Tech Sheds A Trillion

Earlier this week in our Sector Weightings report, we highlighted how the weight of the Technology sector remains well above that of any other sector, though, it did come off recent highs. In terms of market cap, the Tech sector is still valued at nearly $11 trillion. The next largest sectors are Health Care and Consumer Discretionary at a little over $5 trillion. Utilities is currently the only sector with a market cap under $1 trillion. Remember, back in April 2020, the S&P 1500 Energy sector’s market cap got down to just $701 billion!

Taking a look at the changes three weeks into the new year, Tech has already shed over a trillion dollars in market cap. Combined, Consumer Discretionary, Health Care, and Communication Services have also fallen by over a trillion dollars. Meanwhile, only Energy has seen its market cap increase.

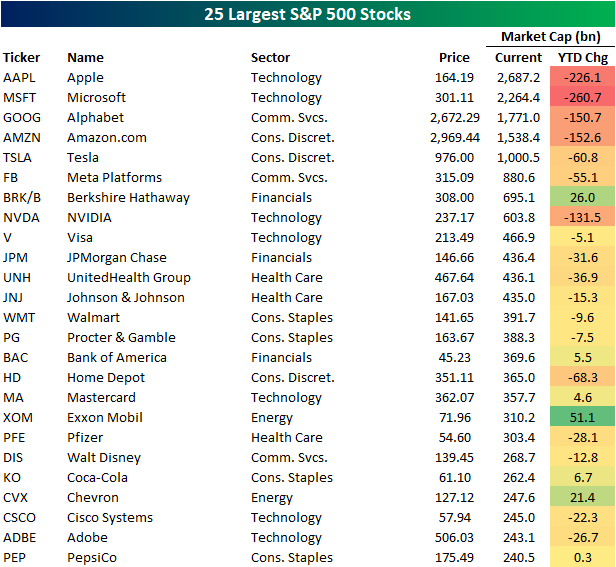

As for the individual stocks of the S&P 500, there are currently five members with market caps above $1 trillion, and those five stocks have seen a combined drop in market cap of roughly $850 billion year-to-date. Apple (AAPL) and Microsoft (MSFT) are the biggest of these with market caps of $2.69 trillion and $2.65 trillion respectively, and as such, their declines year to date are the largest of any S&P 500 stock. Of the 25 largest S&P 500 members, only a handful have seen their market caps rise so far in 2022. Exxon Mobil (XOM) has seen the largest increase followed by Berkshire Hathaway (BRK-B) and Chevron (CVX).

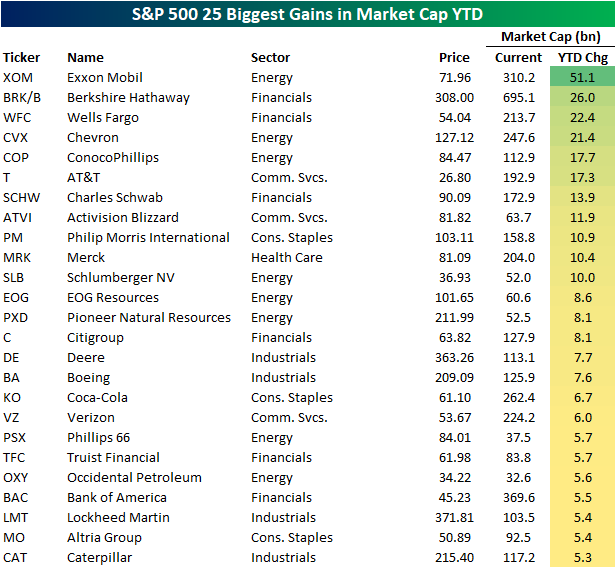

In the table below, we show the 25 S&P 500 stocks that have seen their market caps rise the most this year. Not only does an Energy stock top the list, but across these 25 names, Energy stocks have the most representation. Financials also have a decent number making the list while not a single Consumer Discretionary or Tech name is to be found.