Tesla: Headed Much Higher After Blockbuster Shareholder Event

Source: Wikipedia.com - Tesla Roadster 2: 0-60 time 1.9 seconds, top speed 250 mph+, range 620 miles, and that's just the base model... Available in 2020.

Tesla Takes Off After Blockbuster Shareholder Event

Tesla (TSLA) surged by over $20 or nearly 10% following the company’s blockbuster shareholder event last week. The primary reason for the surge was Tesla’s constructive guidance regarding several crucial developments. Many of the company’s short and long-term initiatives appear to be well on track, which suggests Tesla’s phenomenal growth is going to continue, the company will likely become net profitable very soon, and its stock price is going to go much higher.

Key Takeaways from the Shareholder Event

Elon Musk is staying on in his role– After a shareholder vote Elon Musk is staying on in his twin role as CEO and Chairman of the company. This is a significant vote of confidence for the CEO and is very beneficial for the overall long-term wellbeing of the company.

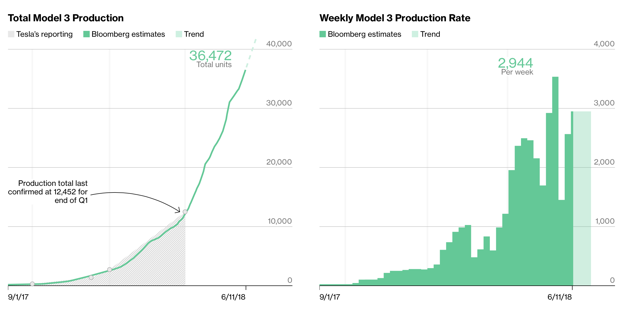

5K Model 3s per week production rate is swiftly approaching– The CEO reiterated that the company will very likely hit its target rate of 5K Model 3s per week by the end of June. According to the Bloomberg Model 3 Tracker, Tesla was already rolling out over 3,500 Model 3s per week in the third week of May. Right now, the figure shows about 3,000 but that is due to the 6-day shutdown period (line optimization) at the end of May.

Source: Bloomberg.com

The actual weekly production rate should be significantly higher than Bloomberg’s model currently suggests as it uses an average, and does not seem to account for the 6-day shutdown. Therefore, the company is very likely to attain its production target rate by the end of Q2. This indicates most of the production issues have been resolved, and Tesla is beginning to execute the Model 3 production process extremely well. This should lead to much better efficiency, economies of scale, higher margins, net income profitability, and a significantly higher stock price.

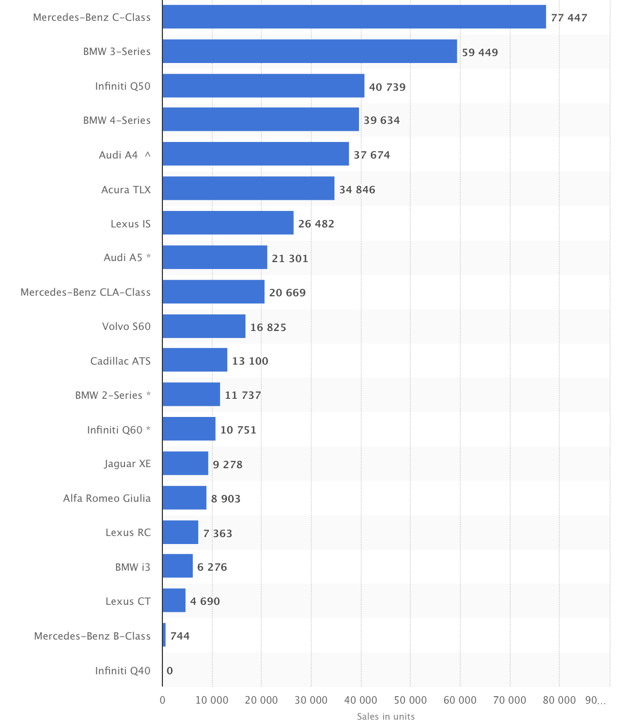

Model 3 is now the bestselling premium sedan in America- Well, that did not take long. The Model 3 is now officially the bestselling luxury sedan in America. And this does not mean it’s the best amongst EVs or hybrids, no Tesla’s Model 3 is the best overall. The Model 3 recently passed Mercedes Benz C Class to become the bestselling premium sedan in the U.S.

