Tame Volatility With These 3 Low Beta Stocks

Image Source: Unsplash

Beta measures a stock's volatility in comparison to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0.

A beta above 1.0 suggests a stock is more volatile than the broader market, and a beta below 1.0 indicates the opposite. Low-beta stocks can provide several beneficial advantages for portfolios, including defensive qualities.

They can also offer stabilization when combined with high-beta stocks, helping to give a more balanced risk profile.

Three low-beta stocks – Interactive Brokers (IBKR - Free Report), Elevance Health (ELV - Free Report), and Consolidated Edison (ED - Free Report) – could all be considered for those looking for a more conservative approach.

In addition to decreased volatility, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

Let’s take a closer look at each.

Elevance Health Keeps Beating Earnings Expectations

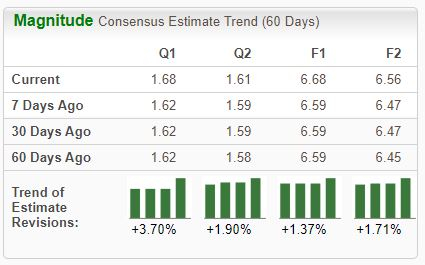

Elevance Health operates as a health benefits company, supporting consumers, families, and communities throughout the care journey to lead healthier lives. The company sports a favorable Zacks Rank #2 (Buy), with earnings expectations inching higher nearly across the board.

ELV’s latest quarterly results pleased investors, with shares moving well higher after the earnings release. Regarding headline figures, Elevance posted a 1% beat relative to the Zacks Consensus EPS estimate and reported sales modestly below expectations.

Earnings grew 12.5% year over year, whereas sales increased 1%. Below is a chart illustrating the company’s quarterly revenue.

Image Source: Zacks Investment Research

Interactive Brokers Crushes S&P 500

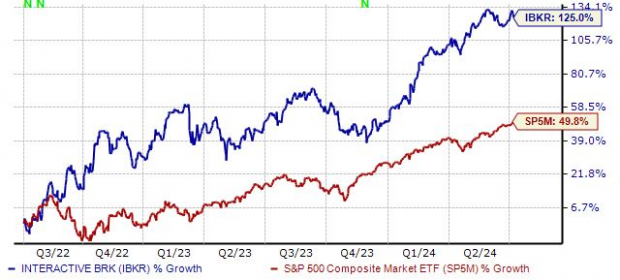

Interactive Brokers Group operates as an automated global electronic market maker and broker. Analysts have positively revised expectations across the board, landing the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

It’s worth noting that the stock is a big-time outperformer over the last two years, adding an impressive 125% in value compared to the S&P 500’s 50% gain. Increased trading activity has benefited the company nicely over recent years.

Image Source: Zacks Investment Research

Consolidated Edison Keeps Rewarding Shareholders

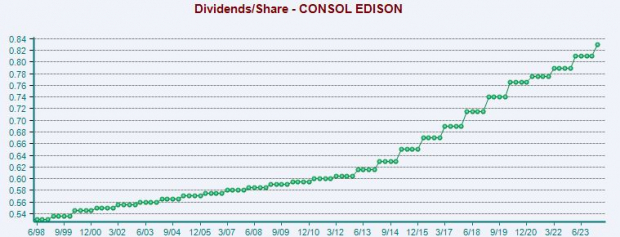

Consolidated Edison, a current Zacks Rank #2 (Buy), is a diversified utility holding company with subsidiaries engaged in both regulated and unregulated businesses. The company has been a great earnings performer, exceeding the Zacks Consensus EPS estimate by an average of 6% across its last four releases.

Income-focused investors could find ED shares attractive, currently yielding a solid 3.8% annually. Dividend growth is also apparent, with the company sporting a modest 2% five-year annualized dividend growth rate.

The company has long displayed a shareholder-friendly nature, as we can see illustrated below.

Image Source: Zacks Investment Research

Bottom Line

Low-beta stocks can provide several beneficial advantages for portfolios, including defensive qualities.

They can also offer stabilization when combined with high-beta stocks, helping to give a more balanced risk profile.

And for those seeking a more conservative approach, all three low-beta stocks above - Interactive Brokers, Elevance Health, and Consolidated Edison – could be considerations.

In addition to decreased volatility, all three sport favorable Zacks Ranks, reflecting optimism among analysts.

More By This Author:

EV Stocks Surge: Are They Back?

Bear Of The Day: Walgreens Boots Alliance

Bull Of The Day: Super Micro Computer