Tesla Q2 Preview: Can Shares Regain Power?

Image Source: Unsplash

This week, earnings season officially kicks into high gear. During 2022 Q1, we witnessed numerous double-digit valuation slashes following many quarterly reports, a reflection of the challenging macroeconomic backdrop we find ourselves in.

Now, for Q2, investors are anxiously waiting for companies to pull the curtain back and unveil their quarterly results. It’ll reveal how companies have performed amid supply chain disruptions and soaring costs.

A poster-child for growth stocks, Tesla (TSLA - Free Report), is set to release quarterly results after the trading session on Wednesday, July 20th. We’re all familiar with Tesla, the company that has revolutionized the EV (electric vehicle) industry.

Of course, Tesla is much more than an EV producer, with operations in renewable energy generation, storage, and consumption as well.

Let’s look closely at the company to see how it stands heading into the report.

Total EV Deliveries

The key metric that will be watched like a hawk and one that’ll decide how the entire earnings report unfolds is the company’s total EV deliveries for the quarter. It’s a critical metric that will allow us to see just how many EVs Tesla has been able to produce and place in the hands of consumers.

For the quarter, the Zacks Consensus Estimate for total deliveries resides at 303,500, which reflects a slight 2% decrease from 2022 Q1 total deliveries of 310,000.

However, when compared to the year-ago quarter, it reflects a massive 50% increase. Additionally, it’s worth noting that Tesla has exceeded the Zacks Consensus Total Deliveries Estimate in five of its previous six quarters, all by at least 3.5%.

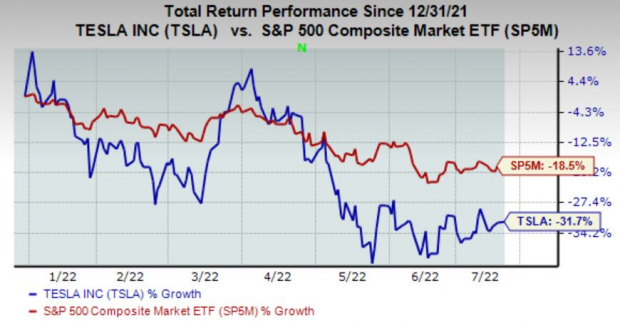

Share Performance & Valuation

Year-to-date, Tesla shares have suffered, losing more than 30% in value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, the picture changes upon expanding the time frame to encompass a year’s worth of price action; Tesla shares have gained nearly 12%, crushing the general market’s performance.

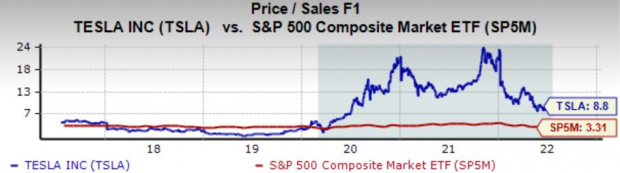

Image Source: Zacks Investment Research

It’s no secret that Tesla shares sport elevated valuation metrics. However, its current forward price-to-sales ratio of 8.8X is a fraction of its 23.9X high in 2021.

Additionally, shares trade at a steep 146% premium relative to the S&P 500.

Image Source: Zacks Investment Research

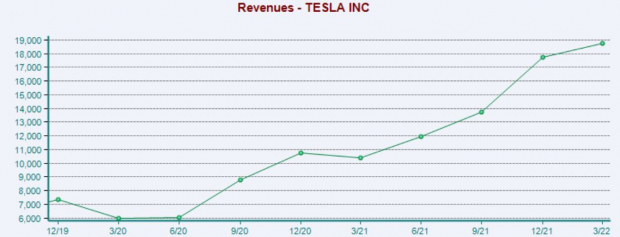

Quarterly Performance

Tesla has repeatedly reported quarterly earnings above expectations; over its last ten quarters, the EV giant has exceeded the Zacks Consensus EPS Estimate an impressive nine times. TSLA recorded a substantial 50% bottom-line beat in its latest quarterly report.

Quarterly sales also reflect stellar consistency; Tesla has beat quarterly revenue estimates in ten consecutive quarters.

Image Source: Zacks Investment Research

Growth Estimates

Over the last 60 days, analysts have been overwhelmingly bearish, with six out of six estimate revisions being downwards, pushing the Consensus Estimate Trend down 16%.

However, the $1.91 per share estimate pencils in an inspiring 31% growth in earnings from the year-ago quarter.

Image Source: Zacks Investment Research

In addition, Tesla is forecasted to generate $17.4 billion in revenue for Q2, notching a substantial 45% uptick in quarterly revenue year-over-year.

Bottom Line

Tesla shares have been one of the best places for investors to park cash over the last several years. As we inch more and more towards the EV standard, the company stands to massively benefit.

The company is a Zacks Rank #2 (Buy), earnings are forecasted to grow substantially, and total deliveries year-over-year are forecasted to rise significantly.

However, the company has undoubtedly experienced harsh margin compression throughout the quarter, which investors should be highly aware of.

More By This Author:

IBM Q2 Earnings and Revenues Beat Estimates

Previewing The Airliners: Can Shares Take Flight?

5 Dividend-Paying Stocks To Buy Ahead Of Earnings Next Week

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more