Target’s Troubles

Image Source: Unsplash

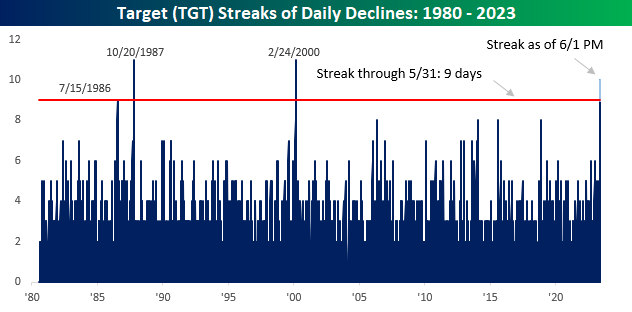

It’s been a miserable couple of weeks for shares of Target (TGT) as the stock is on pace for its tenth straight day of losses today. Whether or not the stock closes up or down today, the nine-day losing streak heading into Thursday was the longest in more than 23 years, and there have only been three other streaks that were as long or longer than the current one.

While shares of Target (TGT) have been down sharply over the last two weeks (-20.2%), its main competitor Walmart (WMT) hasn’t had nearly as rough of a time as its shares are down just 1.5%. At the current level of -18.7 percentage points, the two-week performance spread between TGT and WMT is at an extreme, and there are only a handful of other periods since 1980 where the spread was wider in WMT’s favor. What’s ironic, however, is that exactly a year ago today, TGT’s two-week underperformance versus WMT was even wider at -22.8 percentage points. Back then it was a disastrous earnings report that caused the stock to crater.

The recent weakness in TGT has been mostly attributed to a negative backlash from the merchandise associated with the company’s Pride campaign, and while that may have accelerated the decline, it’s important to note that the stock has been steadily underperforming WMT for well over a year now. The chart below shows the relative strength of TGT versus WMT over the last five years. While TGT was a big beneficiary relative to WMT during the year after COVID when consumers were flush with cash, once the checks stopped, so too did the outperformance. As of today, the stock’s relative strength versus WMT is at the lowest level since the first half of 2020.

More By This Author:

May And YTD 2023 Asset Class Performance

Debt Deal Moves To The House

Some Good Inflation News

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more