minus regulatory credits. Again, this illustrates the company's improving profitability and decreasing reliance on regulatory credit income. Excluding regulatory credits, the company's operating margin came in at a very healthy 12.5%.

The company's $611 million in R&D costs was slightly more than the $550 million I expected. R&D also grew at about 67% YoY. However, I don't view the rising cost negatively, as Tesla's research and development seem to pay off after introducing new products to market. SG&A costs came in at $994 million, essentially in line with my $990 million figure. Now, the exciting thing here is that SG&A costs were up by only 12% YoY. This modest rise is while total revenues surged by 57%, and the company delivered far more vehicles this year. This dynamic illustrates that Tesla continues to manage costs exceptionally well and is continuously improving efficiency.

My gross profit figures were very close to the company's results, and Tesla's gross profit surged by 77% YoY. Also, if we excluded regulatory credits, the company's gross profit would have increased by about 103% YoY. I anticipated the company's gross margin would be 26.2%, and the actual figure came in slightly higher at 26.6%. Excluding regulatory credit income, Tesla would have still delivered a very healthy 25.1% gross margin rate. The company achieved an extremely high 30.5% combined automotive sales gross margin.

This high mark illustrates the company's distinct ability to improve manufacturing efficiency due to Tesla's economies of scale. Furthermore, once regulatory credits got deduced, it appears that the company's Model 3/Y segment operated at a gross margin of around 29-30% (remarkably efficient). Minus regulatory credits, the overall gross margin improved from just 17% to about 25% YoY. I was slightly optimistic about the company's revenues, but Tesla's revenues still beat consensus estimates and grew by nearly 60% YoY.

The Bottom Line: Tesla Has Immense Growth Ahead

A primary reason why Tesla's stock continues to head higher is the company's enormous growth potential. A "remarkable growth story" is not something you typically hear with a company scheduled to deliver over $70 billion in revenues next year. I've seen analysts attempt to compare Tesla to Alphabet, Amazon, or Facebook (FB), but there is no comparison to be made here, in my view.

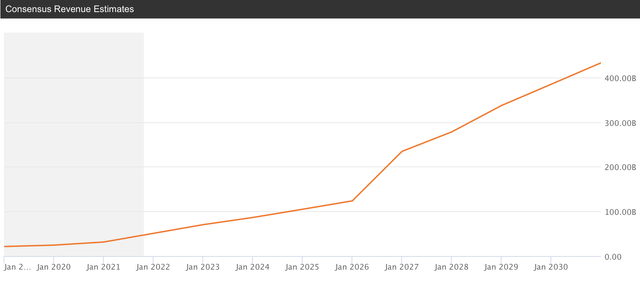

A possible comparison here is Amazon about 5-10 years ago when the company had massive growth ahead. However, now Amazon is setting up for around $562 billion in revenues next year, and the company could double revenues by 2030. Alphabet will deliver nearly $300 billion in revenues next year and should double sales by 2030. Facebook is set to provide about $140 billion in revenues next year and should also roughly double sales by the end of this decade. Here are Tesla's projections, where the company could grow revenues by nearly tenfold through 2030.

Tesla - Revenue Growth Expectations

Source: seekingalpha.com

This remarkable growth dynamic is why we see Tesla trading at about 120 times 2022's earnings expectations. Yes, Alphabet trades at 25 times forward EPS estimates, and Amazon is at 50. However, you are looking at companies that will likely double revenues over the next 7-8 years, whereas Tesla offers substantially more revenue growth potential.

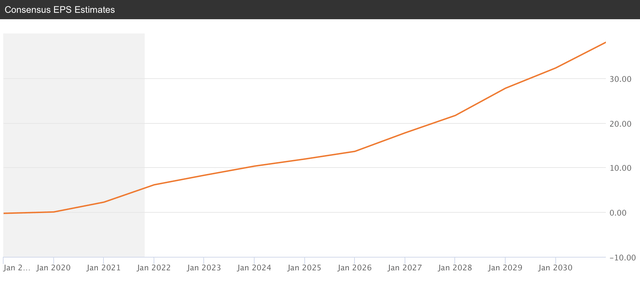

Also, we need to consider earnings growth. For instance, why does Amazon trade at a P/E roughly double to Alphabet? A primary reason for this dynamic is Amazon's likely ability to increase earnings much more than Alphabet in future years. For instance, analysts anticipate Amazon can increase EPS by about fourfold into 2030. On the other hand, Alphabet will likely increase EPS by only 100% into 2030. Therefore, Amazon's P/E, which is double Alphabet's right now, makes sense when looking at the two companies' overall growth story.