Source: Autoblog.com

In fact, if well look at the chart we see that BMW 3 Series and Mercedes C Class sales are in clear decline and the Model 3 has an extremely robust upward trajectory. This suggests that the Model 3 is beginning to capture significant market share from its German counterparts and could achieve a similar level of dominance in the entry and mid-sized premium sedan segments as the Model S has achieved in the large premium sedan market.

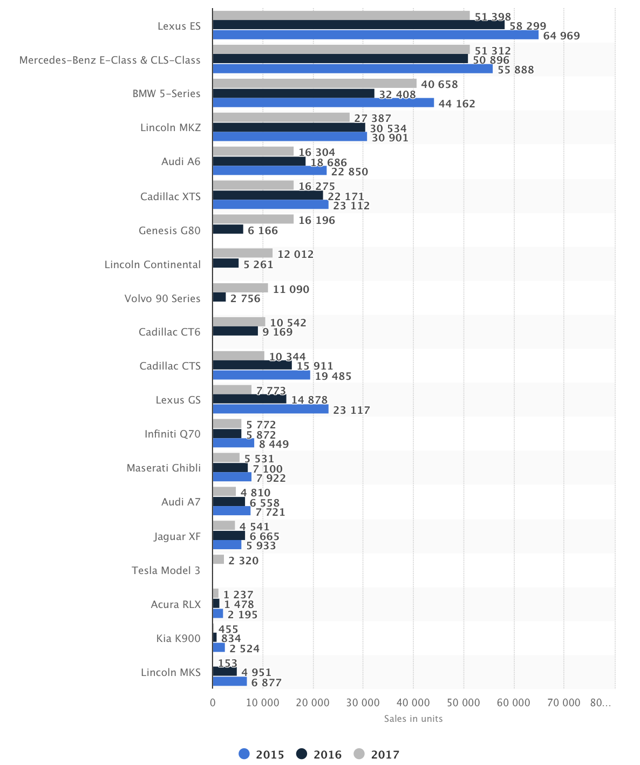

Just a reminder, the Model S practically outsold its 3 nearest competitors last year and if the Model 3 can reach a similar dominance in the entry and mid-sized luxury sedan segments it should have sustainable annual demand of about 300K vehicles in the U.S. alone. European demand eventually should be about the same. So, this is roughly 500-600K near-term annual Model 3 demand, and this is not including China and the Asia Pacific region.

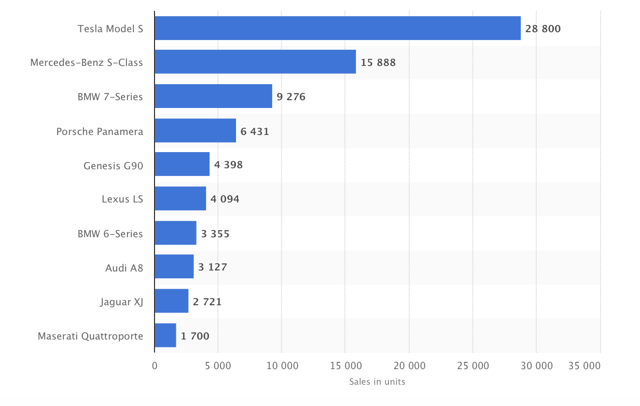

Source: Statista.com - We can see that in the U.S. the Model S came extremely close to outselling the S Class, 7 Series, and the Panamera combined last year.

