5 Dividend-Paying Stocks To Buy Ahead Of Earnings Next Week

Photo by Chris Liverani on Unsplash

The second-quarter earnings season has seen a shaky start thanks to reports from a few banking giants. Market participants will keenly watch this earnings season as it will provide the most descriptive view of U.S. corporate health amid record-high inflation and an extremely hawkish Fed.

Wall Street has reported its worst-performing first half this year in 50 years. Most of the stocks suffered a bloody blow due to mounting inflation, tougher-than-expected monetary control by the Fed, an extremely high-interest rate regime, and a lack of any restoration of the pandemic-led devastation in the global supply-chain system.

At this juncture, dividend-paying stocks are highly attractive to investors as these offer a regular income stream during the market’s downturn. Here we have selected five dividend-paying stocks with a favorable Zacks Rank that are poised to beat second-quarter earnings next week. These are — Halliburton Co. (HAL - Free Report), F.N.B. Corp. (FNB - Free Report), NextEra Energy Partners LP (NEP - Free Report), Schlumberger Ltd. (SLB - Free Report), and Quest Diagnostics Inc. (DGX - Free Report).

Q2 Earnings Results in the Early Stage

As of Jul 14, 25 companies within the S&P 500 Index reported their financial numbers. Total earnings of these companies are down 3.4% year over year on 10.6% higher revenues, with 68% beating EPS estimates and 64% beating revenue estimates.

Although we are just at the initial stage of the second-quarter reporting cycle, the 68% EPS beat percentage and 64% revenue beat percentage for the 25 S&P 500 Index members is below what we had seen from this group in other recent periods. The percentages are also toward the lower end of the 5-year range.

Despite these headwinds, our latest projection is that for the second quarter as a whole, total earnings of the S&P 500 Index will rise 2.1% year over year on 9.7% higher revenues. However, the aggregate net margin is expected to be compressed by 0.95%.

In addition to revenues and the net profit numbers of companies, several metrics of margins, like gross margin, operating margin, and net margin will be of immense importance to market participants this earnings cycle. Moreover, the outlook of U.S. corporates will guide the next course of Wall Street’s movement.

Our Top Picks

Five dividend-paying companies will report second-quarter 2022 earnings results next week. Each of these stocks carries Zacks Rank #2 (Buy) and has a positive Earnings ESP.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings releases.

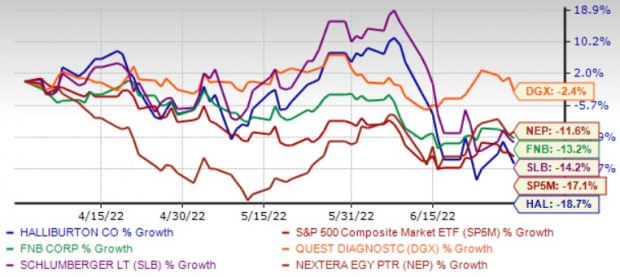

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Halliburton (HAL)

Halliburton provides products and services to the energy industry worldwide. High commodity prices have increased demand for HAL’s services in North America, to which it is heavily exposed.

In particular, Halliburton’s key Completion & Production unit margins are likely to improve, with management expecting better pricing leverage going forward. Besides, Halliburton's strong free cash flow generating ability indicates its financial strength. Its healthy relationship with national oil companies and digitization efforts also bode well. The increasing cloud-based data flow between sites and back office translates into expanded margins for Halliburton.

HAL has an Earnings ESP of +2.73%. It has an expected earnings growth rate of 77.8% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.5% over the last 30 days.

Halliburton recorded earnings surprises in the last four reported quarters, with an average beat of 6%. The company is set to release earnings results on Jul 19, before the opening bell.

F.N.B. Corp. (FNB)

F.N.B. remains well-poised for growth on the back of solid loans and deposit balances, and efforts to improve fee income. Manageable debt levels and a solid liquidity position bode well and should keep supporting its strategy to grow inorganically. FNB’s capital deployment activities seem impressive, through which the company will likely continue enhancing shareholder value.

FNB has an Earnings ESP of +0.55%. It has an expected earnings growth rate of 3.2% for the current year. The Zacks Consensus Estimate for current-year earnings improved 1.6% over the last 7 days.

FNB recorded earnings surprises in the last four reported quarters, with an average beat of 8.1%. The company is set to release earnings results on Jul 20, after the closing bell.

Quest Diagnostics Inc. (DGX)

Quest Diagnostics provides diagnostic testing, information, and services in the United States and internationally. On a positive note, the base business showcased strong year-over-year growth last quarter.

DGX specifically noted the investments to further accelerate growth in the base business. With a bullish expectation for the remainder of 2022, Quest Diagnostics raised its full-year guidance.

DGX has an Earnings ESP of +5.37%. The Zacks Consensus Estimate for current-year earnings improved 0.1% over the last 60 days. Quest Diagnostics recorded earnings surprises in three out of the last four reported quarters, with an average beat of 13.7%. The company is set to release earnings results on Jul 21, before the opening bell.

Schlumberger Ltd. (SLB)

Schlumberger is the largest oilfield services player, with a presence in every energy market across the globe. Being the leading provider of technology for complex oilfields, SLB is better positioned to take up new offshore projects in international markets.

The significant improvement in oil prices is aiding its overall business. Schlumberger reported strong first-quarter results, driven by strong drilling activities in North America, Latin America, and the Middle East. SLB is targeting net-zero greenhouse gas emissions by 2050.

Schlumberger has an Earnings ESP of +2.10%. It has an expected earnings growth rate of 44.5% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.1% over the last 90 days.

SLB recorded earnings surprises in the last four reported quarters, with an average beat of 6.7%. The company is set to release earnings results on Jul 22, before the opening bell.

NextEra Energy Partners LP (NEP)

NextEra Energy is expanding domestic clean energy assets through acquisitions and organic initiatives. NEP has stakes in natural gas pipelines in Texas and gains from an increase in natural gas production.

To enhance flexibility, NextEra Energy completed a few financing agreements to secure funds for acquisition. NEP benefits from declining installation costs and improving renewable technology. It has sufficient liquidity to meet obligations.

NextEra Energy has an Earnings ESP of +49.01%. It has an expected earnings growth rate of 52.5% for the current year. NEP is set to release earnings results on Jul 22, before the opening bell.

More By This Author:

Bull Of The Day: Lamb Weston Holdings, Inc.

Morgan Stanley Lags Q2 Earnings And Revenue Estimates

JPMorgan Chase & Co. Misses Q2 Earnings And Revenue Estimates

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more