These 2 Tech Titans Generate Substantial Cash: MSFT & AAPL

Image Source: Pexels

Strong cash flows reflect financial stability, allowing companies to pay down debt, pursue growth opportunities, and shell out dividend payments for stock owners.

These companies are also better equipped to weather downturns, providing another beneficial advantage for investors from a long-term standpoint.

And for those seeking cash-generating machines, two mega-cap tech giants – Microsoft (MSFT - Free Report) & Apple (AAPL - Free Report) – fit the criteria nicely. Let’s take a closer look at how each currently stacks up.

Cash King Apple

Apple shares have jumped back into favor following the tariffs de-escalation announcement, up nicely from 2025 lows. Its latest set of quarterly results also came with several positives, including record Services revenue and record EPS for its March quarter. Total sales grew 5% year-over-year throughout the above-mentioned period, with adjusted EPS of $1.65 up 8% from the same period last year.

Below is a chart illustrating the company’s quarterly sales.

Image Source: Zacks Investment Research

The company has long been a cash-generating machine, providing many benefits over the years, including higher dividend payouts. In fact, Apple raised its quarterly payout in its latest quarterly release, reflecting the 13th consecutive year of higher payouts.

Shares yield a modest 0.5% annually, though the company’s 4.6% five-year annualized dividend growth helps bridge the gap. On a trailing twelve-month basis, the tech titan has generated $98.4 billion in free cash flow.

MSFT Shares Benefit from AI

Microsoft shares have been strong in 2025 so far, up 10% compared to the S&P 500’s 0.6% gain. Concerning headline figures in its latest release, EPS of $3.46 and sales of $70.0 billion both handily exceeded our consensus expectations, continuing its recent streak of better-than-expected results. Sales grew an impressive 13% year-over-year, whereas EPS climbed 18%.

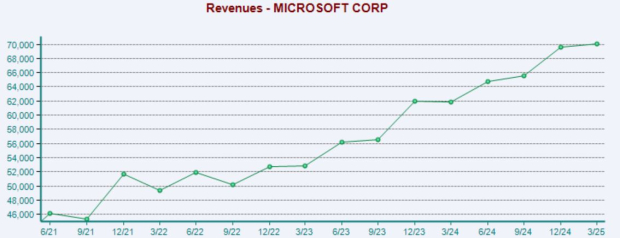

Below is a chart illustrating MSFT’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Microsoft Cloud and AI strength drove the strong results, with Microsoft Cloud revenue soaring 20% year-over-year to $42.4 billion. Demand has remained strong for the tech titan, with commentary alluding to the trend remaining for years to come.

Importantly, its Intelligent Cloud (includes Azure) revenue totaled a strong $26.8 billion, up 21% from the year-ago period. Like AAPL, strong cash flows have aided its shareholder-friendly nature, with Microsoft sporting a 10% five-year annualized dividend growth rate while also generating $69.4 billion in free cash flow over the trailing twelve months.

Bottom Line

Companies with strong cash-generating abilities are great targets, as they have plenty of cash to fuel growth, pay out dividends, and easily wipe out debt. And as mentioned above, these companies are better equipped to handle an economic downturn, undeniably a positive.

For those seeking cash-generators, both tech titans above – Microsoft (MSFT) and Apple (AAPL) – fit the criteria nicely.

More By This Author:

Whatever Happened To Pandemic Stocks? Some Are Showing Life Again

These 3 Companies Crushed Earnings Season

These 3 AI-Related Stocks Crushed Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more