We can see that if the Model 3 reaches similar success demand wise in the entry-level luxury sedan market in the U.S. annual sales could be around 180,000 in this segment.

In addition, if the Model 3 can achieve a similar success rate in the mid-sized luxury sedan segment in the U.S. the Model 3 could experience additional annual demand of roughly 140,000 vehicles.

Model 3 production now 95% automated– With increased and improved automation it is becoming quite clear that Tesla can produce Model 3s with significant efficiency. Achieving 5K per week Model 3 production coupled with extremely high automation should enable Tesla to implement economies of scale in Model 3 production. This should result in much higher margins and significant profit per vehicle.

It is also important to note that just as Tesla can innovate at a higher rate than the competition concerning vehicles (think capability, performance, range, software, interface, design, etc.), it is reasonable to expect that the company will duplicate this success in the factory production process as well. This should eventually allow the company to reach a higher rate of profitability than its counterparts.

Tesla now has over 10,000 Super Charging stations– Incredibly Tesla has managed to double the number of SuperChargers since early 2017 when the company only had 5,000. Super Chargers provide Tesla with an enormous competitive advantage over its adversaries operating in or looking to enter the 100% EV space. Anyone can use third party charging stations, yet only Tesla owners can use Super Charging stations. This will play a significant role when consumers are deciding about which EV to buy going forward.

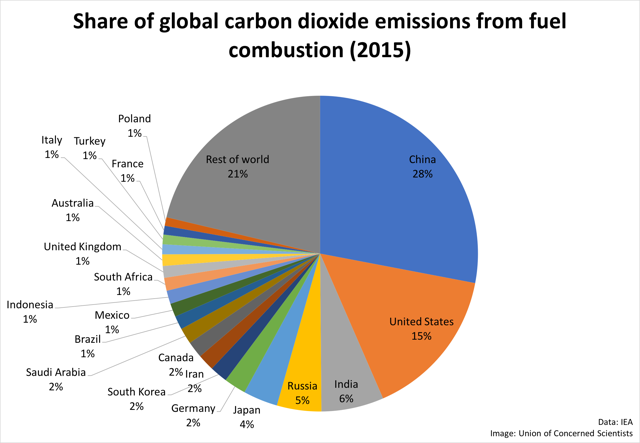

China factory back on the radar– The Chinese government recently announced that it will allow foreign EV makers to fully own auto factories in China. This is done in a significant push to electrify China’s massive car market and reduce enormous CO2 pollution in the largest car marketplace in the world. This implies Tesla will likely be able to own its factory outright, without a “Chinese partner”, bypassing extremely high 25% vehicle tariffs.

Source: UCSUSA.com - China by far has the greatest CO2 fuel emission problem in the world, and is quickly moving towards full electrification of its country's ginormous vehicle fleet.

Robin Ren, head of Tesla’s worldwide sales told investors that the company was very close to announcing a comprehensive deal with the Chinese government. The factory will be a “hybrid facility” that will produce batteries as well as vehicles from the same location. This will open a massive new market for Tesla and will enable the company to be extremely competitive in China.

China is already one of the biggest markets for Tesla vehicles but with a Tesla factory in China, the country will likely become Tesla’s most lucrative market in time. With over 300 million drivers China is now by far the biggest auto market in the world and it is putting enormous emphasis on transitioning to a mostly electric vehicle fleet. In fact, China, as well as many other nations, are likely to flat out ban ICE vehicles within the next 15-20 years. This puts Tesla in a prime position to greatly capitalize on this enormous paradigm shift.

Due to China’s rapidly expanding middle and upper class and an increased emphasis on 100%, EVs demand for the Model 3 in China should be staggering and any comprehensive announcement concerning the new factory should be extremely favorable to Tesla’s stock. I expect something specific to be announced next quarter.

