Teeter-Totter Stock Market

One way of thinking about the share price of a common stock is the price range as a teeter-totter. When the psychology of investors is very negative, enthusiasm for the company hits the ground. On the other end, when everyone is in love with a company’s shares, their end of the board can’t seem to get any higher. Where is the board end hitting the ground currently and who is stuck up in the air on a psychological high?

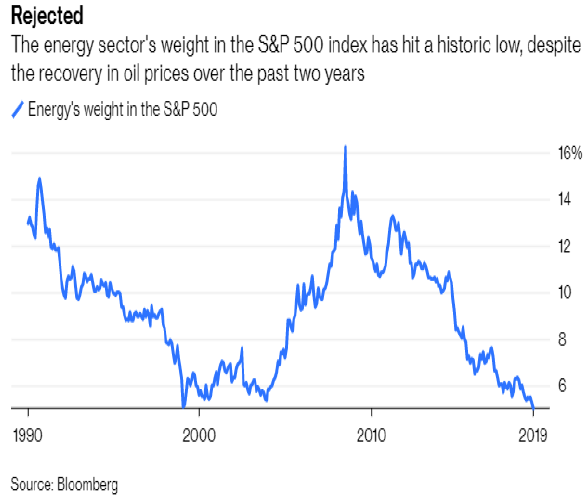

A good way to track this psychological movement is through the lens of the weighting of various sectors of the S&P 500 Index over long periods. Below is a chart of the S&P 500 weighting in energy all the way back to 1990:

(Click on image to enlarge)

To say that energy is bumping along the ground from a psychological standpoint would be a massive understatement. On our playground at school in the 1960s and 1970s, energy would be digging a hole in the ground.

The opposite of this comes in the technology sector of the S&P 500, which isn’t traceable the last ten years. In 1999 at the end of the year, tech was 35% of the S&P 500 Index. Since then, Amazon, Netflix, Facebook and Alphabet/Google have conveniently been moved to the consumer discretionary and communications services category of the S&P 500 Index. If you add them back in to tech, you realize that index investors are as committed to tech today as they were in 1999 at well more than 30% of the index.

In defense of buy and hold investors, the stock market teeter-totter actually sits on historically-rising ground. As companies succeed in growing their business, profits, free cash flow and their moat, the swing from ground to airborne starts from progressively higher and higher ground levels. Remember, Warren Buffett says, “My favorite holding period is forever!”

However, for the discerning value manager like Smead Capital Management, we want to enter participation when the psychological situation is grounded and running the risk of digging a temporary hole. After all, Jesse Livermore, considered the greatest stock market operator of the 1920s said, “Only liars buy right at the bottom!”

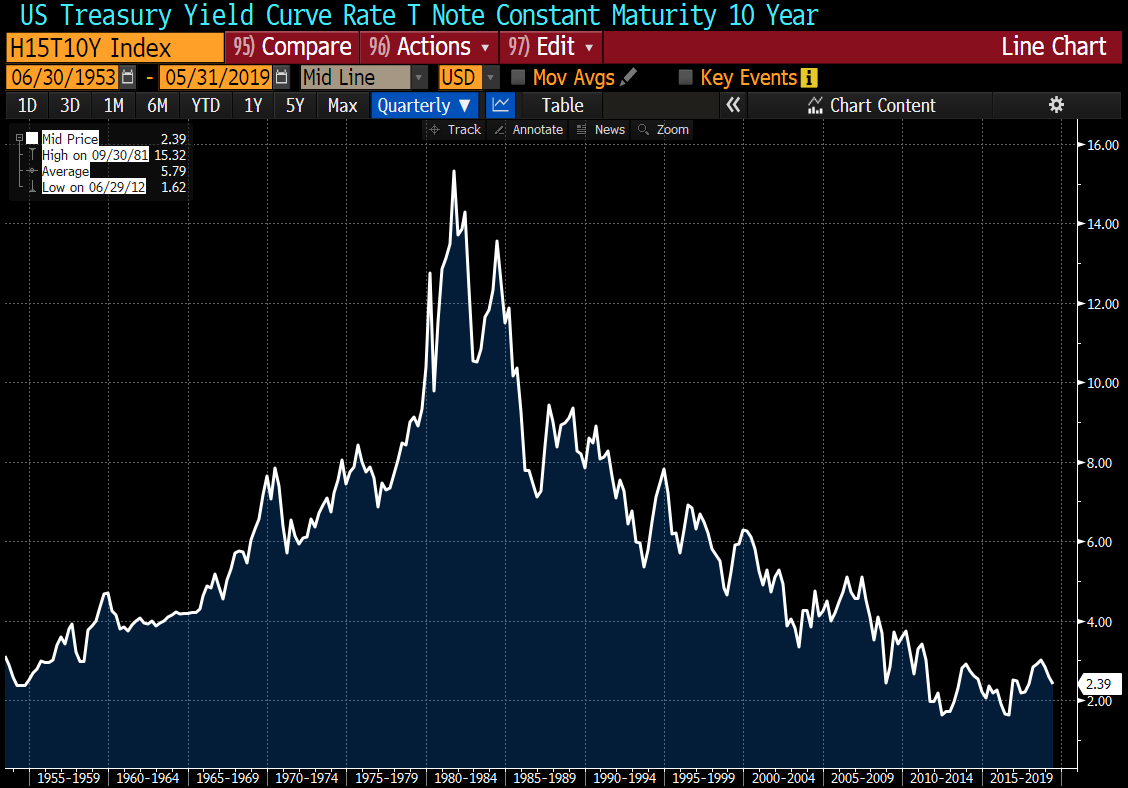

We would toss out the idea that if long-term bonds had a teeter-totter, it would be the interest rate chart of the last 60 years:

(Click on image to enlarge)

Source: Bloomberg.

Treasury bonds are stuck at the top of the teeter-totter board and don’t have the future growth in profits, free cash flow and moat to overcome serious over-valuation.

Putting this together, we believe the teeter-totter is high on tech stocks and long-term bonds and very low on energy and other inflation beneficiaries. We bought shares of Occidental Petroleum (OXY) and Macerich (MAC), an owner of Class A entertainment malls in large U.S. metropolitan areas. Ironically, some very outspoken investors are mad that the leaders of OXY traded expensive long-term debt for ownership of Anadarko Petroleum. The debt is at the top of the teeter-totter and oil assets in the ground are at the bottom. If/when investors see the next wave of un-seeable inflation the next five years, we believe they will buy shares of asset-heavy companies and push that end of the board higher.

On the other hand, inflation would reduce the value of future profits and reduce price-to-earnings multiples on growth stocks. This would drop their seats toward the ground. Simultaneously, a jump in inflation and interest rates would send bond investors into a free-fall.

Disclosure: This article contains information and opinions based on data obtained from reliable sources, which is current as of the publication date, and does not constitute a recommendation ...

more

I'd avoid bonds although I don't see rates moving up unless Trump really ramps up the tariffs which is bad for our economy and our companies that export as well. Even so, the slowing growth of the economy would probably slow the economy so much demand would fall and prices would come into balance quickly anyhow.

The low rates are a sign of our economic weakness which many often fail to realize. So when people jump up and down and say how great the economy is, give them a big frown. It is not great. That is why you can't get decent returns on your money without taking big risks anymore.