Teekay Is Better Than OK

Image Source: Pexels

MicroMarvel is a series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

- 100% technical buy signals.

- 15 new highs and up 27.97% in the last month.

- 96.20+ Weighted Alpha.

Today's MicroMarvel is the marine shipping company Teekay Shipping (TK). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 12/20 the stock gained 24.66%.

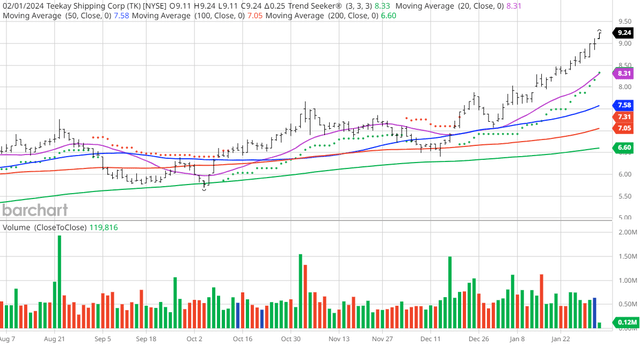

TK Price vs Daily Moving Averages (Barchart)

Teekay Corporation engages in international crude oil and other marine transportation services worldwide. The company owns and operates crude oil and refined product tankers. It also provides ship-to-ship support services; tanker commercial management and technical management operation services; and operational and maintenance marine services. As of March 1, 2023, the company operated a fleet of approximately 54 owned and chartered-in vessels. It serves energy and utility companies, major oil traders, large oil consumers and petroleum product producers, government agencies, and various other entities that depend upon marine transportation. Teekay Corporation was founded in 1973 and is headquartered in Hamilton, Bermuda.

Barchart Technical Indicators:

- 100% technical buy signals

- 96.20+ Weighted Alpha

- 83.73% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 15 new highs and up 27.97% in the last month

- Relative Strength Index 78.67%

- Technical support level at $8.86

- Recently traded at $9.24 with a 50-day moving average of $7.57

Fundamental Factors:

- Market Cap $818 million

- P/E 5.38

- Wall Street analysts are not making solid Revenue and Earnings projections but one analyst projects a 5 year annual compounded Earning growth of 12%

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 1 strong buy and 2 buy recommendation this month

- Value Line give the stock an above average rating of 2

- CFRAs MarketScope rates the stock a strong buy

- 10,080 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: FTAI Aviation - Sky's The Limit

Cardiol Therapeutics - This Penny Stock Is An Analysts Favorite

Chart Of The Day: Comfort Systems USA - Hotter Than Ever

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.