The Model Y and Tesla Semi Question– Nothing specific was mentioned about the Model Y and Semi, aside from the likelihood of production starting in 2020 for the Model Y and the Semi having even better specs due to new innovative initiatives. However, it is very likely that Tesla will need to build another factory in the U.S. to handle increased production due to the new vehicles, as the Fremont facility simply won’t handle all of Tesla’s vehicles.

Source: Electrek.com - Tesla Semi was revealed to have even better specs than previously anticipated due to new innovative initiatives. Essentially, the Tesla Semi could command a significant portion of the lucrative Class 8 Semi market worth many billions in annual revenues. Many of the top fleet operators in the U.S. (Walmart, PepsiCo, Sysco, etc.), have already made reservations.

The Model Y and Semi production facility will very likely be announced in Q3/Q4 this year and will coincide with improved profitability in the Model 3 segment. Once Tesla becomes net income positive or at least close to it by the end of this year the company will likely make the announcement concerning the new facility.

This will allow the company to raise capital for the new plant on very favorable terms. Perhaps you’re asking how Tesla will pull this off at around the same time as the Chinese factory will need financing. For one, Tesla has very influential partners with extremely deep pockets in China. Tencent (TCEHY), Chinese tech giant, and one of the most valuable and influential companies in the world (market cap $505 billion, cash $23 billion) has taken a significant stake in Tesla. I view this as a strategic partnership that should enable Tesla to acquire a lasting foothold in China.

It is plausible that Tencent could play some sort of financial role concerning the Chinese factory, and if not Tesla can tap some of the more traditional channels for financing. And capital for the Model Y and Semi production facility could be raised via various channels as well, similar to prior CapEx financing. Once Tesla demonstrates to investors the company can be net income profitable it should have no problem securing capital on extremely favorable terms.

Long-term factory outlook– In time Tesla expects to have about 12 massive hybrid factories positioned all around the globe. Each factory will likely be geared towards producing both batteries as well as a wide range of Tesla vehicles. An important factor to consider is if Tesla is valued at around $50 billion with just one car production facility, how much will it be valued at once the company has 12 extremely profitable production plants? We’ll return to the future valuation question a bit later in the article

Source: VoaNews.com

What Separates Tesla from the Rest

Making products with “passion” is essentially what separates Tesla from the rest of the herd in the auto industry. This is much like what Apple (AAPL) under Steve Jobs accomplished, (i.e. iPod, iPhone, etc.), create amazing products that consumers love, and in turn creating a remarkable movement as opposed to just pushing out consumer products. Tesla is basically doing the same thing, possibly even on a bigger scale, and is becoming a phenomenon in the process rather than just another automobile manufacturer.

Many people, especially millennials love Tesla products, the company is becoming fully synonymous with “cool” much like Apple was in its prime. After all, what other company effectively spends nothing on advertising but is known around the whole world?

Source: InsideEVs.com - Do you know any other company capable of this kind of advertising, and with no actual cost to the company? I don't...

Drastically Underestimated Demand

Some people continue to dramatically underestimate demand for Tesla vehicles. Also, demand for Model S/X has not decreased, as the company slightly decreased production to focus more resources on the Model 3 ramp up. The backlog, as well as demand, has actually increased for Tesla’s more expensive vehicles despite slightly lower sales over last year. Sales of the S/X vehicles should get back to growth once Tesla can increase production capacity.

Source: JohnChow.com

Let’s not forget that Tesla’s Model S/X sold extremely well in the U.S. and in Europe, as well as in other areas the cars were available in last year. In fact, the Model S was by far the best selling large luxury sedan in the U.S. as well as in Europe last year.

With nearly 500,000 reservations the Model 3 remains the most highly anticipated vehicle in history. The automobile is also garnering rave reviews from the vast majority of consumers who’ve attained one, which is extremely important. This suggests the Model 3 could replicate, and possibly surpass the results that the Model S has achieved. This means it can capture significant market share in the U.S. and in Europe in the short to intermediate term, and then capture substantial market share in China, Asia Pacific, and other significant regions in the intermediate to long-term.

