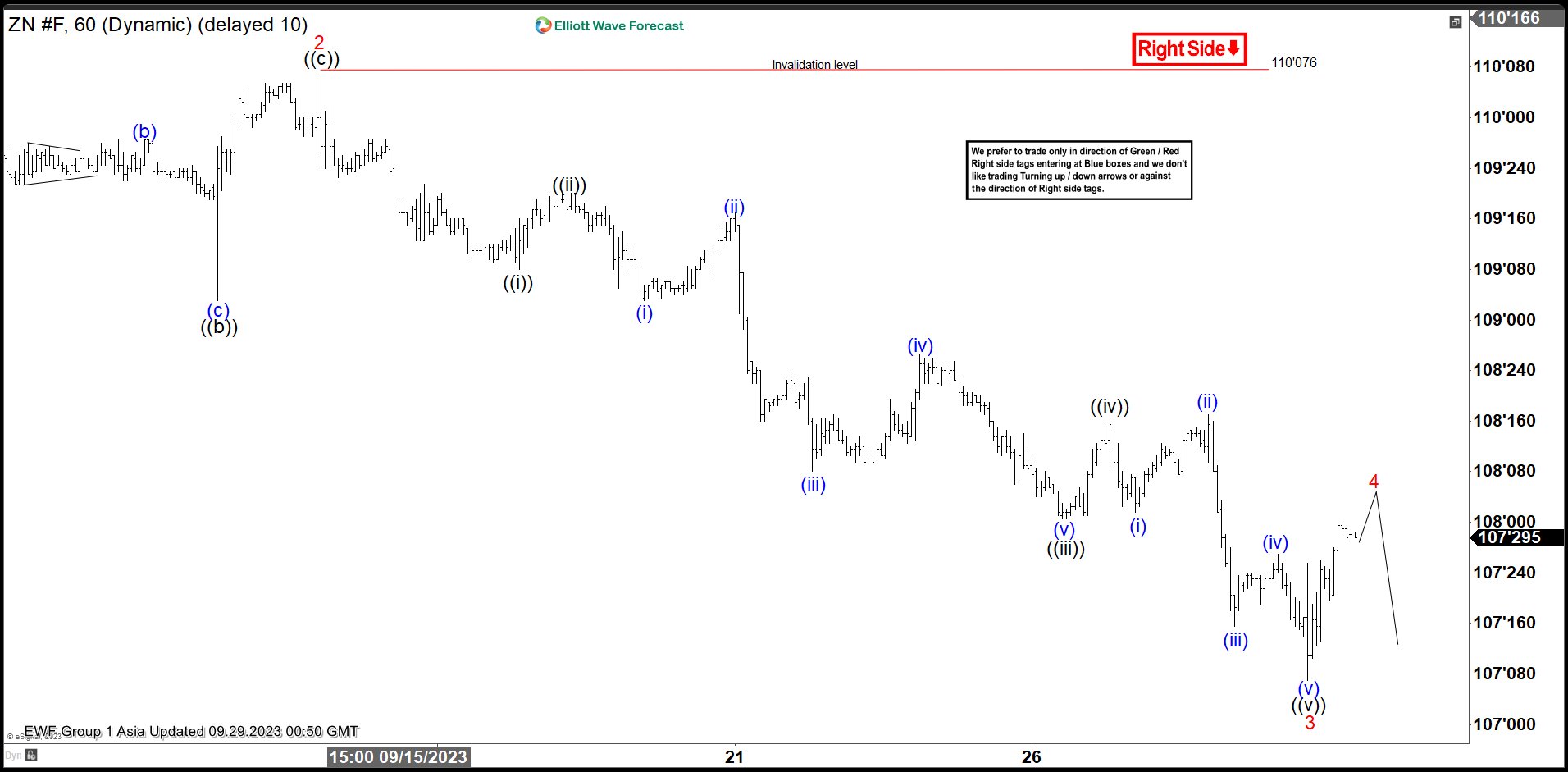

Ten Year Notes Bearish Impulse Remains Incomplete

Image Source: Pexels

The short-term Elliott Wave view suggests that the cycle from 9.1.2023 high in Ten Year Notes ($ZN) remains incomplete. The decline is unfolding as a 5 waves impulse Elliott Wave structure. Down from 9.1.2023 high, wave 1 ended at 109’19, and the rally in wave 2 ended at 110’07. The Notes extended lower in wave 3 as an impulse in lesser degree. Down from wave 2, wave ((i)) ended at 109’08, and wave ((ii)) rally ended at 109’2.

The Notes then extended lower in wave ((iii)) towards 108 and the rally in wave ((iv)) ended at 108’17. Final leg wave ((v)) ended at 107’07 which completed wave 3. Wave 4 is in progress to correct the decline from 110’07. The potential target for wave 4 is 23.6 – 38.2% Fibonacci retracement of wave 3. This area comes at 107’29 – 108’11. Near term, as far as the pivot at 110’07 high stays intact, expect rally in wave 4 rally to fail in 3, 7, 11 swing for further downside.

Ten Year Notes (ZN) 60 Minutes Elliott Wave Chart

(Click on image to enlarge)

$ZN Elliott Wave Video

Video Length: 00:03:57

More By This Author:

Nasdaq 100 ETF Continues Bearish Move Lower

Walt Disney: The Stock Is Trading Within Buying Area

Gold Miners Junior Looking To End Flat Correction

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more