Tesla Vs. Rivian: What's Currently The Better Buy?

Image Source: Unsplash

Investors should be aware of the heightened volatility within EV stocks.Tesla (TSLA - Free Report) has been a polarizing stock over the last decade, delivering massive gains for investors as we increasingly shift toward EVs.

And in 2025, shares have been volatile, down 30% overall with big price swings.

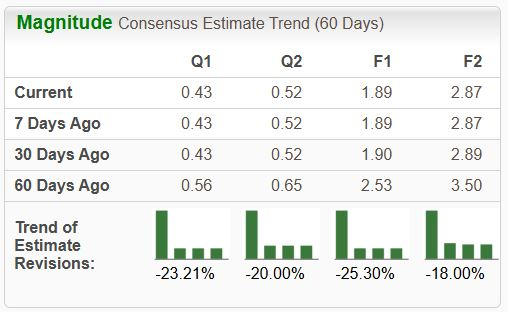

Notably, the stock currently sports an unfavorable Zacks Rank #5 (Strong Sell), with analysts revising their EPS expectations negatively across the board in a big way over recent months.

Image Source: Zacks Investment Research

The downward revisions paint a challenging picture for TSLA’s share performance in the near term, and investors can expect a heightened level of volatility here given the stock’s historical nature.

With that said, let’s take a closer look at its latest set of quarterly results and a big competitor, Rivian Automotive (RIVN - Free Report) .

Tesla Faces Volatility

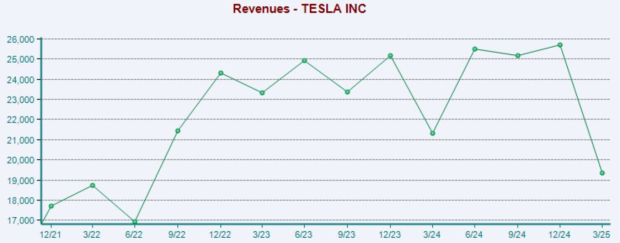

Tesla reported Q1 revenue of $19.3 billion and adjusted EPS of $0.27 in its latest release, reflecting year-over-year declines of 9% and 50%, respectively. Still, results from Tesla’s Energy Generation & Storage segment reflected some positivity, with sales climbing 67% year-over-year to $2.7 billion.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Concerning EV production/deliveries, Tesla delivered roughly 337k EVs and produced nearly 363k throughout the period.

While the EV numbers are important, another critical aspect of the release was the margin picture, with the company’s gross margin contracting to 16.3% vs. a 17.4% print in the same period last year. Please note that the margins chart below is calculated on a trailing twelve-month basis.

Image Source: Zacks Investment Research

The crunched profitability has been a big headwind for the stock, regularly dictating post-earnings price movements as of late.

Rivian Posts Record Profit

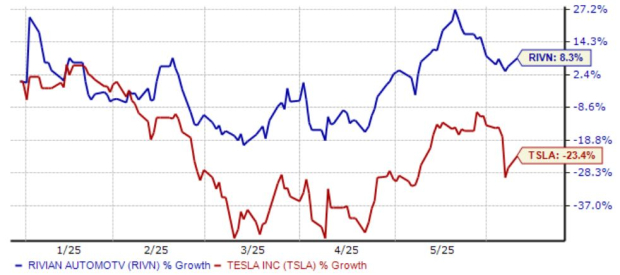

Rivian shares have been much stronger in 2025 so far, gaining 8% compared to Tesla’s 23% decline. Its latest set of quarterly results was primarily positive, with gross profit of $206 million reflecting a quarterly record.

Notably, the company produced roughly 14.6k vehicles throughout the period, delivering 8.6k. While the numbers are miniscule compared to that of Tesla, the results remained in-line with management’s previous guidance, a critical hurdle to clear for any EV player.

Image Source: Zacks Investment Research

It’s worth noting here that while Rivian has 100% US vehicle manufacturing and sources most materials (excluding cells) in the US, it’s still not immune to the impacts of the current global trade and economic environment. The company revised its current-year guidance concerning vehicle deliveries as a result, now expecting FY25 deliveries in a range of 40-60k.

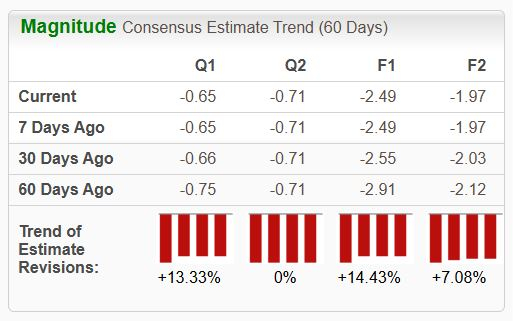

Rivian currently sports a Zacks Rank #2 (Buy), boasting a much more bullish EPS outlook relative to that of Tesla (TSLA) .

Image Source: Zacks Investment Research

Bottom Line

Tesla (TSLA) shares have been big-time winners over the past decade for many, but recent performance has undoubtedly left a sour taste in many mouths.

The recent profitability crunch and slowing sales growth are driving forces behind the stock’s poor performance, with competition also quickly becoming fierce. Rivian (RIVN) shares have been much stronger in 2025, with the company’s EPS outlook much more favorable.

Given Tesla’s current Zacks Rank #5 (Strong Sell) rating, investors would be better off focusing on stocks seeing positive EPS revisions, precisely what Rivian has seen over recent months.

More By This Author:

3 AI Stocks Flashing Bullish Momentum

What's Going On With Tesla Shares?

These 2 Tech Titans Generate Substantial Cash: MSFT & AAPL

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more