Strong Run Of Earnings Continues

After a strong start to the week yesterday, US stocks are starting Tuesday on a modestly negative note with S&P 500 and Nasdaq futures both down less than 0.10%. The pace of earnings reports is finally starting to pick up, and what has been a strong reporting period so far in terms of results has remained that way this morning. As we type this, of the 14 companies reporting so far this morning, they have all exceeded EPS forecasts, and only one (NOC) missed top-line estimates. You can’t ask for much better than that!

With futures modestly lower, there’s still a lot of time left, but it’s pretty amazing to see that the S&P 500 still hasn’t traded outside of its intraday range from 10/10, which would make it seven straight days of trading inside a prior day’s range. Already, the current period ranks as just the 12th time in the last 40 years, and if the streak extends to seven, it would be just one of eight. For more on the topic, check out today’s Chart of the Day.

Outside of equities this morning, the 10-year yield is still below 4%, crude oil and natural gas are both up 1%, but precious metals are all uncharacteristically getting hit hard. Gold is down over 2%, while silver, platinum, and palladium are all down over 4%. Crypto prices also remain weak as Bitcoin trades back down below $110K and Ethereum is firmly below $4K with a decline of over 2.5%. Neither has been able to get back on track in the last couple of weeks.

Japanese stocks finished off their intraday highs overnight, but, along with other major indices in the region, finished higher on the session. Sanae Takaichi was officially elected PM, but there was a bit of sell-the-news reaction; Chinese stocks were the strongest in the region, finishing up more than 1% on optimism over US trade talks.

Europe is much like Asia this morning, with modest gains across the board. The STOXX 600 is up 0.1%, with Italy leading things higher, rallying by 1%.

Netflix (NFLX) will report earnings after the close today, which reminded us of an earnings report from the company in July 2011, when then CEO Reed Hastings announced that the company would be splitting off its DVD business from streaming, raising prices in the process. For consumers who wanted to continue with both services, the changes resulted in a 60% price hike from $10.00 to $15.98 per month. News of the price hikes and launch of the Qwikster DVD service were received poorly by the company’s customers and investors alike.

Right before the plan was announced, NFLX was trading at record highs, having just rallied 180% in the prior year. Within months, though, it gave up all of those gains, falling more than 70%. While there were other macro-related factors behind that drop, NFLX’s poorly communicated pricing plans and new strategy contributed to the weakness.

Following that decline in the wake of the Qwikster announcement, Hastings issued a public apology regarding how the changes were communicated, which included the quote above. Another month after his apology, Netflix reversed plans to separate the units (but kept the price hikes), relegating Qwikster to the waste bin of other disastrous product launches like New Coke, and more recently, the Cracker Barrel restaurant rebrand. Also, how can we ever forget the Apple Newton, rocking out with the Microsoft Zune, snacking on Olestra-infused WOW! Potato chips, and then the McDonald’s Arch Deluxe for dinner? The story of Qwikster and its demise before ever even launching serves as a reminder that the how of a message’s delivery can take on just as much importance as the message itself. It’s also a lesson that people and companies often become most vulnerable after a long string of successes, just as the feeling of invincibility starts to set in.

Hopefully, Netflix has no Qwiksters up its sleeve for today’s earnings report. Even after rallying 3% yesterday, the stock heads into the report short on momentum. While up over 60% in the last year and 25% in six months, the stock is down about 8% from its highs in the summer, forming a trend of lower highs. Looking on the bright side, the lack of a meaningful rally leading up to today’s report means that expectations likely aren’t too high.

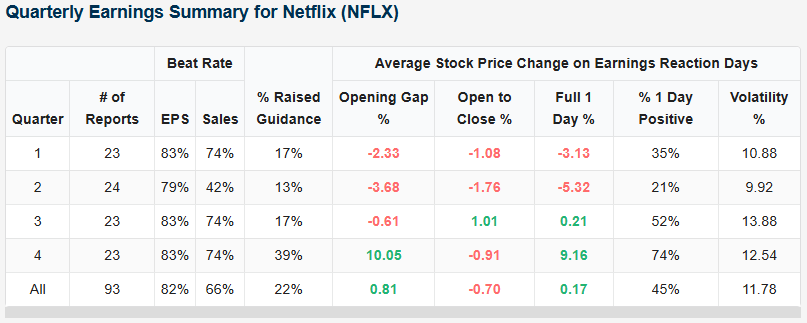

Looking at prior earnings reports from our Earnings Explorer, NFLX also has history slightly on its side. Over the last 23 years, its Q3 report has been the second-best of the four quarters in terms of stock price reaction. As shown in the table below, like Q4, NFLX has exceeded EPS forecasts 83% of the time in Q3 and topped sales forecasts 74% of the time. On its earnings reaction day, the stock averaged a gain of 0.21% with gains 52% of the time. That’s peanuts compared to the average gain of 9.2% following Q4 reports, but it beats the sharp declines that tend to follow Q1 and Q2 reports.

While NFLX will get most of the investor attention after the close today, another stock with a strong track record heading its report today is Capital One Financial (COF). Given its business, it will also give us a good read on the health of the consumer.

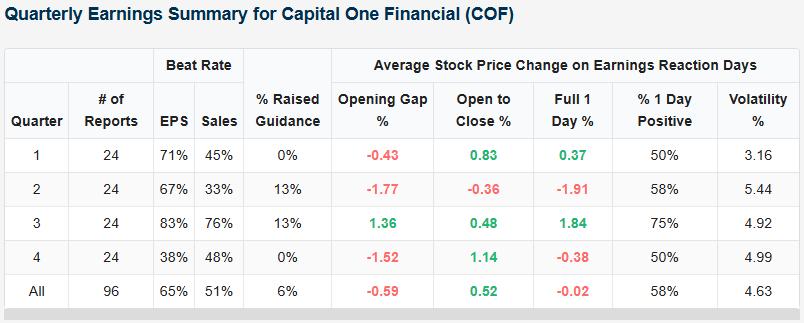

As shown in the snapshot below, COF has exceeded EPS and sales forecasts more in Q3 than in any other quarter. As a result, its average earnings reaction day performance has been a gain of 1.84% with positive returns 75% of the time. That’s also better than any other quarter.

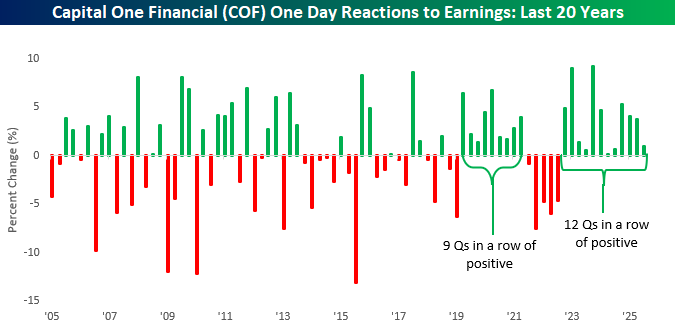

Even more notable for COF is that the company has reacted positively to earnings for an incredible 12 straight quarters! Looking at COF’s one-day reactions to earnings over the last 20 years shows an interesting pattern. Whereas there was no streaky trend in terms of stock price reactions from 2005 through 2019, since then, it has been the opposite. COF has gone nine straight quarters with positive one-day reactions, then five straight quarters with negative reactions, followed by 12 quarters in a row of positive reactions. Talk about streaky!

More By This Author:

Small Business HesitationQ3 Earnings Season Begins

Homebuilders Struggle

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more