Tech And Utilities Lead The Way

US equity futures are modestly positive this morning following comments from potential Fed chair-in-waiting Christopher Waller, who said he expects the Fed to cut rates further this year, but at a ‘careful’ pace. Long-term treasury yields are notably lower as the 10-year yield trades down nearly 5 basis points to 4.10%. After dropping below $4,000 per ounce yesterday, gold is up nearly 1%, trading at $4,010. Crude oil prices are down over 1% on the prospects of peace in the Middle East, and crypto trades modestly higher at just about $121K.

With the government still shut down, the only economic data on the calendar is the University of Michigan Sentiment report, and Chicago Fed President Goolsbee will speak at a bank conference shortly after the open. Speaking of economic data, the BLS has recalled furloughed staff this morning to ensure that the September CPI report gets released by the end of the month.

Asian markets were weak overnight, with the notable exception of South Korea, which rallied 1.7%. Japan, Hong Kong, and China, however, were all down 1% or more. Japanese PPI increased 0.3% m/m, triple the rate of consensus expectations, solidified market expectations for another rate hike this year. Despite Friday’s decline, the Nikkei finished the week 5.1% higher while Hong Kong traded down 3.1% and China was up fractionally.

In Europe, equity markets have been much tamer this morning. The STOXX 600 is little changed, and no major country’s benchmark index is up or down more than 0.3%, and most are on pace to finish the week with modest gains or losses.

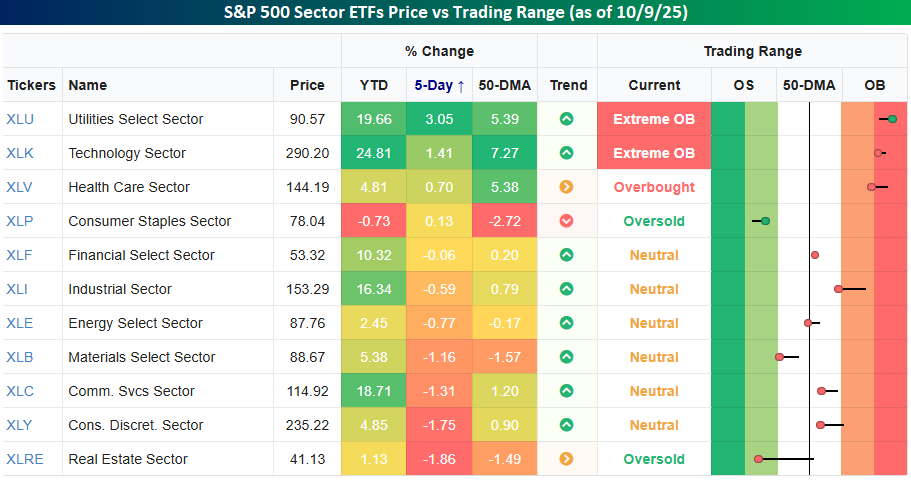

The last five trading days have been full of divergence at the sector level. The S&P 500 is fractionally higher, but seven out of eleven sectors have traded lower, including four sectors – Real Estate, Consumer Discretionary, Communication Services, and Materials – that are down over 1%. The only two sectors with gains of more than 1% are the formerly strange bedfellows of Utilities (3.05%) and Technology (1.4%). Both these sectors are also the only two trading at Extreme Overbought levels.

It wasn’t long ago that Utilities was considered the most defensive sector in the market, while Technology was considered the most risky sector. Like everything else now, it seems, AI has upended prior norms, although given the power-intensive nature of AI-related applications, the moves make sense.

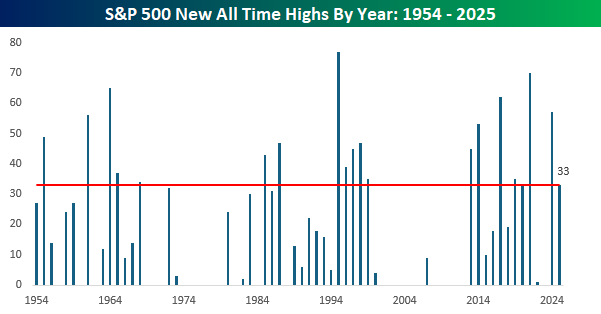

Yesterday was a down day for the S&P 500, but in the seven trading days this month, there have already been five record closes, taking the YTD total to 33. If the year were to end today, 33 record highs in a year isn’t particularly noteworthy as it ranks tied for the 19th most since 1954.

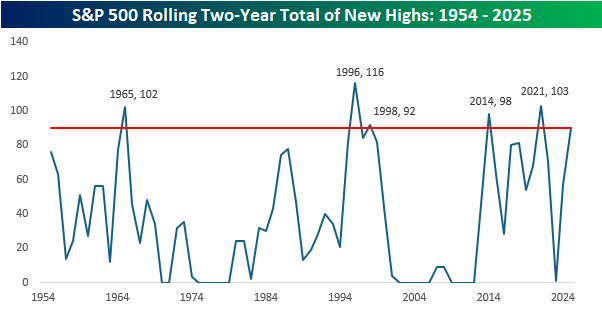

What’s been more impressive is that the 33 record closes followed last year’s total of 57. With 90 record closing highs in the last two calendar years, there have only been five other two-year stretches when the S&P 500 had more record closing highs, and not to jinx anything, but there’s a legitimate chance that by the end of the year, the last two years could end up ranking well into the top five.

More By This Author:

A Strong Six MonthsKey ETF Performance In September, Q3, And Year-To-Date

Bitcoin Rallies Right On Cue

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more