Cardiol Therapeutics - This Penny Stock Is An Analysts Favorite

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

MicroMarvel is a series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

Photo by Nicholas Cappello on Unsplash

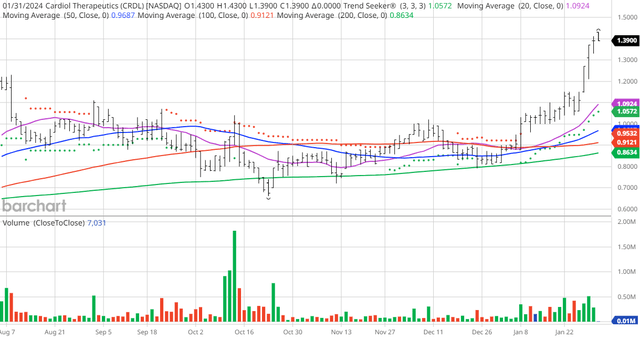

Today's MicroMarvel is the clinical stage biotechnology company Cardiol Therapeutics (CRDL). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 1/9 the stock gained 33.65%.

CRDL Price vs Daily Moving Averages (Barchart)

Cardiol Therapeutics Inc., a clinical-stage life sciences company, focuses on the research and development of anti-fibrotic and anti-inflammatory therapies for the treatment of cardiovascular disease (CVD). Its lead product CardiolRx, which is in Phase II/III multi-national, randomized, double-blind, and placebo-controlled study to evaluate the efficacy and safety of CardiolRx for patients hospitalized with COVID-19, as well as for the treatment of recurrent pericarditis and acute myocarditis. The company is also developing subcutaneous formulation of CardiolRx for the treatment of fibrosis and inflammation in the heart that is related with the development and progression of heart failure. Cardiol Therapeutics Inc. was incorporated in 2017 and is headquartered in Oakville, Canada.

Barchart Technical Indicators:

- 100% technical buy signals

- 106.88+ Weighted Alpha

- 99.83% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 15 new highs and up 65.89% in the last month

- Relative Strength Index 81.68%

- Technical support level at $1.3430

- Recently traded at $1.3078 with a 50-day moving average of $.9687

Fundamental Factors:

- Market Cap $90.84 million

- Wall Street analysts are not making solid Revenue and Earnings projections

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 1 strong buy and 2 buy recommendation this month

- Analysts price targets are $3.56 to $5.99 with a consensus of $4.77 - That is a 241% gain over its recent price!

- CFRAs MarketScope rates the stock a sell based on quantitative factors

- Already 1,430 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Comfort Systems USA - Hotter Than Ever

Chart Of The Day: Acuity Brands Sees The Light

Universal Technical Institute Is Firing On All Cylinders

Disclosure: MicroMarvels highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile ...

more