Now, Tesla trades at a forward P/E of about 120, but analysts anticipate that EPS can increase by about sixfold into 2030. The company's projected EPS growth is notably higher than Alphabet's 2x and Amazon's 4x expectations. Thus, Tesla deserves a higher multiple.

Tesla - EPS Growth Expectations

Source: seekingalpha.com

However, I believe that the 6x figure is highly conservative, and Tesla can probably grow EPS much more than this. Just going by the company's anticipated 9x revenue increase into 2030 coupled with expectations for improved efficiency and economies of scale capabilities, we should see a much more significant rise in EPS than the proposed 6x figure we see now.

Here's What Tesla's Earnings Could Look Like in Future Years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue growth | 30% | 28% | 19% | 90% | 22% | 24% | 18% | 17% | 15% |

| EPS | $10 | $12 | $15 | $18 | $23 | $28 | $35 | $43 | $50 |

| Forward P/E ratio | 120 | 115 | 110 | 100 | 90 | 80 | 70 | 65 | 60 |

| Price $ | 1,440 | 1,725 | 1,980 | 2,300 | 2,520 | 2,800 | 3,010 | 3,250 | 3,500 |

Source: Author's Material

If you wonder what the revenue surge in 2025 is about, it's the Tesla Semi, another product that should unlock a key market for Tesla to compete in. Generally, I don't think that my EPS estimates are too optimistic, and we see that if robust growth and strong execution continue at Tesla, we can see the stock at substantially higher levels in future years. Also, I realize that a $3,500 price tag on the stock implies a valuation of $3-4 trillion for Tesla. However, if the company continues to execute and deliver, market participants should continue to pay up for the company's stock.

Risks to Consider Before You Invest

Of course, when you are talking about Tesla, there are risks to consider. While I estimate that the company can earn $50 per share in 2030, the company is very far from such figures right now. Therefore, there is the risk that Tesla will not illustrate the kind of earnings growth I envision. A slowdown in demand, increased competition, supply issues, decreased growth, and other variables are all risks we should consider before betting on Tesla to increase EPS nearly tenfold by 2030. Serious concerns could cause Tesla's valuation to lose altitude, and the company's share price could even head in reverse if any serious issues should arise. Therefore, I believe one should consider the risks carefully before committing any capital to a Tesla investment.

A Different Perspective of Tesla's Valuation

While I am bullish on Tesla's intermediate and longer-term prospects, the company's valuation remains a concern. Right now, the company trades at about 100 times my forward P/E estimates. However, if we look at consensus figures, Tesla's forward P/E (2022 estimates) is around 125 now, and the company's 2021 projected P/E ratio is at a whopping 170. Now, Tesla's valuation is much higher than many high-growth tech firms, never mind automobile manufacturers.

When you boil things down, Tesla gets the bulk of its revenues from car sales. Therefore, Tesla may get valued more like an automobile company someday rather than a high-growth tech firm. There will be about 71 million cars sold in the world this year, and Tesla will only account for about 1% of total vehicles sold. However, Tesla's trillion-dollar valuation is now worth more than its nine closest competitors combined. While Tesla should continue to gain share in the automobile market, the company represents just one percent of unit sales. It is trading at a valuation equivalent to about 90% of unit sales. Is the market getting ahead of itself on Tesla, and are shares overvalued right now?

Also, let's not forget about the company's debt and liabilities. Tesla has around $6.5 billion in long-term debt obligations. Moreover, the company has approximately $8.3 billion in accounts payable and nearly $30 billion in total liabilities. This number is substantially higher than the company's roughly $16 billion in cash and short-term investments. Other trillion-dollar giants have tens of billions in cash. At the same time, Tesla's position is much smaller, and the company is still far less profitable than many of its counterparts.

Disclosure: I/we have a beneficial long position in the shares of TSLA, GOOG, FB either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses ...

more

Quite an interesting analysis, almost more sunshine than I can stand at one time. There is, however, one bit of cloud ahead, which is that every one of those battery powered vehicles must recharge those batteries to keep moving, and while charging stations are being installed, it still takes the power grid infrastructure to connect to the power sources. Presently that structure is not nearly up to the task, and upgrading it is neither a rapid process nor a cheap one. Just look at Texas, last year's electric heating troubles.

Beware! The future is approaching rather rapidly! Not so much sunshine then.