Source: Teslarati.com

By significant market share I mean sustainable annual demand of roughly 300,000 Model 3s in the U.S., 250,000 or more in Europe, and eventually at least 300,000 in China. I expect overall annual worldwide demand of roughly 700,000 Model 3 vehicles by 2022. Model Y should experience similar or greater success in the very lucrative crossover space when it arrives in around 2020.

A Word About “Competition”

I often here the argument that “when competition arrives Tesla is doomed”. However, the fact is that Tesla has proven an ability to innovate at a much greater pace than the supposed competition. Tesla attracts some of the brightest minds in IT, much more so than any car company, or just about any company for that matter. Also, if it weren’t for Tesla 100% EVs would not even be on the radar right now as a mass market alternative to ICE cars.

Tesla’s ability to innovate at a faster pace allows the company to control more aspects pertaining to its business, such as sales, servicing, charging, software, and so on. In addition, this suggests that traditional automakers will find it extremely difficult to keep up with Tesla as the company should continue to remain several steps ahead of the competition on a perpetual basis.

Take the Model 3 for instance. There is nothing remotely similar performance, capability, range, design, and price wise on the market or coming to market any time soon. And, this pertains to EVs and ICE vehicles alike. Tesla is a new age Silicon Valley visionary enterprise, and not just another automaker. Therefore, the company can achieve unrivaled results, can continue to innovate much more efficiently than its counterparts in the auto industry, and deserves to be valued at a much higher valuation.

What Will Tesla be Worth 15 Years from Now?

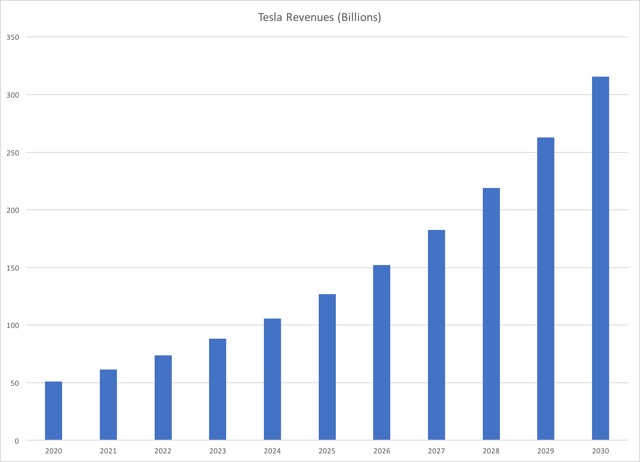

In my first ever Tesla article on SA I asked a very simple, and in my view a very realistic question, “Will Tesla become a trillion-dollar company?” Under my assumptions, Tesla should be able to deliver at least 7 million vehicles annually by 2030. This is also roughly consistent with Tesla’s long-term objective for 12 factories, each putting out 500K or more vehicles per year. With an ASP of $50K per vehicle Tesla’s sales will be about $350 billion, and this is not including energy storage, generation, services, or any other Tesla business, present or future.

Through increased automation and economies of scale, Tesla has the potential to become enormously profitable and should sustain extremely robust growth for many years due to staggering demand for its products. Companies like Amazon (AMZN), and Apple command near trillion-dollar valuations and trade at 3-5 times sales. Tesla has the potential to deliver relatively high margins 25% + long-term gross margin, so there is no reason to assume Tesla would not command a similar valuation. And with $350 billion in sales Tesla would only need a price to sales ration of below 3.

Also, it’s not that difficult to imagine Tesla revenues eclipsing $300 billion by 2030. All the company would need is a relatively modest 20% annual revenue growth rate from an estimated $50 billion in revenues in 2020. This allows the company to surpass $300 billion in sales in 2030. Also, it is important to point out that Tesla’s revenues have grown by about 60% on average over the last 5 years, so a 20% growth rate is quite modest in my view.

