Bear Of The Day: Fresenius Medical

The latest move higher in the market has boosted all kinds of stocks. That means, even stocks with weak earnings trends have rebounded because they were simply so oversold. Be careful when you come in and buy the dip blindly. Sometimes, the stocks that are going up along with the rest of the market are not the quality names that you should be betting on.

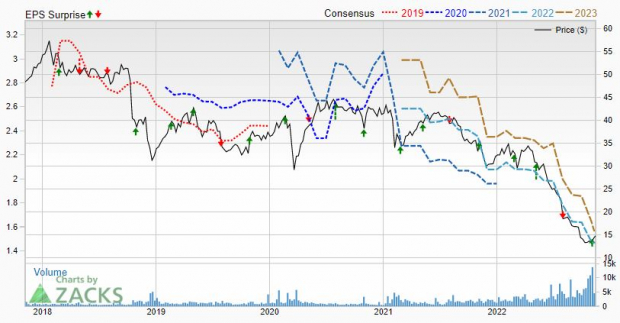

One way to avoid stocks with weak earnings trends is to pass on Zacks Rank #5 (Strong Sell) stocks. These stocks have seen earnings estimates drop over the last few weeks, which means that Wall Street could be turning bearish. Today’s Bear of the Day is one such stock. I’m talking about Zacks Rank #5 (Strong Sell) Fresenius Medical (FMS - Free Report).

Fresenius Medical Care AG & Co. KGaA provides dialysis care and related dialysis care services in Germany, North America, and internationally. It offers dialysis treatment and related laboratory and diagnostic services through a network of outpatient dialysis clinics; materials, training, and patient support services comprising clinical monitoring, follow-up assistance, and arranging for delivery of the supplies to the patient's residence; and dialysis services under contract to hospitals in the United States for the hospitalized end-stage renal disease (ESRD) patients and for patients suffering from acute kidney failure.

Image Source: Zacks Investment Research

The reason for the unfavorable rank is that over the last 60 days, three analysts have cut estimates for the current year and next year. The negative moves have cut our Zacks Consensus Estimate for the current year from $1.67 to $1.46 while next year’s number is off from $1.86 to $1.56. That’s a 29% contraction this year and growth of just 6.7% next year.

More By This Author:

Ralph Lauren Q2 Earnings And Revenues Top EstimatesBreaking Down Walmart Stock Before Q3 Earnings

Wynn Resorts Reports Q3 Loss, Tops Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more