Target Q3 Preview: Rebound Quarter Inbound?

Image: Bigstock

The Zacks Retail and Wholesale sector has sailed through rough waters in 2022, down more than 20% and lagging behind the S&P 500 by a fair margin. A big-time player residing in the realm, Target (TGT - Free Report), is gearing up to unveil quarterly results on Nov. 16, before the market opens.

Target provides an array of goods, ranging from household essentials and electronics to toys and apparel for men, women, and kids. It also houses food and pet supplies, home furnishings and décor, home improvement, automotive products, and seasonal merchandise. The company has evolved from just being a pure brick-&-mortar retailer to an omnichannel entity.

Currently, the retail titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B. How is everything else shaping up? Let’s dive deeper and find out.

Share Performance & Valuation

TGT shares have sailed through rough waters in the year of 2022, down more than 20% and underperforming the S&P 500 by a fair margin.

Image Source: Zacks Investment Research

Over the last month, however, TGT shares have tacked on roughly 13% in value, outperforming the S&P 500.

Image Source: Zacks Investment Research

TGT shares have recently been seen trading at a 20.3X forward earnings multiple, which is above the 17.1X five-year median by a fair margin and represents a 17% discount relative to its Zacks Retail and Wholesale sector. TGT sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

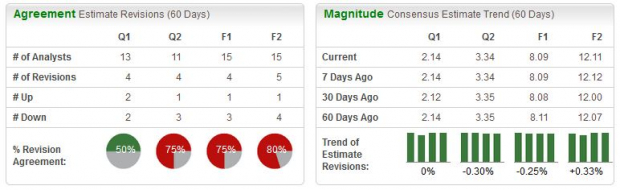

Analysts have had mixed reactions for the quarter to be reported, with two upward and two downward earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $2.14 indicates a year-over-year decline in earnings of more than 25%.

Image Source: Zacks Investment Research

Still, the company’s top-line is in better shape; the Zacks Consensus Sales Estimate of $26.4 billion indicates a year-over-year revenue uptick of roughly 2.8%.

Quarterly Performance

TGT has struggled to exceed bottom-line estimates as of late, falling short of EPS expectations in back-to-back prints. In its latest release, the retailer missed on the bottom-line by more than 40%.

Sales results have primarily been mixed; TGT has exceeded revenue estimates in two of its last four quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

TGT shares reside in the red year-to-date, but they have outperformed the general market over the last month, indicating that buyers have arrived. The company’s forward earnings multiple sits above its five-year median but below its Zacks sector average.

Analysts have had mixed reactions for the quarter over the last several months, with estimates indicating a year-over-year decline in earnings but an uptick in revenue – likely a reflection of margin compression.

The company has struggled to exceed quarterly estimates as of late, posting a wide bottom-line miss in its latest release. Heading into the print, Target (TGT - Free Report) carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of -2.3%.

More By This Author:

3 Top-Ranked Stocks Up More Than 25% The Past Month

Lowe's Lined Up For Q3 Earnings: What's In The Cards?

Bear Of The Day: Fresenius Medical

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more