Universal Technical Institute Is Firing On All Cylinders

MicroMarvel is a series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

Image Source: Pixabay

Today's MicroMarvel is the mechanics' educational company Universal Technical Institute. I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 12/22 the stock gained 22.46%.

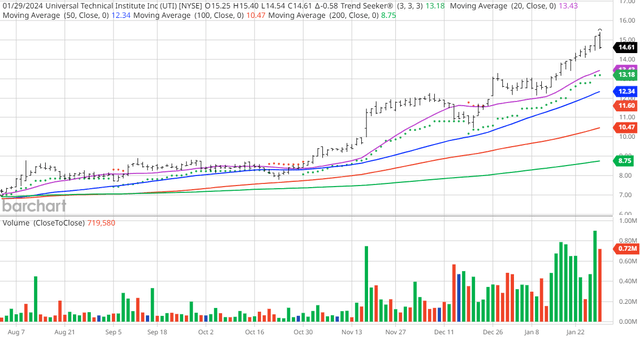

UTI Price vs Daily Moving Averages (Barchart)

Universal Technical Institute, Inc. (UTI) is the leading provider of post-secondary education for students seeking careers as professional automotive, diesel, motorcycle, and marine technicians. With more than 250,000 graduates, UTI offers undergraduate degree, diploma, and certificate programs at 16 campuses across the US, and manufacturer-specific training programs at dedicated training centers. Through its campus-based school system, UTI provides specialized post-secondary education programs under the banner of several well-known brands, including UTI, Motorcycle Mechanics Institute, Marine Mechanics Institute, and NASCAR Technical Institute. In October 2023, the company continued to execute its growth and diversification strategy with the announcement of additional program expansions of Heating Ventilation Air Conditioning and Refrigeration (HVACR) in Avondale, Ariz.; Bloomfield, N.J.; and two California locations, Long Beach and Sacramento.

Barchart Technical Indicators:

- 100% technical buy signals

- 45.20+ Weighted Alpha

- 30.24% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 16 new highs and up 16.69% in the last month

- Relative Strength Index 69.41%

- Technical support level at $14.70

- Recently traded at $14.61 with a 50-day moving average of $12.34

Fundamental Factors:

- Market Cap $518 million

- P/E 79.95

- Wall Street projects Revenue will grow 16.70% this year and another 4.90% next year

- Earnings are estimated to increase 353.80% this year, an additional 33.90% next year, and continue to compound at the annual rate of 15.00% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 5 strong buy and 1 hold recommendation this month

- Analysts price targets are $12 to $17 with a consensus of $15

- The individual investors following the stock on Motley Fool voted 335 to 41 for the stock to beat the market with the most experienced investors voting 69 to 7 for the same result

- Value Line give the stock an above average rating of 2

- CFRAs MarketScope rates the stock a hold

- Only 709 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Fiserv - Steady Growth In Both Revenue And Earnings

Sky Harbour - Will It Fly High?

Chart Of The Day: Take-Two Interactive Software - Not Playing Any Games

Disclosure: MicroMarvels highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile ...

more