Bear Of The Day: Walgreens Boots Alliance

Walgreens Boots Alliance (WBA) is a retail drugstore chain that sells prescription and non-prescription drugs. The company also sells general merchandise products, including household items, convenience and fresh foods, personal care, beauty care, photofinishing, and candy.

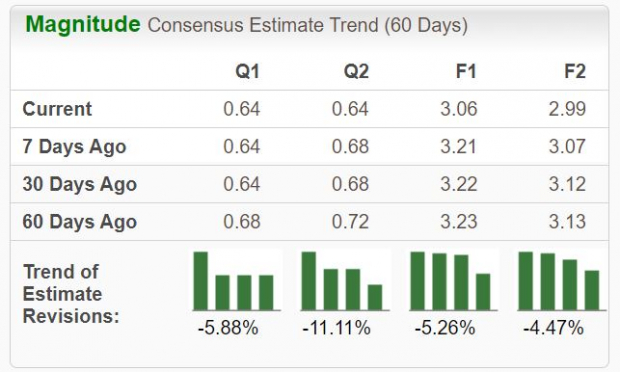

Analysts have taken a bearish stance on the company’s outlook, landing the stock into a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

In addition, the company is in the Zacks Retail – Pharmacies and Drug Stores industry, which is currently ranked in the bottom 1% of all Zacks industries.

Let’s take a closer look at the company.

Walgreens Boots Alliance

WBA shares have faced consistent pressure year-to-date, down more than 50% and widely underperforming. A recent set of weak quarterly results caused a post-earnings share plunge, with the company falling short of EPS expectations but delivering a modest sales beat.

Image Source: Zacks Investment Research

WBA lowered its outlook following the release, explaining the knee-jerk reaction that followed.

CEO Tim Wentworth acknowledged the weaker-than-expected results, stating, "We continue to face a difficult operating environment, including persistent pressures on the U.S. consumer and the impact of recent marketplace dynamics which have eroded pharmacy margins. Our results and outlook reflect these headwinds, despite solid performance in both our International and U.S. Healthcare segments.”

The company’s margin pressures are illustrated further below. Please note that the chart is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Shares yield 8.3% annually now following the steep decline, though it's critical to note that investors should remain on the sidelines until the company’s earnings picture shifts positively and it provides further guidance on its strategic initiatives.

Bottom Line

Margin pressures and lowered guidance paint a challenging picture for the company’s shares in the near term.

Walgreens Boots Alliance is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

Bull Of The Day: Super Micro ComputerThese AI Stocks Have Fallen: Time To Buy Nvidia, Super Micro Computer, Broadcom?

Like Dividend Aristocrats? Try These 3 Dividend Kings Stocks