Source: Author's Material

Thus, it is plausible that the company could command a trillion-dollar valuation, especially if it can reach the projected automotive segment sales target by 2030 or so. Essentially, this is where the trillion-dollar valuation comes from, which represents about an 18.5-fold increase from current levels, and suggest a possible share price of nearly $6,000 could be reached by 2030 or thereabout.

Risks to Tesla and My Bullish Outlook

In my view, the greatest risk to Tesla is a significant recession. In a dramatic downturn, revenue growth is likely to slow drastically and financing could become much harder to come by, especially if credit markets freeze up. In this case, the company's shares would likely appear substantially overvalued and the stock would probably trade a lot lower. Nevertheless, the declines would still likely be transient and the stock would very likely recover over time.

Another risk to the bullish thesis is if Tesla's costs continue to spiral out of control. If Tesla does not continue to significantly improve Model 3 efficiency and get its SG&A costs and R&D expenditures under control, the company will continue to bleed cash and will find it very difficult to turn a profit. In this case, a loss of confidence in Tesla is possible which could result in a collapse of its share price. In my view, this scenario is extremely unlikely but investors should be aware of this possibility.

The Bottom Line

The updated developments that were announced during the annual shareholder meeting were extremely constructive. Tesla is seeing substantial improvements in the crucial Model 3 segment. Production is approaching the company’s target rate of 5K vehicles per week, and demand shows every sign of remaining extremely robust going forward.

In addition, the company provided solid hints towards further expansion into markets like China. In addition, it appears increasingly likely that as Model 3 production continues to improve Tesla will become net income profitable by the end of the year. Moreover, as the company clearly demonstrates to investors that it can effectively function as a profitable enterprise it is likely to tap markets for CapEx financing to fund its Tesla Semi, Model Y, and China projects.

Improved efficiency and profitability coupled with robust demand, further expansion, and other constructive factors should serve as substantial catalysts for Tesla’s shares throughout the second half of 2018. Therefore, Tesla’s stock is extremely likely to move significantly higher into year’s end and in 2019.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss ...

more

If the trade wars hit while this company is in deep financial trouble, what will happen, author? Interesting article. EV's may have a place. I don't think they are the choice of most. Self driving cars are a con. That con ups the price of every Tesla EV.

I think "deep financial trouble" is a bit of an over dramatization. Tesla is relatively sound financially and is a lot closer to generating net income than many believe.

There will be no trade war and even if there were Tesla would likely not be impacted significantly. And I assure you self driving is not a con, it's the future.

I agree. While #Tesla is facing some financial woes, it's nothing that can't be overcome. Amazon, Groupon, Facebook and countless other companies lost billions before they became the cashcows they are today. Becoming more bullish on $TSLA

Donald Kaplan and Joe Black, the new software supposedly has a warning every thirty seconds to keep your hands on the wheel. If you have to keep your hands on the wheel of a self driving car what is self driving about it? Seems to me that TSLA has taken the warnings of the dangers inherent in these vehicles to heart, but then, why pay for an over priced cruise control system?

Gary, if true, that's a bit ridiculous. And probably very annoying. Though maybe the warning is only triggered with no hands on the wheel (hopefully at least one works - I admit driving that way a bit too often).

It will be many years before I'd trust my life to a self driving vehicle. That being said, like everything, the R&D has to start somewhere and autonomous vehicles are very much the future. I doubt any of our grandchildren will even know how to drive a car.

I agree. I'd rather invest in bitcoin than Tesla. I think we are a generation away from cars that can actually drive themselves safely.

I don't know if i'd agree self driving cars are a con. But in regards to a trade war, might that not be just as likely to help $TSLA? For example, isn't #Trump considering taxing car imports from Canada by 25%? Cars imported from Canada account for about 22% of US car sales. If such a tax goes into affect that might make a #Tesla more affordable by comparison.

This is good news. I was starting to worry about #Musk's off behavior. $TSLA.